David Friedberg: California is sitting on half a trillion dollars in bonds, staring at an $18B deficit that’s about to explode past $30B, and still plans to keep borrowing just to function. This is the world’s 4th largest economy, already financially cornered — and that’s before you even factor in the looming pension bomb. To meet existing pension promises alone, California may need to borrow another half a trillion dollars. Let that sink in. The bond market isn’t optional anymore — it’s life support. The real question is simple and terrifying: how does this end without collapse?

Chamath Palihapitiya: There is no way out for states like this. Federal bailouts aren’t coming — and even if they tried, the bond auctions would expose the truth instantly. Investors will look back and ask one question: why didn’t you cut waste when you had the chance? As Nick Shirley exposed, 20–30% of budgets could’ve been cut for a decade, freeing up $25–30 TRILLION to pay down debt. Instead, nothing was done. And now the same people want sympathy, bailouts, and trust.

David Friedberg: California is sitting on half a trillion dollars in bonds, staring at an $18B deficit that’s about to explode past $30B, and still plans to keep borrowing just to function. This is the world’s 4th largest economy, already financially cornered — and that’s before… pic.twitter.com/gM0C1plg5j

— Ian Miles Cheong (@ianmiles) January 10, 2026

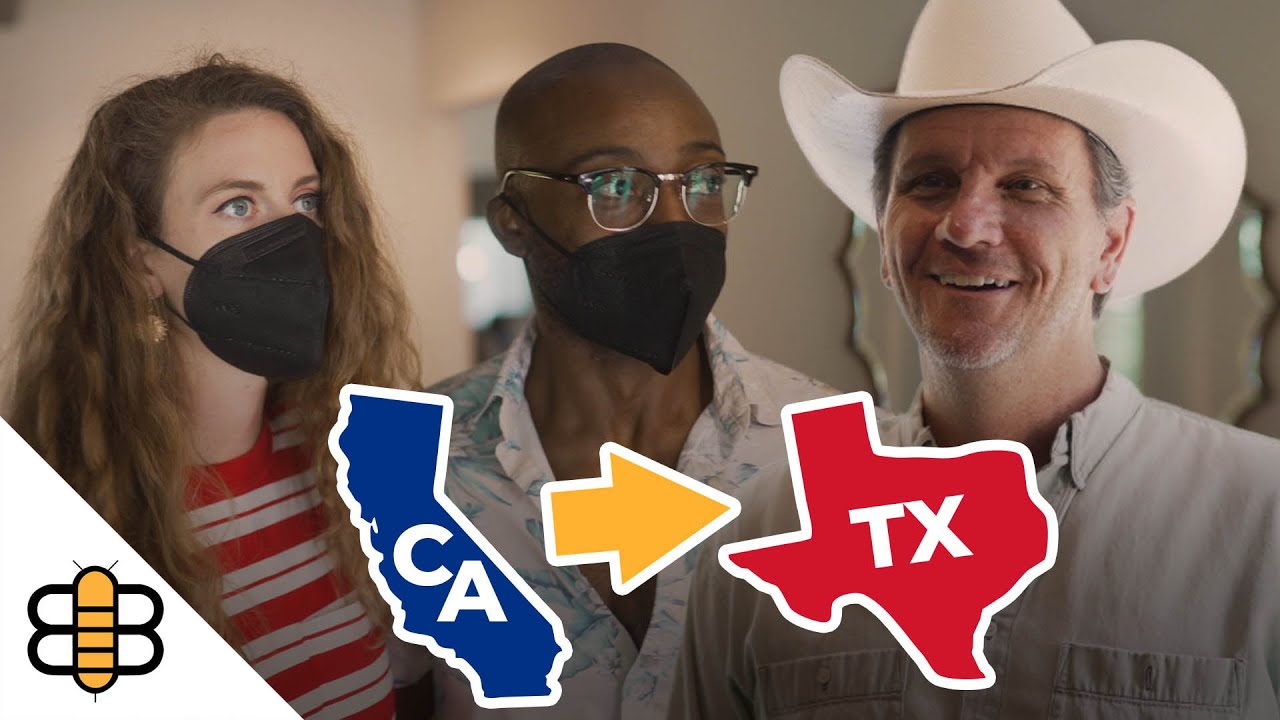

The proposed "wealth tax" is already causing an exodus from California. It turns out successful individuals would rather not have the government seize their assets simply to create a bigger pot of money for fraud, waste, and corruption. pic.twitter.com/Zz1fkO1urq

— Kevin Kiley (@KevinKileyCA) January 3, 2026

Read this

It’s not 1% a year for 5 years.

It’s a one time 5% tax on all assets and it will kill entrepreneurship in California.

Here is an example:

John Doe starts a company. He takes a nominal salary – say $150k for this example – and the rest in equity in the company. Let’s say he owns 20%. He raises VC capital in 2026 from someone that invests $100M into the company and values the company at $6B. This means his 20% is “worth” $1.2B.

I put it in quotes because he can’t actually sell. He has a paper value that putatively says he’s a billionaire. But he actually lives on $150k because that is what his income is. Just because someone decides to make a bet on the business does not mean some bank account in your name magically gets created with $1.2B in it.

Under the proposed tax, however, John Doe would now owe $60M in cash to California in 2027.

How will he pay it?

Is there some buyer you know of, that the rest of the market doesn’t, that will do a deal at the max value when there is a distressed seller like John Doe who needs money he doesn’t have to pay taxes on value he also doesn’t have!

Now imagine that after the tax is assessed, in early 2027, the company takes a write down to $200M. Now his share is $40M. But he still owes $60M. Again, there are no buyers for his shares per se.

He still only makes $150k/yr.

What is this person supposed to do? He now has a “worth” of $40M but owes California $60M.

Should he declare bankruptcy now because he tried to start a business but was retarded enough to do it in California?

So did you really get the billionaires??

No. Because the mega billionaires have already left or are tax structured to minimize the tax or will fight it.

You will, however, drag a bunch of young, energetic folks who want to make things and hire people into bankruptcy court.

It’s not 1% a year for 5 years.

— Chamath Palihapitiya (@chamath) December 28, 2025

It’s a one time 5% tax on all assets and it will kill entrepreneurship in California.

Here is an example:

John Doe starts a company. He takes a nominal salary – say $150k for this example – and the rest in equity in the company. Let’s say he… https://t.co/zdq1bqovXX