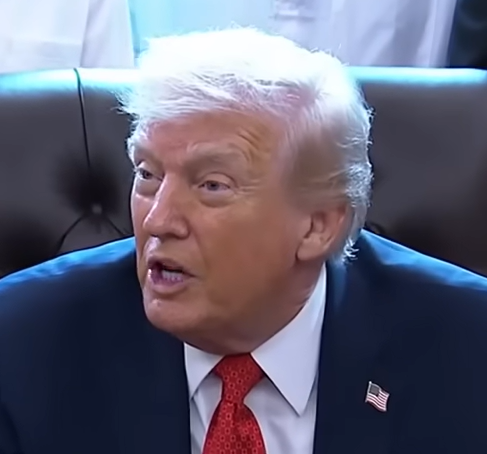

In a decisive move that underscores his America First agenda, President Donald Trump has positioned the United States as the dominant force in Venezuela’s oil sector following the U.S.-led operation that removed Nicolás Maduro from power on January 3, 2026. This intervention has shifted control of the world’s largest proven oil reserves—over 300 billion barrels—to American oversight, with U.S. companies like Chevron, ExxonMobil, and ConocoPhillips set to lead rehabilitation efforts. During a January 9, 2026, White House meeting with oil executives, Trump declared: “China can buy all the oil they want from us.” This seven-word statement marks a profound victory for American economic leverage, ensuring that Venezuelan crude flows through U.S.-controlled channels, in dollars, and under American terms.

Verifying the Foundations: Venezuela’s Oil in Context

Venezuela holds the planet’s largest proven crude reserves, primarily in the Orinoco Belt, surpassing even Saudi Arabia. However, decades of mismanagement under Maduro, combined with U.S. sanctions since 2017, reduced production from a peak of around 3 million barrels per day (bpd) in the early 2000s to approximately 1.1 million bpd in 2025. Maduro relied on alliances with Russia and China to evade sanctions. Russia offered military and technical support, while China provided over $50 billion in loans secured against future oil deliveries, turning Venezuelan crude into collateral.

In 2025, China absorbed the majority of Venezuela’s exports—around 400,000–470,000 bpd, or roughly 4–5% of its total crude imports—mostly heavy Merey crude suited to its independent “teapot” refineries. Russia facilitated evasion via a “shadow fleet” of tankers that operated covertly, often in non-dollar currencies like yuan. Trump’s policy has dismantled this: U.S. forces seized multiple tankers, including Russian-flagged vessels, and rerouted flows. Venezuela has agreed to transfer 30–50 million barrels directly to the U.S., with sales proceeds controlled by Washington. American firms are positioned to boost output, potentially reaching 1.5 million bpd in the near term with $10–20 billion in investments, and higher with $100 billion over time.

U.S. Refineries: Built for Venezuelan Heavy Crude

Many U.S. Gulf Coast refineries, particularly in Texas, Louisiana, and Mississippi, are specifically configured to process heavy, sour crude like Venezuela’s Merey grade. These facilities—operated by companies such as Chevron, ExxonMobil, Marathon, Valero, and Phillips 66—were upgraded in the 1990s and 2000s with coking units, hydrocrackers, and desulfurization equipment to handle dense, high-sulfur oil from Venezuela, Mexico, and other sources. This makes them far more efficient with Venezuelan crude than with lighter shale oil, allowing for higher yields of valuable products like diesel, jet fuel, and asphalt. Experts note that Gulf Coast refineries can readily absorb an additional 1 million bpd or more from Venezuela, optimizing operations, reducing costs, and potentially stabilizing or lowering fuel prices for American consumers.

The Geopolitical Ripple Effects: Undermining BRICS and De-Dollarization

BRICS (Brazil, Russia, India, China, South Africa, and expanded members) has pursued de-dollarization for years, using energy trade to erode U.S. financial dominance. Russia supplied discounted crude to China in yuan, while Venezuela provided a non-Western heavy oil source, enabling sanctions evasion and non-dollar settlements. This “multipolar energy order” depended on supply diversity beyond U.S. control.

Trump’s actions have shattered this foundation. By mandating sales through U.S. firms in dollars, every barrel sold to China or Russia reinforces the petrodollar system and funnels revenue to U.S.-controlled accounts. This is monetary warfare presented as energy security, compelling adversaries to participate in the system they sought to escape. Venezuela, once a BRICS cornerstone, is now firmly under American influence.

Russia suffers immediate setbacks. Moscow invested heavily in Maduro for two decades, including military support. The U.S. seizure of Russian-flagged tankers, despite submarine escorts in some cases, exposed Moscow’s inability to protect allies—eroding its credibility with states like Syria or Cuba. Venezuelan heavy crude now competes with Russia’s Urals blend in Asian markets, potentially displacing Russian exports to China and weakening Moscow’s position amid global pressures.

China faces heightened vulnerability. Beijing’s teapot refiners (China’s independent, privately owned oil refineries) depended on discounted Venezuelan Merey, but with flows redirected, China must negotiate U.S.-set prices and terms. Losing even 4–5% of imports exposes supply chain risks in a slowing economy. Trump’s offer—”buy all the oil they want from us”—is conditional: purchase through American intermediaries or face shortages and premiums.

Framing the Win: Trump’s America-First Triumph

This is not overreach—it’s strategic leadership that prioritizes American prosperity. Trump has transformed a geopolitical liability into an economic asset, securing affordable energy for U.S. refiners, generating jobs via private investments, and stabilizing global prices for American consumers. By emphasizing private capital over taxpayer funds, Trump avoids costly interventions while maximizing returns.

U.S. firms gain priority in rebuilding infrastructure, potentially adding billions to the economy. Weakened BRICS unity hampers anti-U.S. alliances, while Russia’s diminished influence accelerates its isolation. China’s leverage shrinks, setting the stage for stronger trade negotiations. In seven words—”China can buy all the oil they want from us“—Trump has dismantled de-dollarization efforts, reclaimed Western Hemisphere dominance, and reaffirmed America as the world’s energy powerhouse. This is America winning again, decisively and unapologetically.