China’s economic miracle is often dismissed as mere low-cost labor or copycat manufacturing, but beneath the surface lies a far more sophisticated system of central planning than commonly imagined. Through decades of strategic industrial policy, the Chinese state has orchestrated the creation of hyper-specialized “industrial clusters”—entire cities or districts that dominate the global supply chain for a single product category, from lighters in Wenzhou to socks in Datang. This “one city, one product” model combines top-down guidance with local entrepreneurship, building self-reinforcing ecosystems of suppliers, skilled workers, and infrastructure that deliver unmatched speed, scale, and cost efficiency—making China’s manufacturing dominance not accidental, but the product of intricate, adaptive planning that few outsiders fully grasp.

This video, titled “The Hidden Logic of China’s Supply Chain: Why One City Makes One Thing?“, features a Chinese sourcing expert named ‘Eric’ explaining why China’s manufacturing dominance isn’t random or just “luck,” but the result of highly specialized industrial clusters—self-reinforcing ecosystems where entire supply chains for a specific product are concentrated in one city or region.

Key Points:

- Specialization by City: Unlike in the West, where factories are often scattered, China has dedicated “capital cities” for specific industries. Examples include:

- Lighters → Wenzhou

- Christmas decorations → Yiwu

- Small home appliances (e.g., hair dryers) → Ningbo/Cixi

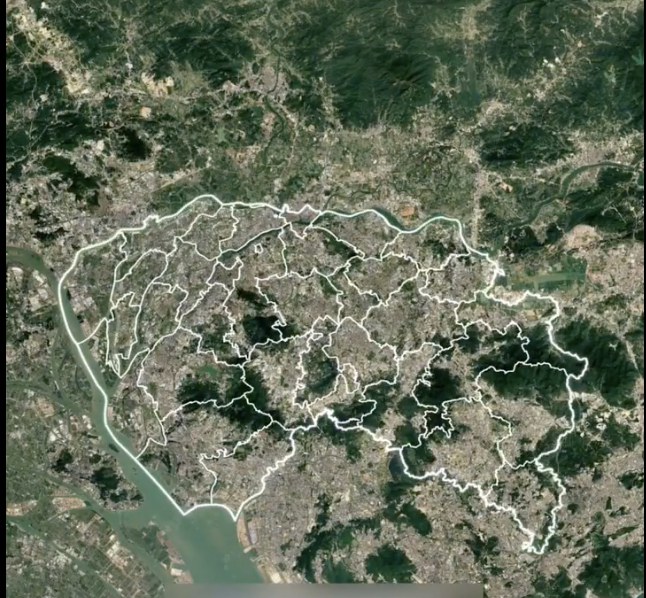

- Electronics → Shenzhen/Dongguan

- Toys → Shantou Chenghai

- Socks → Yiwu Datang

- Furniture → Foshan Shunde

- Textiles → Shaoxing Keqiao

- Luggage → Baoding Baigou

- Why These Clusters Form and Thrive: Decades of development have created complete ecosystems: raw material suppliers, component manufacturers (e.g., motors, heaters, molds), assembly factories, specialized labor (workers trained specifically for that product), optimized machinery, repair shops, and logistics—all within a small radius (e.g., 5km in some cases). This makes production faster, smoother, and dramatically cheaper.

- Competitive Advantage: A single specialized Chinese city can outcompete entire countries in a product category because the full supply chain is “next door.” Being outside the right cluster means “fighting gravity”—higher costs, delays, and inefficiencies. Picking the wrong city can waste 20-40% of a buyer’s budget.

- Not Luck, But Intentional Design: Eric emphasizes this is a “self-reinforcing ecosystem” built over time with suppliers, labor, machines, and infrastructure all aligned.

How This Relates to China’s Central Planning Being More Complex

This system illustrates a sophisticated form of state-guided industrial policy rather than pure free-market forces or simplistic top-down Soviet-style planning.

The Chinese government has actively encouraged (through incentives, infrastructure investment, local policies, and strategic planning) the formation of these hyper-specialized clusters since the reform era. It combines central coordination with regional competition and private entrepreneurship, creating massive scale, efficiency, and resilience in global supply chains.

This “one city, one product” model is far more intricate and adaptive than outsiders often imagine, explaining why China dominates so many manufacturing categories despite appearing “planned.” It’s a hybrid system: directed yet decentralized at the cluster level, making it hard for other nations to replicate or compete against.

The video ends with Eric offering sourcing help, positioning himself as a guide to this “hidden map” that most foreign buyers don’t understand. It’s a great intro to appreciating the depth and intentionality behind China’s industrial powerhouse.

China’s industry is a different beast 🤯

— International Cyber Digest (@IntCyberDigest) December 14, 2025

Every product and its supply chain are tied to one huge city the size of a nation, Eric explains.

This is why other nations can’t compete with China. pic.twitter.com/ddLw63hTSf