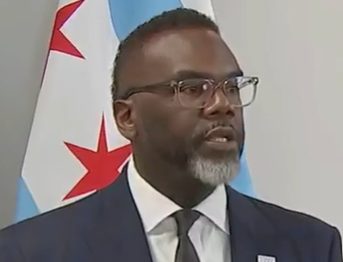

Listen up, Chicagoans. Your radical mayor, Brandon Johnson, that teachers’ union puppet who’s turned the Windy City into a fiscal dumpster fire, is at it again. Facing a whopping $1.1 billion budget hole for 2026, he’s dusting off the old “head tax” playbook—a per-employee shakedown on big employers to rake in cash for his pet projects. And get this: He swears up and down it won’t touch a single job. As if slapping extra costs on hiring won’t make businesses think twice about expanding or even sticking around. This isn’t innovation; it’s desperation from a guy who’s allergic to cutting waste. With revelations pouring out in early December 2025 showing his plan getting tweaked amid fierce pushback from aldermen and business leaders, it’s clear this tax is a recipe for economic suicide. Let’s dissect this nonsense, how it supposedly works, and why history screams “been there, bombed that.”

The Shakedown Scheme: How Johnson’s Head Tax Would Hammer Employers

Johnson’s latest brainchild, unveiled in October 2025 and revised just this week on December 10, is a corporate head tax targeting the city’s biggest players. The original pitch hit companies with 100 or more workers at $33 bucks per head per month, but after getting laughed out of the room, he narrowed it to outfits with 500-plus employees. That still socks it to around 250 businesses, pulling in an estimated $82 million a year—peanuts against that billion-plus deficit, but hey, every drop in the socialist slush fund counts.

Here’s the drill: Employers cough up $33 monthly for each worker on the payroll, funneled straight into city coffers to plug holes in everything from violence prevention programs to whatever bloated bureaucracy Johnson fancies. It’s sold as a “fair share” from fat cats, but in reality, it’s a lazy grab that ignores Chicago’s real problems—like skyrocketing property taxes, pension black holes swallowing $2.5 billion annually, and a downtown that’s a ghost town post-COVID. Recent tweaks came after a bloc of 27 aldermen introduced counter-proposals on December 10, scrapping the tax entirely and pushing for actual reforms like trimming the fat from the city’s 40,000-strong workforce. But Johnson? He’s digging in, insisting this won’t chase jobs away. Spoiler: It will.

Do you really need empirical proof, if each additional employee you hire will increase your business’s tax, that head taxes will suppress employment?

Surely this is obvious. To anyone who had spent time in the private sector.

— NOfP-X (@NOfPPlus) December 12, 2025

Johnson’s Job-Killing Delusion: Why His “No Impact” Claim Is Pure Fantasy

The mayor’s bold-faced assertion that this tax won’t ding employment is about as believable as a Cubs World Series streak. He and his cheerleaders are peddling the line that there’s “no evidence” it’s a job killer, but dig into the economics, and it’s crystal clear: Jacking up the cost of each employee makes hiring more expensive, plain and simple. Studies show these kinds of payroll-style taxes can slow job growth, especially at smaller or newer firms scraping by on thin margins. They nudge bosses toward automation, outsourcing, or just flat-out relocating to friendlier turf—like Indiana or Wisconsin, where Illinoisans have been fleeing in droves.

Think about it: If you’re a company eyeing expansion, why add bodies in Chicago when every new hire costs an extra $396 a year? That’s not chump change—it adds up fast for a firm with thousands on staff. Revelations from December 2025 cabinet leaks and economic reports highlight how similar taxes distort labor markets, reducing wages or hours to offset the hit. One analysis pegs the drag on employment at up to 1-2 percent in affected sectors, with low-skill workers taking the biggest beating. Johnson’s crew waves away the warnings, but businesses aren’t buying it. With Chicago’s unemployment already hovering at 5.2 percent—higher than the national average—this tax could tip more folks onto the dole, ballooning welfare costs and deepening the deficit death spiral. It’s not rocket science; it’s Economics 101, and Johnson’s flunking it.

Chicago’s Head Tax History: A Job-Stifling Flop That Got the Boot

This ain’t Johnson’s first rodeo with the head tax—Chicago’s been down this road before, and it ended in a U-turn. Back in 1973 under Mayor Richard J. Daley, the city slapped a $3 per employee per month fee on businesses with 15 or more workers. It started small but ballooned over decades, hitting $800 annually per head by the early 2010s. Businesses howled it was a “job killer,” stifling growth and making the city less competitive. By 2011, with the economy reeling from the Great Recession, Mayor Rahm Emanuel pushed to phase it out, starting in 2012 and fully repealing it by 2014. The move was hailed as a win for employers, unlocking hiring and investment that had been on ice.

What happened? Pre-repeal, companies cited the tax as a top reason for skipping town or capping staff. Post-repeal, job growth ticked up 1.5 percent in key sectors like finance and tech, with firms like Google expanding footprints. But fast-forward to now, and Johnson’s revival ignores those lessons. Recent December 2025 reports reveal the old tax cost the city $100 million in lost economic activity yearly through reduced hiring alone. It’s like bringing back bell-bottoms—outdated, ugly, and nobody wants it.

Seattle’s Head Tax Horror Show: Passed, Protested, and Promptly Pulled

If Chicago’s history isn’t warning enough, look west to Seattle’s 2018 debacle. The progressive paradise passed a $275 per-employee annual tax on businesses grossing over $20 million, aimed at funding homelessness programs. Sound familiar? It was supposed to rake in $47 million a year, but the backlash was instant and brutal. Amazon, the city’s top dog, paused construction on a massive HQ expansion, threatening to bail and take 7,000 jobs with it. Starbucks and other giants piled on, warning of hiring freezes and relocations.

The tax never even kicked in fully—it got repealed just a month after passage on June 12, 2018, in a 7-2 council vote amid a citizen referendum push that gathered 45,000 signatures in weeks. Effects? Even the threat tanked business confidence, with surveys showing 62 percent of firms reconsidering growth plans. Post-repeal, Seattle’s economy rebounded, adding 50,000 jobs in the following year. Johnson’s ignoring this too, but with Illinois Governor J.B. Pritzker publicly blasting the idea as “absolutely opposed” back in October 2025, the writing’s on the wall: Head taxes don’t build cities; they bleed them.

Drain the Chicago Swamp: Time to Ditch This Dumb Idea for Good

Johnson’s head tax is a desperate Band-Aid on a gunshot wound, peddled with fairy tales about zero job impact. History from Chicago’s own flop and Seattle’s quick kill proves it’ll chase employers out faster than rats from a sinking ship. With a revised proposal still facing a council showdown this week and a potential government shutdown looming if no budget passes by December 31, 2025, Chicagoans deserve better—real cuts to waste, pension reforms, and pro-growth moves that put America First. Let the mayor’s socialist dreams die on the vine; the city’s future depends on it. Wake up, Windy City: Vote these tax-and-spend clowns out before they turn your town into Detroit 2.0.