I’ve been in Panama with some friends for the past two weeks, in part to enjoy warm sunshine.

But I’m also here because I wanted to research possible options in case the United States somehow wound up with a hard-core leftist in the White House.

With “Crazy Bernie” fading and “Looney Liz” out of the race, that no longer appears to be an immediate threat.

That being said, America’s grim long-run fiscal outlook, combined with the other factors such as young people’s senseless support of socialism, suggests that it may just be a matter of time before the U.S. morphs into a stagnant, European-style welfare state.

(And don’t forget that Joe Biden is actually farther to the left than Barack Obama and Hillary Clinton.)

So let’s investigate whether Panama is a good option, not just for Americans, but also for people from other nations as well.

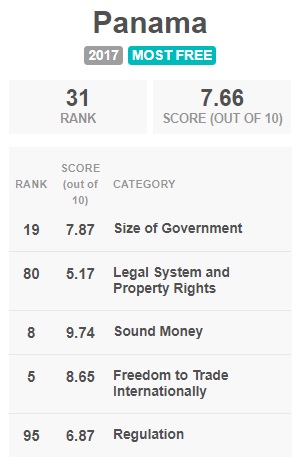

The place to start is the Fraser Institute’s Economic Freedom of the World. Based on their comprehensive rankings of economic liberty, Panama gets a 7.66 on a 0-10 scale, which places it at #31 out of 162 nations.

That puts the country comfortably in the top quartile of “most free” jurisdictions. Moreover, it is the second-freest nation in Latin America, trailing only Chile (#13).

Here’s how Panama does when looking at specific components of economic policy.

- The good news is that the country gets a solid score for fiscal policy (#19) and excellent scores for monetary policy (#8) and trade (#5).

- The not-so-good news is that Panama has a middling score for rule of law and property rights (#80) and a weak score for regulation (#95).

These scores are only a snapshot for the most-current year, so it’s also worth noting that Panama has been very stable.

For the past couple of decades, its score has ranged between a low of 7.27 and a high of 7.88. Going back further in time, it’s even been ranked in the top 10 a couple of times.

In other words, Panama has not been susceptible to wild policy swings. Or Venezuelan-style foolishness.

To be sure, the politicians in Panama are prone to populist measures, but bad policies are adopted for vote-buying reasons (i.e., public choice) rather than ideology. Indeed, there is not a successful left-wing party in the country.

Because Panama gets good-but-not-great scores for economic liberty, you won’t be surprised to learn that the people of Panama enjoy decent-but-not-great living standards.

According to World Bank calculations, Panama qualifies as a “high income” nation, but that category is very broad (basically $14,000 and up). For perspective, per-capita income in Panama is only about one-fourth of U.S. levels.

And, notwithstanding convergence theory, that gap probably won’t shrink much in the near future since the United States currently has significantly more economic liberty (ranked #6 compared to #31).

But this column is for people who fear that America’s score may tumble in the future because of a frightening development (perhaps a President AOC?).

Here’s a few final thoughts to consider.

- Panama’s currency (from the country’s inception) is the dollar.

- There is a large community of expats already in Panama, including thousands of Americans.

- The government has done a good job of managing the Panama Canal.

- The nation is making slow but steady progress on problem areas such as infrastructure.

- Crime and personal security are not major concerns.

- The tax burden is very reasonable, particularly for people with non-Panamanian income.

The bottom line is that Panama is a good place for foreigners. The government has a welcoming attitude so long as immigrants are self-sufficient. And you don’t need to be rich to live a nice life in Panama.

P.S. In the past, I’ve suggested that Australia is the best long-run option if the United States suffers a Greek-style economic decline. That’s still true, especially since the Aussies have a mostly private Social Security system. Switzerland is always a good option, along with the Cayman Islands, especially for people with more assets (everyone should keep in mind that those jurisdictions may not be ideal if the the U.S. and most of Europe are in decline and American readers should remember the IRS’s odious exit tax).

Daniel J. Mitchell is a public policy economist in Washington. He’s been a Senior Fellow at the Cato Institute, a Senior Fellow at the Heritage Foundation, an economist for Senator Bob Packwood and the Senate Finance Committee, and a Director of Tax and Budget Policy at Citizens for a Sound Economy. His articles can be found in such publications as the Wall Street Journal, New York Times, Investor’s Business Daily, and Washington Times. Mitchell holds bachelor’s and master’s degrees in economics from the University of Georgia and a Ph.D. in economics from George Mason University. Original article can be viewed here.

Self-Reliance Central publishes a variety of perspectives. Nothing written here is to be construed as representing the views of SRC.