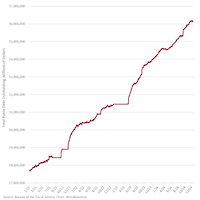

The federal debt has fallen $77 billion over the last 2 days, but only because Treasury has simultaneously drained $104 billion from its cash account; which looks like Janet Yellen is trying to set up her replacement at Treasury for failure, leaving a depleted cash reserve (the opposite of what Yellen inherited, the largest Treasury cash balance ever) which will give the next Treasury secretary less flexibility just as bonds yields are rising.

As the mood in Republicans is to rein in the debt, (although Trump can see his problem and wants an upward move on the ceiling), we can see challenging times ahead.

The federal debt has fallen $77 billion over the last 2 days, but only b/c Treasury has simultaneously drained $104 billion from its cash account; sure seems like Yellen is trying to set up her replacement at Treasury for failure – a short 🧵 pic.twitter.com/NF7hbz35zj

— E.J. Antoni, Ph.D. (@RealEJAntoni) December 30, 2024

Here’s a simplified explanation:

- Government’s Checking Account: Imagine the government has a big bank account where it keeps cash for daily expenses.

- Janet Yellen’s Actions: Before January 1st, Janet Yellen, who was the U.S. Treasury Secretary, has been using up a lot of the money in this account.

- Debt Ceiling: The “debt ceiling” is like a credit limit on how much the government can borrow. Until January 1st, there’s no set limit on borrowing – it’s like having an unlimited credit card for that time.

- Impact on January 1st: Once January 1st hits, the unlimited borrowing ends, and a new, fixed limit on how much can be borrowed kicks in. If the government’s checking account is nearly empty at this point, the new administration, under Trump, will find itself with low cash and unable to borrow more without Congress raising the debt ceiling.

- Immediate Problem for Trump’s Administration: Because the money was spent before the limit was reapplied, Trump’s team would have to deal with this debt limit issue right away after taking office, making it an urgent problem due to the low cash reserves left by the previous spending.

In essence, by spending down the cash reserves before the debt ceiling was set again, it’s like setting up a financial challenge for the next administration, in this case, Trump’s, right from the start.

I would vote against the debt ceiling deal. We need to think on the timescales of history, not 2-year election cycles. We should stand for principles, not incrementalism or window-dressing. I won’t apologize for that. pic.twitter.com/lIUnkwJ1mN

— Vivek Ramaswamy (@VivekGRamaswamy) May 29, 2023