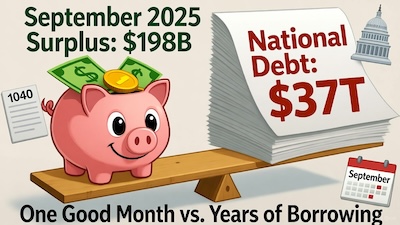

In September 2025, the U.S. government made headlines by recording a massive $198 billion budget surplus—the biggest ever for that month. This means the government took in more money than it spent during September. At the same time, the U.S. national debt is over $37 trillion, a number so big it’s hard to even picture.

Why isn't every single person in America celebrating the fact that the federal government hit a historic $200 billion surplus in September? pic.twitter.com/yT4cPe69HL

— George (@BehizyTweets) October 16, 2025

How can the government have extra cash one month but still owe so much overall? Let’s break it down in a way that’s easy to understand.

What’s a Budget Surplus?

Think of the federal budget like your own bank account. The government collects money (called revenues) from things like taxes you pay on your income or that businesses pay on their profits. It also spends money (called outlays) on things like schools, roads, hospitals, and the military. When the government collects more money than it spends in a month, that’s a surplus. In September 2025, the government collected about $607 billion in taxes—way more than the $409 billion it spent. That left a surplus of $198 billion.

Why was September so special? Well, September is often a good month for the government because a lot of taxes, like those from businesses, come due at the end of the fiscal year (September 30). Plus, the economy was doing well, with more people working and businesses earning profits, so tax payments were higher than usual. Some extra money from tariffs (taxes on imported goods) also helped.

What’s the National Debt?

Now, let’s talk about the national debt. This is the total amount the government has borrowed over many years to pay for things when it didn’t have enough cash. Imagine you keep borrowing money to buy stuff because your allowance isn’t enough. Over time, your debt piles up, even if you have a good month where you earn some extra cash. That’s what’s happening with the U.S. government.

As of October 2025, the national debt is over $37 trillion. That’s money the government owes to people and groups who buy its bonds (like IOUs), including banks, foreign countries, and even parts of the government itself, like the Social Security trust fund. This huge number comes from years of spending more than the government collects, especially during big events like wars, recessions, or pandemics.

How Can Both Happen at Once?

It might seem confusing that the government can have a surplus and still owe trillions, but it’s not as weird as it sounds. Here’s why:

- Surplus is short-term, debt is long-term. A surplus is like getting a big paycheck one month—it’s just for that moment. The national debt is like the total balance on a credit card you’ve been using for years. One good month doesn’t erase years of borrowing.

- The surplus is small compared to the debt. The $198 billion surplus is a lot of money, but it’s tiny compared to $37 trillion. It’s like paying $200 off a $37,000 credit card bill—it helps, but you’re still in debt.

- The whole year matters more. Even with a surplus in September, the government spent more than it earned for the entire year of 2025. The total deficit (when spending beats revenue) for the year was about $1.8 trillion. That means the debt grew by $1.8 trillion, even with September’s good news.

- Borrowing is normal. The government borrows by selling bonds to cover deficits. A surplus lets it pay back a little, but the debt has been building for decades—through wars, tax cuts, and big programs like Social Security and Medicare.

Here’s a quick comparison to make it clear:

| Surplus (September 2025) | National Debt (Ongoing) |

|---|---|

| A one-month win: $198 billion extra | Total owed: $37 trillion |

| Happens when taxes > spending | Grows when spending > taxes over years |

| Like a big birthday cash gift | Like a huge student loan you still owe |

Why Does This Matter?

The September surplus is great news—it shows the economy is strong, with lots of people and businesses paying taxes. It also means the government didn’t have to borrow as much that month. But the huge national debt is a reminder that the U.S. has been spending more than it earns for a long time. Big programs like healthcare, Social Security, and defense cost a lot, and interest on the debt alone is now over $1 trillion a year. That’s money that could go to schools or roads but instead pays old loans.

Looking ahead, experts say the debt could keep growing unless the government finds ways to spend less or collect more taxes. For now, the September surplus is like a small victory in a much bigger challenge.

Want to Learn More?

If you’re curious about the numbers, check out the U.S. Treasury’s Monthly Treasury Statement online. It’s like the government’s monthly bank statement, showing exactly where the money comes from and where it goes. Understanding this stuff helps you see how the country’s finances work—and why it’s such a big deal!