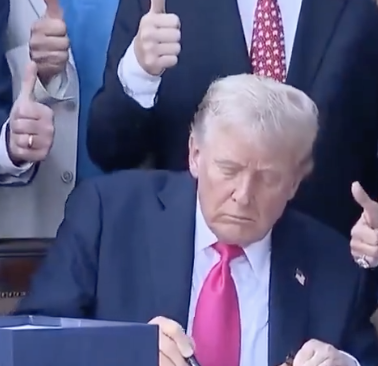

On July 4, 2025, President Donald Trump signed the One Big Beautiful Bill Act (H.R. 1) into law, marking a monumental victory for conservative principles. Passed by the House on July 3, 2025, with a 218–214 vote and by the Senate on July 1, 2025, with a 51–50 vote secured by Vice President JD Vance’s tie-breaker, this 870-page reconciliation package delivers on core Republican promises from the 2024 campaign. From cementing tax relief to strengthening border security and reining in federal spending, the bill represents a bold step toward an America First agenda. Below are the key highlights of the final version, viewed through a conservative lens, showcasing its transformative impact on the economy, security, and governance.

Permanent Tax Relief for Workers and Businesses

The cornerstone of the Big Beautiful Bill is the permanent extension of the 2017 Tax Cuts and Jobs Act (TCJA), ensuring that individual income tax rates and brackets remain at their pro-growth levels. This prevents a $4 trillion tax hike that would have hit middle- and working-class families had the TCJA expired in December 2025. The bill increases the standard deduction to $16,000 for individuals and $32,000 for joint filers through 2028, reducing taxable income for millions. For seniors, a temporary $6,000 deduction for those 65 and older, available from 2025 to 2028, eases financial burdens, with a phase-out for incomes above $75,000 (individuals) or $150,000 (joint filers). The child tax credit rises to $2,200 permanently starting in 2025, with inflation adjustments from 2026, supporting families without expanding refundable credits that conservatives view as disincentives to work.

Small businesses, the backbone of the economy, benefit from the permanent extension of the Section 199A Qualified Business Income deduction at 20%, preserving a critical tax break for pass-through entities. The bill also eliminates taxes on tips and overtime pay through 2028, with a $25,000 tip deduction cap (phased out above $150,000 for individuals or $300,000 for joint filers) and a $12,500 overtime deduction cap, fulfilling Trump’s campaign pledge to reward hard-working Americans. A temporary $10,000 deduction for interest on new auto loans for U.S.-assembled vehicles, from 2025 to 2028, incentivizes domestic manufacturing while offering relief to car buyers.The state and local tax (SALT) deduction cap, a contentious issue, rises from $10,000 to $40,000 starting in 2025, with a phase-out for incomes above $500,000 and a reversion to $10,000 in 2030. This compromise addresses concerns from Republicans in high-tax states like New York while maintaining fiscal discipline. The estate tax exemption increases to $15 million, adjusted for inflation, shielding family farms and businesses from punitive taxation. These provisions, conservatives argue, fuel economic growth, with estimates suggesting families could see up to $13,300 more in take-home pay and workers gaining $11,600 in higher wages over four years.

Border Security and Immigration Enforcement

The bill allocates $175 billion for immigration and border enforcement, delivering the most robust border security package in history. This includes $46.5 billion for border wall construction, $45 billion for detention capacity, and $30 billion for Customs and Border Protection resources. A $10 billion fund empowers states to assist with federal immigration enforcement and deportations, reinforcing local-federal partnerships. New fees, including a $100 asylum application fee, help offset costs while deterring frivolous claims. Conservatives hail these measures as a fulfillment of Trump’s promise to restore order at the southern border, where illegal crossings have plummeted since January 2025 due to stringent administration policies. The bill’s focus on enforcement over amnesty aligns with the GOP’s commitment to national sovereignty.

Reforming Welfare and Medicaid for Accountability

The Big Beautiful Bill introduces long-overdue reforms to Medicaid and the Supplemental Nutrition Assistance Program (SNAP), emphasizing personal responsibility and program integrity. Medicaid, which serves 73 million Americans, now requires able-bodied adults to work 80 hours per month, with exemptions for pregnant women, children, and the disabled. Re-enrollment shifts to every six months with income and residency verifications, rooting out fraud. The bill reduces the Medicaid provider tax from 6% to 3.5% by 2032, easing burdens on healthcare providers while saving $1 trillion over a decade. A $50 billion rural hospital stabilization fund mitigates impacts on underserved areas, addressing concerns from senators like Susan Collins.

For SNAP, serving 40 million Americans, states with payment error rates above 6% must contribute 5–15% of costs starting in 2028, incentivizing efficiency. These reforms, conservatives argue, preserve safety nets for the truly needy while eliminating waste. Critics claim 11.8 million could lose Medicaid coverage and 3 million could lose SNAP benefits by 2034, but Republicans counter that these projections overstate impacts and reflect a return to pre-expansion eligibility norms.

Energy Independence and Deregulation

The bill advances American energy dominance by repealing most clean energy tax credits from the 2022 Inflation Reduction Act, saving $500 billion over a decade. Credits for electric vehicles, home EV chargers, and energy-efficient systems are eliminated, while solar and wind credits phase out by 2027. The carbon dioxide sequestration credit is expanded, and clean fuel production credits are extended, supporting fossil fuel innovation. The Strategic Petroleum Reserve receives funding to bolster national security, and $12.5 billion modernizes the Federal Aviation Administration’s air traffic systems, enhancing energy-efficient aviation. Conservatives view these moves as a rejection of costly green mandates, unleashing domestic oil, gas, and coal production to lower energy costs, projected to rise 30% under prior policies.

Defense and National Pride

National security is fortified with $150 billion for military modernization, including $25 billion for the Golden Dome missile defense system, $29 billion for shipbuilding, and $15 billion for nuclear deterrence. The Defense Department gains $1 billion for border security, underscoring the link between domestic and global threats. The bill allocates $150 million for events celebrating America’s 250th anniversary in 2026 and $40 million for the National Garden of American Heroes, honoring figures like George Washington and Ronald Reagan. These investments, conservatives assert, restore military readiness and foster patriotism eroded by progressive policies.

Fiscal Discipline and Deficit Concerns

The bill raises the debt limit by $5 trillion to accommodate new spending and tax cuts, projected to add $3.3 trillion to deficits over a decade, per the CBO. However, Republicans dispute this, arguing that economic growth from tax cuts and $2 trillion in mandatory savings—through cuts to programs like NOAA’s climate initiatives and Interior’s conservation projects—will offset costs. The rescission of Inflation Reduction Act funds, including $285 million for USDA export programs and bioenergy initiatives, reflects a commitment to slashing wasteful spending.

Conservatives acknowledge the deficit challenge but prioritize growth-oriented policies, citing the TCJA’s success in driving 3.5% GDP growth in 2018.

Conservative Opposition and Compromises

The bill faced resistance from fiscal conservatives like Representatives Thomas Massie, Chip Roy, and Ralph Norman, who opposed its debt increase and insufficient spending cuts. In the Senate, Rand Paul voted against early reconciliation instructions, and Senators Thom Tillis and Susan Collins raised concerns over Medicaid cuts. Compromises, such as boosting rural hospital funding and removing a proposed AI regulation moratorium, secured passage. The elimination of provisions banning Planned Parenthood funding and restricting welfare for undocumented immigrants disappointed some conservatives but preserved the bill’s viability under reconciliation rules.

In the final analysis, how did we do?

The One Big Beautiful Bill Act of 2025 is a conservative triumph, delivering historic tax relief, robust border security, and welfare reforms while advancing energy independence and national defense. By making the TCJA permanent, eliminating taxes on tips and overtime, and investing $175 billion in border enforcement, the bill fulfills Trump’s 2024 mandate. Despite adding $3.3 trillion to deficits, its $2 trillion in savings and pro-growth policies align with conservative values of limited government and economic freedom. As Speaker Mike Johnson declared on July 3, 2025, this legislation jumpstarts the economy and ensures prosperity for decades. For conservatives, it’s a bold step toward restoring the American Dream.