Poland implemented a full closure of its border with Belarus on September 12, 2025, citing heightened security risks from the ongoing Russian-Belarusian “Zapad-2025” military exercises. The decision, announced by Prime Minister Donald Tusk, suspends all non-essential crossings, including passenger and freight traffic, and deploys an additional 5,000 troops to the 418-kilometer frontier, supplementing the existing 4,000 personnel. Tusk described the move as a response to “hybrid warfare” tactics, including Russian drones entering Polish airspace during the drills, which began on September 10, 2025.The closure extends previous restrictions first enacted in September 2021, when Poland limited access amid a surge of over 20,000 migrants directed toward the European Union by Belarusian authorities. Temporary suspensions have occurred periodically since then, but the current action is the most extensive, halting rail, road, and air links except for humanitarian and diplomatic purposes.

Security and Humanitarian Ramifications

Polish officials recorded over 15,000 illegal crossing attempts from January to August 2025, with 8,000 prevented by border guards. The government attributes the recent increase—reaching 1,200 attempts per day in late August—to Belarus’s strategy of using migrants as leverage against EU sanctions following the 2020 disputed election that retained President Alexander Lukashenko in power. On September 16, 2025, Tusk allocated 2 billion zloty ($500 million) for enhanced fencing and surveillance along the border.

Humanitarian concerns have mounted, with temperatures falling to 5 degrees Celsius (41 degrees Fahrenheit) overnight on September 17, 2025. Authorities reported rescuing 120 migrants from hypothermia in the initial 48 hours after the closure, including families from Syria and Afghanistan. An estimated 4,000 individuals remain in makeshift camps near the border as of September 18, 2025.

Immediate Effects on Bilateral Trade

The shutdown disrupts a vital trade corridor between the EU and Belarus, which exchanged goods worth 3.5 billion euros ($3.8 billion) in 2024, mainly wood products, fertilizers, and machinery. Poland exported 1.2 billion euros ($1.3 billion) to Belarus last year, while importing 2.3 billion euros ($2.5 billion) in essential raw materials for its chemical and agricultural industries.

Freight rail, accounting for 70% of cross-border cargo, stopped on September 12, 2025, stranding 200 railcars carrying Belarusian potash and Polish dairy products. The Polish trucking association noted 1,500 vehicles queued at alternate routes through Lithuania by September 17, 2025, raising transport costs by 25%. Urea prices, a key fertilizer, increased 8% in Warsaw markets on September 16, 2025, risking a 5% decline in 2026 wheat yields if supplies remain limited.

Broader Implications for European Supply Chains

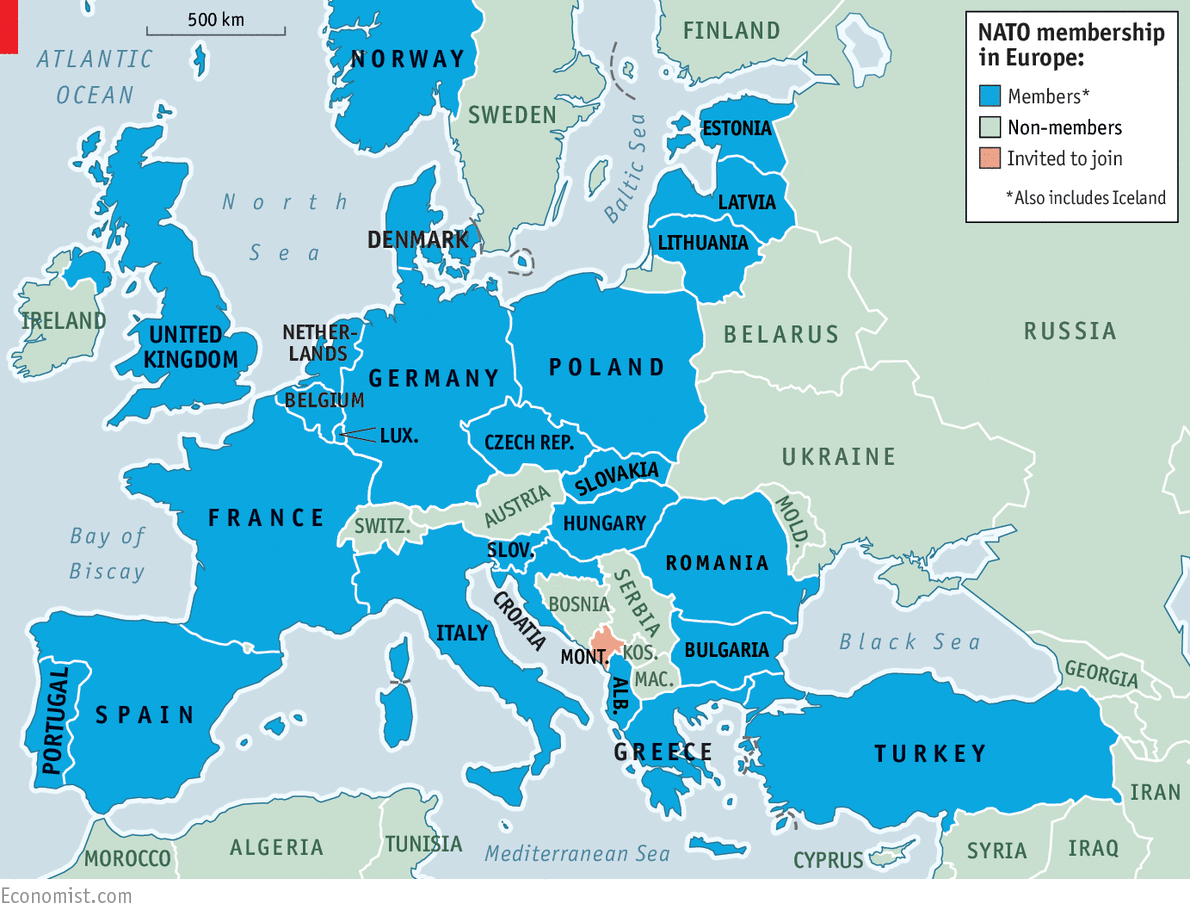

The border closure strains regional logistics, particularly energy and agriculture sectors. Belarus provides 15% of Poland’s fertilizer imports, vital for 14 million hectares of farmland. Lithuania, which sealed its Belarus border in 2022, faces added pressure, with delays extending shipment times by 48 hours to Baltic ports. The European Central Bank indicated on September 17, 2025, that the disruption could contribute 0.2% to regional inflation by year-end due to elevated food production costs.EU foreign ministers convened in Brussels on September 18, 2025, endorsing Poland’s measures and committing 1 billion euros ($1.1 billion) for border security enhancements. A poll of European business leaders on the same day revealed 72% expressing concern over rising costs from geopolitical tensions, with 65% supporting stronger EU border protections.

Disruptions to Chinese Trade with Europe

The closure has halted a key rail corridor for Chinese exports to the European Union, disrupting the China-Europe Railway Express that routes goods through Belarus and Poland. This pathway handled approximately €25 billion ($27 billion) in annual trade in 2024, representing a small but critical segment of the €800 billion total EU-China commerce. E-commerce platforms such as Temu and Shein, reliant on fast rail deliveries for apparel and consumer goods, reported delays of up to 10 days for shipments as of September 17, 2025, prompting Beijing to urge Poland to reopen crossings.

Polish logistics firms, including PKP Cargo, warned of prolonged shutdowns exacerbating bottlenecks, with 300 freight trains rerouted through Germany and the Baltics by September 18, 2025. The disruption affects 30% of Belarus’s potash exports to Europe, indirectly impacting Chinese fertilizer imports used in EU agriculture. Chinese officials expressed concerns on September 17, 2025, about broader supply chain vulnerabilities, with futures for key commodities like soybeans rising 3% on international markets.

Global Trade Disruptions and Long-Term Outlook

The action reverberates worldwide, affecting commodity flows. Belarus accounts for 20% of global potash exports, with 30% routed through Poland to ports in Gdansk and Gdynia for distribution to Asia and Latin America. Brazilian soybean producers, dependent on Belarusian fertilizers for 40% of needs, saw futures prices rise 3% on the Chicago Board of Trade on September 17, 2025.U.S. agricultural exports to Poland, totaling $1.1 billion in 2024 (including corn and soybeans), may encounter delays at Baltic hubs, though direct effects are minimal. American energy companies imported 500,000 tons of Belarusian refined products via Polish routes last year, reporting no immediate shortages as of September 18, 2025. The U.S. Department of Agriculture projected a 4-6% increase in global fertilizer prices if the closure persists beyond October 2025, impacting U.S. farmers who allocate $15 billion annually to imports.

Belarus retaliated on September 18, 2025, by enacting symmetric restrictions on non-essential Polish imports and mobilizing 3,000 additional troops. President Lukashenko addressed the nation on state television, labeling Poland’s actions “economic aggression” and pledging to safeguard sovereignty. Experts anticipate a 10-15% decline in Belarus-EU trade for the remainder of 2025, worsening Belarus’s -2.5% GDP contraction in the first half of the year amid sanctions.

The standoff underscores rising Eastern European tensions, with Poland’s closure signaling a firmer stance against perceived hybrid threats from Russia and its allies. For global trade, it highlights vulnerabilities in overland routes, spurring discussions on diversified supply chains.