The Federal Reserve, our central bank. is conducting a pilot program where a group of big banks will be required to test the effects of climate-related scenarios on their books, a preliminary exercise they claim will have no formal bearing on their regulations – yet.

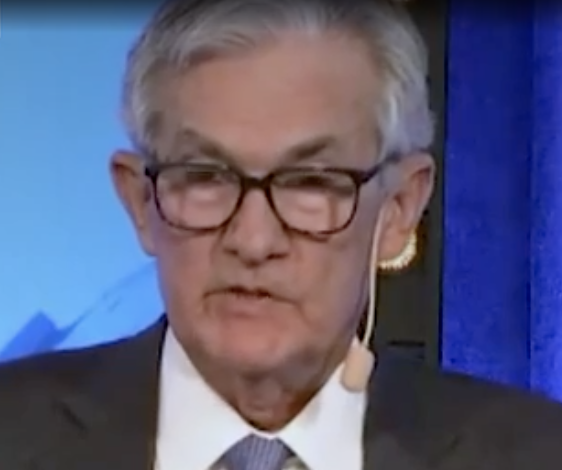

“In my view, the Fed does have narrow, but important, responsibilities regarding climate-related financial risks. These responsibilities are tightly linked to our responsibilities for bank supervision,” Federal Reserve Chair Jerome Powell said. “The public reasonably expects supervisors to require that banks understand, and appropriately manage, their material risks, including the financial risks of climate change.”

His remarks come as the Fed and other regulators such as the Securities and Exchange Commission have come under scrutiny for the role they’re playing in counteracting global warming. Many environmental groups have pushed for the central bank to make it more expensive for banks to lend to the fossil fuel industry, while Republicans have pressed the Fed not to take that route.

The Federal Reserve just ordered banks to "prepare plans for fighting climate change" and this should TERRIFY every American.

— Retro Coast (@RetroCoast) January 17, 2023

What it will mean: no auto loans for gas cars. No mortgages for "energy inefficient" homes. No loans to small businesses that are not "green." Etc. Etc.