Stock markets are reeling as the Federal Reserve and its central bank counterparts clamor to get runaway inflation under control through a series of steep interest rate hikes. Where this ends, no one knows. But it’s no mystery where this inflation began: The Federal Reserve.

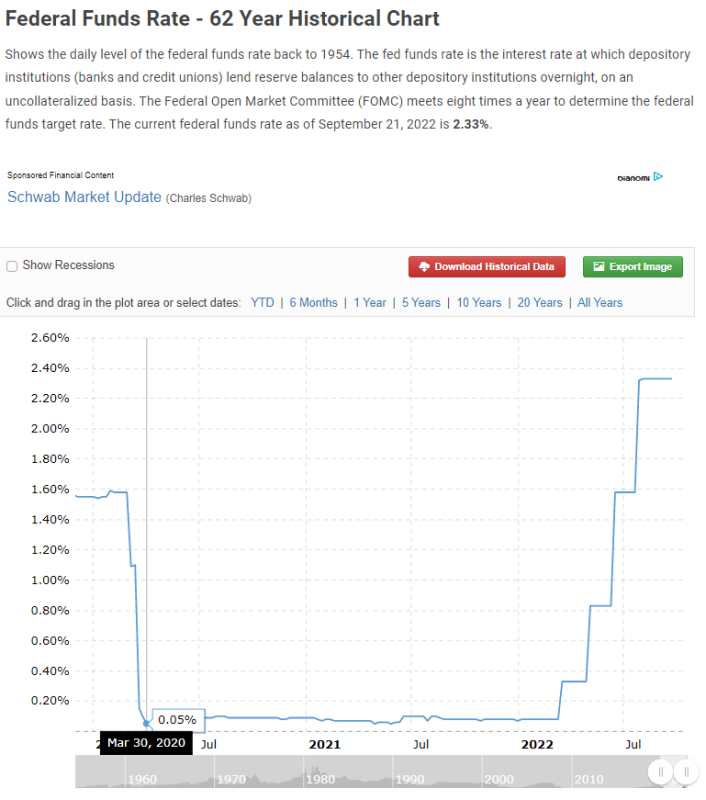

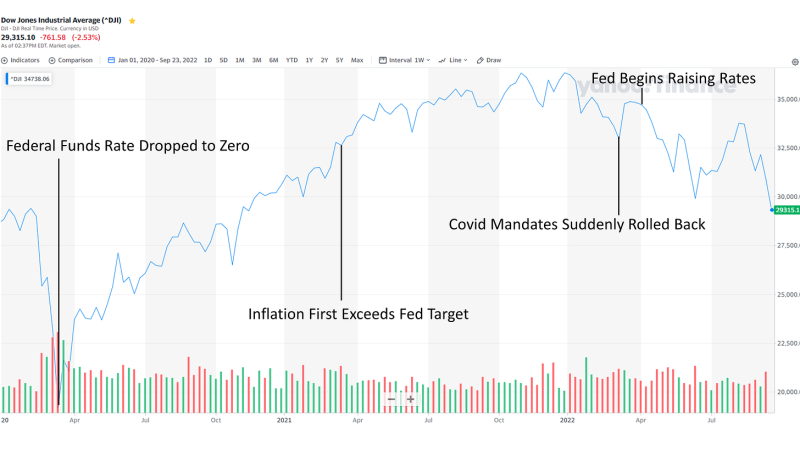

Back in early 2020, talk of an imminent shutdown of the global economy briefly sent the stock market into freefall. The Federal Reserve headed off this market downturn with a series of rapid rate cuts, bringing the federal funds rate to near zero by the end of March 2020.

The Federal Reserve kept the federal funds rate near zero from the end of March 2020 all the way through the end of February 2022, at which point governments rolled back most vaccine passports and Covid mandates for purely political reasons, citing a change in “the science.”

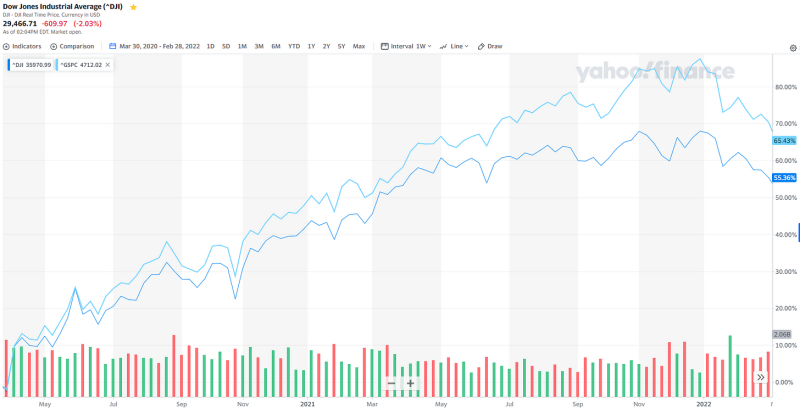

Near-zero interest rates during this two-year period led to an extraordinary boom in stock prices, with the Dow and S&P 500 rising over 55% and 65%, respectively, even as lockdowns and mandates wrecked the economy. This stock market boom fostered more political support for lockdowns and Covid mandates, with the easy money acting as an opiate that led many to believe the economic damage from these policies wasn’t as bad as it really was.

Now that most Covid mandates have been rolled back and we’re seeing record-high inflation, the Fed is rapidly raising rates, leading to a severe market downturn and possibly an economic recession.

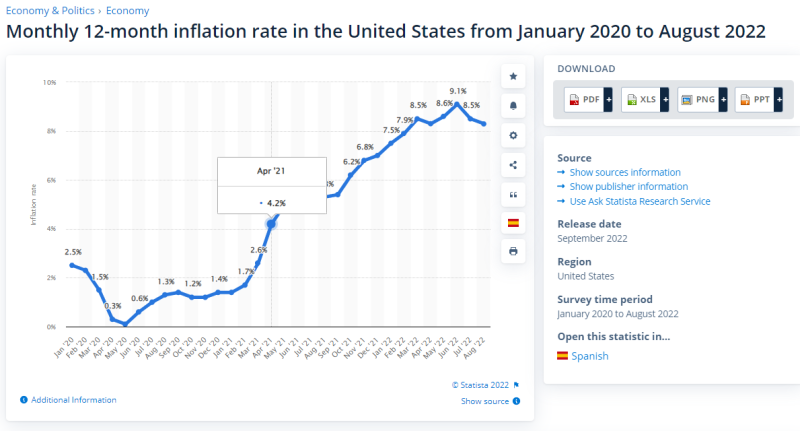

But here’s the problem: Inflation had already begun rising out of control long before the Fed started raising rates. Economists predicted the Fed’s policy would lead to high inflation back in 2020. And in fact, by April 2021, nearly a full year before the Fed began raising rates, the annualized inflation rate had already hit 4.2%—more than double the Fed’s target inflation rate of 2%!

Despite being under a specific mandate to keep inflation under control, the Federal Reserve kept the federal funds rate near zero even while inflation was far above its target for an entire year.

Instead, the Fed waited until just after vaccine passports and Covid mandates were rolled back to begin raising rates and trying to chase down inflation, with its own easy-money policies having prolonged those Covid mandates for as long as possible.

The Federal Reserve flagrantly violated its mandate to maintain price stability when it kept interest rates near zero for a full year after inflation soared above its target. It’s disingenuous for the Fed governors to now act like inflation hawks, pushing the entire economy into recession, after they let inflation run unchecked well above their target for a full year.

The Fed’s specific Congressional mandate to keep inflation under control seems to have been overridden by an unspoken mandate to provide easy money in support of Covid lockdowns.

The point of this article is not to spread fear about the market. The stock market tends to laugh off our petty human foibles and go on doing its thing, so this may ultimately turn out to be a good buying opportunity for those who can afford it. Nor is the point of this article that the Federal Reserve was “in on it” with regard to lockdowns. Rather, most insiders have said that the Fed drank the Kool-Aid, having been convinced to keep rates low by much the same clique of biosecurity and health officials who dictated everything else during Covid.

But the Federal Reserve has a specific mandate to keep inflation and unemployment under control. The Fed does not have a mandate to support a complete shutdown of the economy at the whim of other federal bureaucrats.

The Federal Reserve is a useful system when it sticks to doing its job. But if the Fed governors are going to ignore their specific Congressional mandate to support contradictory political goals whenever they feel like it, then I’m inclined to agree with Ron Paul: End the Fed.

Republished from the author’s Substack

Author

Reproduced with permission. THIS WORK IS LICENSED UNDER A CREATIVE COMMONS ATTRIBUTION 4.0 INTERNATIONAL LICENSE Original here.

- Michael Senger is an attorney and author of Snake Oil: How Xi Jinping Shut Down the World. He has been researching the influence of the Chinese Communist Party on the world’s response to COVID-19 since March 2020 and previously authored China’s Global Lockdown Propaganda Campaign and The Masked Ball of Cowardice in Tablet Magazine. You can follow his work on Substack