We’ve got another exhibit in the hall of shame for how the swamp creatures in D.C. sold out the American Dream to invaders who waltzed across our porous borders. News reports are buzzing about illegal aliens snagging FHA mortgages—those taxpayer-backed loans meant for hardworking citizens scraping together their first home. Turns out, this isn’t just right-wing rage bait; it’s stone-cold fact, courtesy of policy twists under the Biden regime that turned federal housing into a welcome mat for non-citizens. And if you’re wondering why your rent’s through the roof and home prices are a joke, here’s one big fat reason: Your tax dollars were propping up mortgages for people who shouldn’t even be here. But hold the champagne—the Trump team slammed the door shut in 2025, and now it’s time to clean house and make sure this scam never happens again.

This is treasonous…

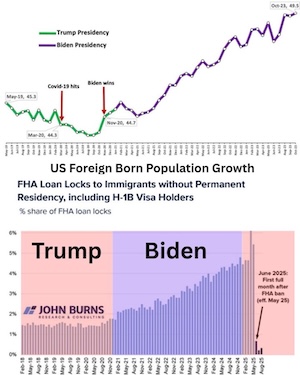

60% of rental demand in America during the Biden Administration was foreign born.

50% of FHA loans with US government tax credits were given to foreigners. pic.twitter.com/GRvKWxbkKx

— C3 (@C_3C_3) December 11, 2025

The Setup: How Biden Turned FHA into a Freebie for Foreigners

Flash back to January 20, 2021, the day Biden plopped into the Oval Office and started undoing everything that kept America secure. One of his first moves? Directing the Federal Housing Administration to wave through mortgages for DACA recipients—those folks brought here illegally as kids but given a hall pass under Obama’s deferred action gimmick. FHA’s own handbook had always required lawful residency for non-U.S. citizens, but Biden’s crew waived that like it was yesterday’s news. Suddenly, if you had work authorization and a Social Security Number, you were golden for an FHA loan, no questions about your actual legal status.

It didn’t stop there. This opened the floodgates for other non-permanent types, like folks with pending asylum claims—many of whom never get approved but stick around anyway. By October 2023, the Consumer Financial Protection Bureau and Department of Justice piled on, telling lenders not to get too nosy about immigration status when deciding on credit. Translation: Don’t ask, don’t tell, and let the taxpayers foot the bill if it all goes south. We’re talking low-down-payment loans insured by Uncle Sam, designed for first-time buyers, now handed out to people who crossed the border without papers. Noncitizen households, including green card holders and illegals, were gobbling up public assistance at a 59% clip, racking up $42 billion in annual costs to you and me. And FHA mortgages? They became part of that gravy train.

The Proof: Illegals Cashing In While Americans Queue Up

Don’t take my word for it—the numbers and revelations paint a damning picture. HUD itself admitted in early 2025 that illegal immigrants had been accessing these loans, exploiting loopholes that let them use Individual Taxpayer Identification Numbers instead of proper Social Security verification. Estimates pegged around 32,000 households illegally tapping into federal housing subsidies overall, with mortgages being a juicy slice of that pie. DACA alone covers about 500,000 people, and many jumped at the chance for taxpayer-backed homeownership.

By March 2025, the horror stories were piling up: Illegals snagging homes in a market where 9 million Americans were already crammed into subsidized housing, waiting for relief that never came. Veterans sleeping on streets while border-jumpers got low-interest loans? That’s not compassion; that’s treason against the folks who built this country. And the housing crisis? Blame the influx—millions of extra bodies driving up demand, jacking prices, and leaving native-born families out in the cold. It was a direct violation of FHA’s core rules, twisted by executive fiat to prioritize outsiders over citizens.

The Crackdown: Trump Slams the Brakes in 2025

Fast-forward to March 26, 2025, and the adults are back in the room. HUD Secretary Scott Turner drops the hammer with a new policy: No more FHA-insured mortgages for non-permanent residents or illegal aliens. Only U.S. citizens and lawful permanent residents—green card holders who played by the rules—qualify now. This nukes the Biden-era waivers, effective May 25, 2025, and gets baked into HUD’s official handbook down the line.

The move came with a Memorandum of Understanding between HUD and the Department of Homeland Security to coordinate the purge, ensuring no more taxpayer dollars flow to invaders. By October 2025, the share of FHA loans going to non-permanent residents had plummeted to near zero, proving the ban worked like a charm. President Trump’s executive orders lit the fire, demanding an end to subsidizing open borders and reclaiming the American Dream for Americans. It’s simple: These programs should benefit vets, families, and workers who pay into the system, not reward those who broke the law to get here.

The Verdict: Yeah, It Happened—And It Was a Slap in the Face

So, are the allegations true? Damn straight. Biden’s policies explicitly allowed DACA folks and other non-status aliens to grab FHA loans, bypassing longstanding requirements for lawful residency. Even if some hid behind ITINs or pending applications, it was a clear abuse, costing billions and inflating the housing mess. The Trump admin’s swift reversal confirms it was happening and needed stopping. No more denying it—this was America Last in action, pure and simple.

Fixing the Mess: Drain the Swamp, Secure the Borders, and Claw Back the Cash

We’ve already taken the first step with the 2025 ban, but that’s just the appetizer. Now, unleash the audits: HUD and DHS need to scour every FHA loan from 2021 onward, identify the invalid ones, and terminate them on the spot. Foreclose if needed, sell the properties, and redirect the proceeds to American families in need. Prosecute the fraudsters—lenders who looked the other way, borrowers who lied about status. Make examples so no one tries this again.

On the big picture, seal the border like Fort Knox: Finish the wall, deploy more agents, end catch-and-release. Deport the millions who snuck in, starting with those who gamed the system. Boost enforcement funding, tie federal aid to states that crack down on sanctuary nonsense. And reform FHA from the ground up—stricter verifications, mandatory E-Verify for all applicants, no more loopholes for “pending” status that drags on forever.

America First means putting our people first, not bankrolling a invasion. We’ve got the tools; now use them ruthlessly. Let this FHA fiasco be the last time illegals get a piece of our pie. If we don’t, the next giveaway will be even bigger—and we’ll have no one to blame but ourselves.

Texas real estate loan agent shows the home of an illegal who has left

He says these homes are purchased using taxpayer subsidized FHA loans

Illegal invaders are literally living way better than American citizens

“This is another home where I’ve been told the undocumented just… pic.twitter.com/2XIAjsPPxl

— Wall Street Apes (@WallStreetApes) December 12, 2025