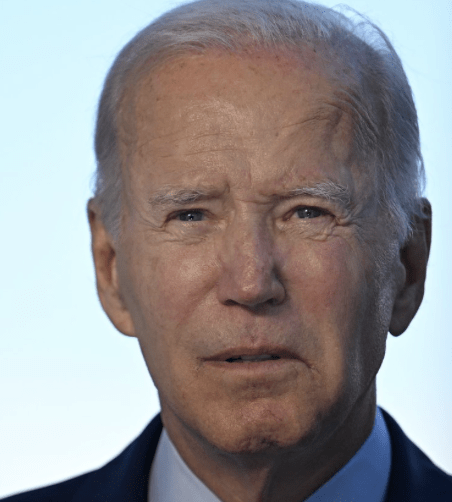

'Major Problems Down The Road': Biden Drains Petroleum Reserves Of Crucial Type Of Crude https://t.co/fIxhwJboZp

— Daily Caller (@DailyCaller) August 5, 2022

Department of Energy (DOE) is emptying the Strategic Petroleum Reserve (SPR) of a crucial kind of oil that domestic refiners can easily process, which could cause oil prices to skyrocket, experts told the DCNF. The question is: Is this a political move designed to take pressure off the Democrats in November’s elections.

American refiners prefer medium-sour crude as they can easily process it into gasoline and other fuel products, according to Bloomberg. The DOE released 4.6 million barrels of medium-sour crude oil from the SPR in late July, meaning that the reserve now has more light-sweet crude than sour — 235 million barrels to 234.9 million — which could raise fuel costs, experts say.

According to Bloomberg:

The US has become the world’s oil barrel of last resort, single handedly keeping prices in the energy market from exploding even higher by selling a large chunk of its Strategic Petroleum Reserve. Washington can’t use the reserve forever: it’s a finite stockpile fighting a potentially unlimited flow shortage. More worryingly, the US is depleting its cache a lot faster than it looks.

And that matters. The International Energy Agency earlier this week warned that “global oil supply may struggle to keep pace with demand next year.” The SPR may be the final cushion late this year and in 2023 to put a lid on oil prices — and global inflation. What Federal Reserve Chair Jerome Powell and his peers around the world do with interest rates hinges in large part on energy market developments.

Because of our lack of investment in refineries here in the US, domestic refiners lack the ability to refine light-sweet crude, a different type of oil that has a much lower density and sulfur content, so sweet crude has to be refined overseas, says fsmetals.com

there are many different grades of crude produced and traded around the world. For our purposes and for simplification, we can break those down to light, sweet crude and heavy, sour crude.”Light” grades are distinguished based on what is known as API gravity – a measurement of density. A majority of U.S. shale crude output growth is at the top of the scale with API gravity above 40 degrees. On the other hand, heavy crude oil or extra heavy crude oil is any type of crude oil which does not flow easily. It is referred to as “heavy” because its density or specific gravity is higher than that of light crude oil. Heavy crude oil has been defined as any liquid petroleum with an API gravity less than 20°.

Generally speaking, Light crude oil receives a higher price than heavy crude oil on commodity markets because it produces a higher percentage of gasoline and diesel fuel when converted into products by an oil refinery. Heavy crude oil has more negative impact on the environment than its light counterpart since its refinement requires the use of more advanced techniques and the use of contaminants.

Moreover, simple distillation — first-level refinement — of different crude oils produces different results. For example, the U.S. benchmark crude oil, West Texas Intermediate (WTI), has a relatively high natural yield of desirable end-products, including gasoline. But the process also yields about one third “residuum,” a residual by-product that must be reprocessed or sold at a discount. In contrast, simple distillation of Saudi Arabia’s Arabian Light, the historical benchmark crude, yields almost half “residuum.” This difference gives WTI a higher premium.

In terms of worldwide production, the following chart explains the relative density and sulfur content of the various, most commonly traded, crudes:

But that is only part of the story.Processing heavy-sour crude oil requires additional refinery units—including crackers, cokers, and hydrotreaters—to yield light products. These additional units increase refinery complexity but also allow the refiner more flexibility to select types of crude oils to purchase and run through their refineries, potentially increasing profitability.

Refiners’ investment decisions often depend on the location of the refinery because of the cost of transporting oil. Gulf Coast refineries in the United States are typically supplied with heavy Mexican and South American crude oils. Gulf Coast refineries are more complex than East Coast refineries, which are supplied with lighter, sweeter Atlantic Basin crude oils.