Consumer and Republican backlash against Environmental, Social and Governance (ESG) investments has increased dramatically in the past year as states, Congress and presidential candidates have taken on the issue, promising to rein in the largely green-conscious movement of capital amid spiraling energy and food costs since 2021.

Boycotts of brands such as Bud Light, Disney and Target, coupled with statements by Blackrock CEO Larry Fink that he no longer wanted to call these so-called sustainable investments ESG— at Aspen Ideas Festival on June 25 Fink said “I’m not going to use the word ESG because it’s been misused by the far left and the far right… we talk a lot about decarbonization, we talk a lot about governance … or social issues, if that’s something we need to address…”—and reported outflows from ESG funds in 2023 have painted a gloomy picture for green and socially conscious investing.

For example, a recent headline from Bloomberg touted “BlackRock, State Street Among Money Managers Closing ESG Funds,” as certain ESG funds were closed. Oilprice.com’s Felicity Bradstock reports, “ESG Investments Face Financial Hurdles,” citing “disappointing returns” and “concern among financial experts.” And the New York Post’s Charlie Gasparino reports “Investment titan BlackRock mutes ESG talk amid backlash” even as Blackrock still controls $700 billion of “pure ESG” assets.

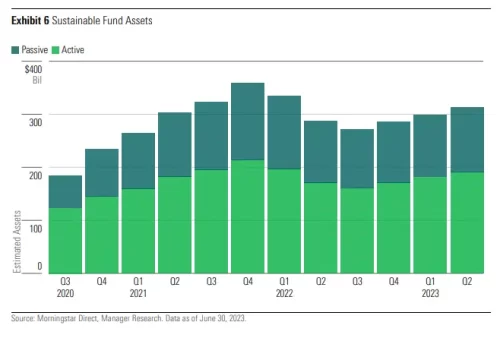

The closures of certain ESG ventures resulted in most recently $635 million of withdrawals from so-called “sustainable” asset funds in the second quarter of 2023, according to Morningstar.

And yet the outflows were not enough to result in negative returns in the funds, which have increased the past three quarters to $313 billion, according to Morningstar: “Despite outflows from sustainable funds, rising equity and bond markets drove assets in these funds to more than $313 billion, their highest point since the first quarter of 2022.”

In other words, ESG is no smaller than it was last year after all markets took a major hit following Russia’s invasion of Ukraine in Feb. 2022. Reports Morningstar, “a 13% decline from the all-time record of $358 billion at the end of 2021 but a 15% increase from the recent low of $272 billion in 2022’s third quarter.” And that is compared to other non-sustainable asset classes, “By comparison, assets in the broader U.S. market also peaked at the end of 2021 and slid by 11% through to the end of June 2023.” So, everything is down compared to the end of 2021, with sustainable asset funds slightly worse for wear than the broader market, but not by much.

Even many of the boycotted companies still appear to be easily profitable. For example, ABInbev, which owns Bud Light who saw U.S. sales plummet after a marketing pitch by transgender activist Dylan Mulvaney, has seen revenue increase globally by 10 percent despite a 10.5 percent drop in U.S. sales.

According to the Daily Investor’s Bianke Neethling, ABInbev’s Mulvaney-generated social media controversy and loss of sales in the U.S “was offset by growth in the company’s other key markets, including Mexico, Colombia, China, Brazil, Europe and South Africa. Earnings grew by more than 20% in Brazil, China and Colombia in the second quarter. In South Africa, the company saw double-digit top-line growth with continued market share gain.”

Similarly, Disney’s gross profits the past 12 months have totaled $28.7 billion, up 3 percent from the year prior. In the second quarter of 2023, it earned $7.85 billion of profits, up 0.47 percent from last year.

Similarly, Target has generated $28.2 billion of profits the last 12 months, including $6.98 billion in the second quarter of 2023.

Get woke, go broke? Where?

In 2022, ESG investments in the U.S. stood at $8.4 trillion, according to the latest data by the USSIF, The Forum for Sustainable and Responsible Investment. It will be interesting to see how 2023 turns out, but right off the bat that was a whole lot of money on the table at the end of last year.

Meaning, the negative ESG headlines we are seeing in certain financial media could mislead that the sustainable and socially conscious investment kick is going anywhere anytime soon. It’s akin to happy talk. Instead, it is digging in its heels — even as it wrestles with how to market itself — while markets continue to work through inflation and interest rate sparked volatility currently roiling investors.

In the meantime, the Department of Labor is still encouraging ESG investments by employer based defined benefit and contribution plans. Tax deferment for retirement savings, including into ESG funds, remains alive and well. And tens of billions of dollars from Congress continues to flow to green companies from the Inflation Reduction Act as the decarbonization agenda continues largely unimpeded.

That, even as crude oil production in the U.S. reached a new record level at 12.9 million barrels a day in July 2023 in response to the inflation and continued supply chain disruptions occurring out of the war in Ukraine, according to the U.S. Energy Information Administration. Over the next few decades, companies like Exxon and Chevron continue to say they plan on proceeding to net-zero on carbon emissions in response to green activist investors.

Longer term, these companies could still see negative outcomes, for example, as Republican-run states and members of Congress look at violations of Title VII of the Civil Rights Act by companies offering racial and gender based hiring and promotion preferences. These concerns are bolstered by the Supreme Court’s decision striking down affirmative action in college admissions as a violation of the Fourteenth Amendment. Or as antitrust lawsuits look at sustainable companies plans to eliminate carbon-based energy in a collusive manner by driving up energy costs.

There are a lot of balls still up in the air. Yes, the American people are more aware of ESG and the influence it has on the U.S. economy, and have fired a few warning shots with targeted boycotts. Certain red states are no longer allowing state workers to make ESG investments in state pensions. But it could be a false comfort.

The greatest trick the devil pulls off is convincing the world he doesn’t exist. We’ll see better where everything ESG stands after the recession and/or market volatility being experienced is over. The Title VII and antitrust liability threats could still cause a big reboot, but my gut says they’ll never give up. As Fink said, even if they don’t call it ESG, the agenda remains: “we talk a lot about decarbonization, we talk a lot about governance … or social issues…” Why would they ever give up?

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2023/10/rumors-of-esgs-demise-are-greatly-exaggerated/