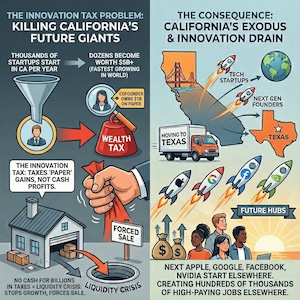

The People’s Republic of California is pulling off the ultimate self-own, and it’s a sight to behold. While President Trump is busy draining the swamp in D.C. and putting America First, the blue-state bozos out West are chasing away their billionaire cash cows with a pitchfork called a “wealth tax.” Yeah, you heard that right – these commie wannabes dreamed up a one-time 5% hit on anyone worth over a billion bucks, payable over five years, and made it retroactive to January 1, 2026, just to make sure no one could dodge the bullet by packing up early. But guess what? The smart money saw it coming and bolted anyway, taking trillions in wealth and billions in potential tax revenue with them. It’s like watching a bunch of vegan hippies try to herd cats – chaotic, pointless, and ending with everyone scratched and broke.

This isn’t some feel-good fairy tale about soaking the rich; it’s a real-time economic suicide pact. California already bleeds residents faster than a bad horror flick, but now the ultra-wealthy are leading the charge out the door. And why not? The state’s turned into a dystopian nightmare where taxes are sky-high, regulations strangle innovation, and the streets are littered with needles and nonsense. The exodus ramped up in late 2025 as word of this tax grab spread, and by January 11, 2026, the damage is done: an estimated $1 trillion in wealth has hightailed it out of Dodge. That’s not chump change – that’s the kind of loot that could fund a small country’s GDP, and now it’s gone, leaving Governor Hair Gel and his cronies staring at an even bigger budget black hole.

Larry and Sergey can’t stay in California since the wealth tax as written would confiscate 50% of their Alphabet shares.

— Garry Tan (@garrytan) January 9, 2026

Each own ~3% of Alphabet's stock, worth about $120 billion each at today's ~$4 trillion market cap.

But because their shares have 10x voting power, the… pic.twitter.com/4DYDDmCDl4

The Usual Suspects: Who’s Packing Up and Heading East

Let’s name names, because these aren’t faceless fat cats – they’re the engines of America’s tech miracle, and California’s treating them like enemy combatants. Top of the list is Larry Page, the Google co-founder who’s worth about $144 billion. He didn’t just dip out; he yanked his family office, Koop LLC, and his flying-car venture, One Aero, straight to Florida, while shuffling other assets to Delaware. Smart move, Larry – Florida’s got no state income tax, beaches without the begging, and leaders who actually like job creators.

Then there’s Peter Thiel, the PayPal maestro sitting on $27.5 billion. He announced his Miami office opening right on New Year’s Eve 2025, basically flipping the bird to California’s tax vampires. Thiel’s no stranger to calling out leftist lunacy, and this tax was the final straw – he’s taking his venture capital wizardry to the Sunshine State, where the only thing retroactive is the good vibes.

Don’t forget David Sacks, the venture capitalist who bolted to Texas. And Larry Ellison, Oracle’s founder with a $192 billion fortune, who’s been unloading California real estate like it’s radioactive – including a $45 million San Francisco pad sold off-market. Public filings show his entities pulling stakes, and whispers say he’s eyeing greener pastures.

But it’s not just these headliners. Financial advisors to the uber-rich report at least a half-dozen billionaires ghosted the state before the January 1 cutoff, with four more confirmed by relocation experts. And the floodgates ain’t closed – expect 15 to 20 more families to follow if voters greenlight this idiocy in November. We’re talking collective net worths in the hundreds of billions, folks like venture investors and tech founders who built Silicon Valley from the ground up. Even Jensen Huang of Nvidia is rumored to be eyeing the exits, though he’s holding pat for now. These aren’t just people leaving; they’re empires on the move, dragging jobs, startups, and innovation with them.

Why They’re Running: Taxes, Tyranny, and Total Dysfunction

Come on, it’s not rocket science – though some of these guys literally build rockets. California’s 13.3% top income tax rate already bites hard, but this new 5% wealth whack is straight-up confiscation. For Page, that’s $7.2 billion yanked from his pocket; for Ellison, $9.6 billion; for Thiel, over $1.2 billion. And it’s not even on income – it’s on net worth, hitting stocks, businesses, everything but real estate and pensions. The lefties say it’s to “offset federal healthcare cuts” and plug a $190 billion Medi-Cal shortfall over the next decade, but that’s code for funding more failed programs while ignoring the fraud and waste that’s already torching billions.

Beyond the tax grab, it’s the whole rotten package. Crime’s out of control – remember when shoplifters could swipe $950 without a slap on the wrist? Homeless encampments turn sidewalks into slums, and regulations make starting a business feel like invading Normandy with a slingshot. Bureaucracy delays everything from permits to progress, and the quality of life? Forget it – unaffordable housing, wildfires, and power outages that make the grid look like a Third World relic. Meanwhile, states like Texas and Florida roll out the red carpet: no income tax, pro-business vibes, and leaders who don’t hate success. It’s America First in action down there – low regs, high growth, and zero apologies for winners winning.

These billionaires aren’t fleeing because they’re greedy; they’re fleeing because California’s become a hostile battlefield for anyone with ambition. And recent revelations? Just this week, on January 11, 2026, venture capitalist Chamath Palihapitiya dropped the bomb: $1 trillion in wealth has already vaporized from the state, with more on the way. That’s fresh intel straight from the front lines, and it’s accelerating as word spreads.

The Bill Comes Due: Trillions Gone, Billions in Lost Revenue

Here’s where it gets ugly for the average Joe still stuck in Cali. That $1 trillion in departed wealth? It’s not just paper – it’s the foundation of California’s tax base. The top 1% already cough up half the state’s income taxes, and billionaires punch way above their weight. Losing even 20-30 of them means hundreds of millions to billions in annual income tax revenue vanishing forever. Add in capital gains – when these titans sell stock, California used to grab 13.3% if they lived there. Now? Zilch. Over a decade, that’s $5 billion to $15 billion gone poof.

The proposed tax was supposed to rake in $100 billion over five years from about 200 billionaires, but with the exodus, that’ll be a fraction – maybe half if they’re lucky. And the ripple effects? Startups flock to Austin and Miami, killing future tax windfalls from the “next Google.” Real estate tanks in ritzy spots like Palo Alto, slashing property taxes. Luxury spending dries up, hitting retail and services. Jobs evaporate as companies relocate – think thousands of high-paying gigs poofing to red states.

California’s already nursing an $18 billion deficit, and this billionaire bug-out turns it into a chasm. The math doesn’t lie: less revenue means more borrowing or higher taxes on the middle class and millionaires left behind. Bonds? The market’s unforgiving – interest rates spike, digging the hole deeper. And fraud? Don’t get me started on the waste in existing billions – daycares grifting federal funds, bloated bureaucracies – but now there’s even less to waste.

America First Wins, California Loses – Again

This billionaire exodus is a frontline victory in the war for economic freedom. While Trump’s slashing waste nationwide, California’s doubling down on socialism lite, and the results are in: the geese laying the golden eggs are flying south. It’s a wake-up call for every blue state – punish success, and success punishes you back. For the rest of us in America First territory, it’s popcorn time: watch the left eat their own while Texas and Florida boom.

But seriously, California – wake up. Your policies are turning the Golden State into fool’s gold. Keep it up, and soon you’ll be begging for a bailout. Good luck with that under a president who puts taxpayers first. The revelations keep coming, and they’re all bad news for the grifters in Sacramento. Stay vigilant, folks – this is how empires crumble.