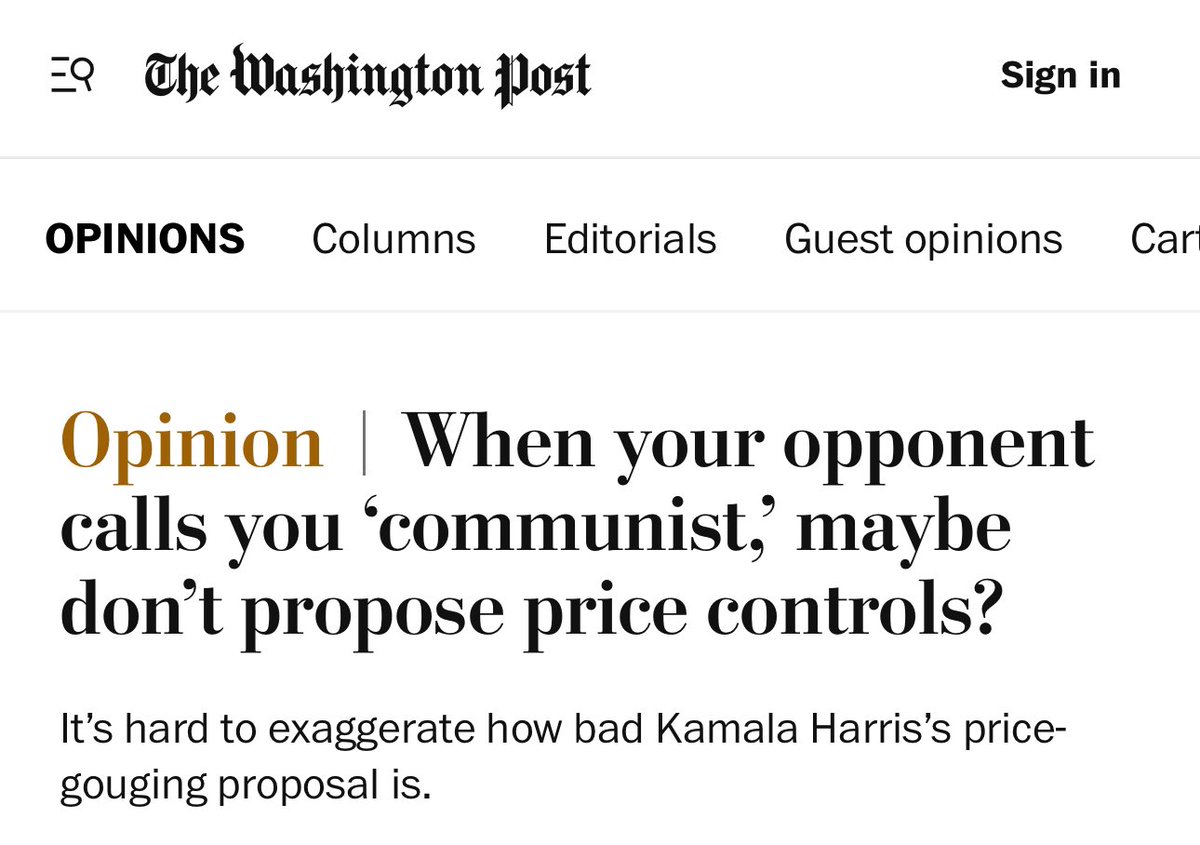

Even the Bezos-owned liberal Washington Post is running opinion pieces slamming Kamala Harris’ communist price control proposal so she must be doing something really wrong.

“How much does it bother you that VP Harris might soon… distance herself from your economic policies?” – Doocy

— Tim Young (@TimRunsHisMouth) August 15, 2024

“She’s not going to.” – Biden

Biden confirms that Kamala will continue to trash our economy if elected. pic.twitter.com/vkhHHnPhpz

Kamala Harris’ campaign unveiled more details about her economic agenda this morning, showing the Democratic nominee would focus on domestic issues. Nothing she outlined does anything about the massive federal debt – in fact, most of her agenda would add to it.

Kamala Harris has unveiled her economic agenda, focusing on:

- Eliminating medical debt for millions.

- Banning price gouging on groceries and food.

- Capping prescription drug costs.

- Providing a $25,000 subsidy for first-time homebuyers.

- Expanding the Child Tax Credit to $6,000 per child.

Here’s an analysis of the potential problems with Kamala Harris’s economic policies based on the information available:

Price Controls and Anti-Trust Measures:

- Price Gouging Ban: Critics argue that price controls, like banning price gouging on groceries, could lead to shortages. When prices are artificially capped, businesses might reduce supply or exit the market, leading to less availability of goods. This has been observed in various historical examples where price controls led to black markets or reduced production.

- Anti-Trust Actions: While aiming to prevent monopolies is generally seen as positive, overly aggressive anti-trust actions could stifle innovation and investment. If companies fear that growth or mergers will lead to scrutiny or forced breakups, they might reduce investment in new technologies or expansion, potentially slowing economic growth.

Housing Policy:

- Down Payment Assistance: While providing assistance for first-time homebuyers sounds beneficial, it could inflate housing prices if not managed carefully. Increased demand without a corresponding increase in supply might lead to higher prices, making homes less affordable for those without assistance.

- New Housing Construction: The plan to construct new housing units could be problematic if it’s not paired with realistic zoning reforms or if it leads to government overreach in the private sector, potentially distorting market dynamics.

Tax Policies:

- Tax on High Earners and Corporations: Raising taxes on high earners and corporations might reduce investment, as higher taxes could lead to capital flight or reduced entrepreneurial activity. This could dampen economic growth if not balanced with incentives for investment or if it discourages wealth creation.

- No Tax on Tips: While removing taxes on tips might seem fair, it could complicate tax systems if not carefully implemented, potentially leading to abuse or requiring new mechanisms to prevent exploitation by higher earners.

Economic Intervention and Spending:

- Government Oversight and Intervention: Critics on X platforms argue that Harris’s policies lean towards more government control over the economy, which could lead to inefficiencies, bureaucratic delays, and less innovation due to increased regulation. Historical examples of heavy government intervention in economies often show mixed results, with potential for economic stagnation or misallocation of resources.

Inflation and Debt Concerns:

- Inflation Management: The plan to combat inflation through price controls and spending might backfire. If government spending increases significantly without corresponding revenue increases or if monetary policy doesn’t adjust, inflation could rise, undermining purchasing power.

- Debt Increase: Critics highlight the potential for these policies to increase national debt significantly, which could lead to higher interest rates, reducing government’s fiscal space for future emergencies or investments.

Political and Economic Philosophy:

- Socialist Tendencies: Some critics see these policies as steps towards socialism, fearing that increased government control over pricing, production, and wealth distribution could lead to economic inefficiencies and loss of individual economic freedoms.

These criticisms largely stem from economic theories advocating for market freedom, suggesting that while government intervention can correct market failures, excessive or misguided intervention might lead to unintended economic consequences.

Supporters of these policies continue to argue that they aim to correct existing inequalities and market failures, potentially leading to a more equitable distribution of wealth and economic stability if implemented correctly. The problem is, they are never implemented correctly.

Forbes has a great overview here: https://www.forbes.com/sites/alisondurkee/2024/08/16/kamala-harris-releases-economic-agenda-heres-what-to-know

KEY FACTS

Grocery Prices: The Harris campaign said the candidate would work in her first 100 days to help Congress pass a national ban on “price gouging” for food and groceries, as well as give the Federal Trade Commission and prosecutors authority to go after companies they determine price gouge, support small businesses in the industry, take a closer look at mergers between big grocery companies and “aggressively” investigate price-fixing in meat supply chains specifically.

Housing Costs: Harris wants to provide $25,000 in down payment assistance for first-time home buyers and is calling for the creation of three million new housing units within the next four years, proposing a tax credit for developers who build starter homes and investing $40 million in an innovation fund to tackle the housing crisis.

Rental Costs: Harris would also expand a tax credit for housing developers who build affordable housing rental units, and is calling on Congress to pass legislation that would stop predatory investors who buy up rental homes and collude with each other to raise rental prices.

Child Tax Credit: Harris proposed giving families a $6,000 tax credit for newborns in their first year of life, and restore a pandemic-era tax credit of $3,600 per child for middle and lower-class families.

Taxes: Harris also wants to expand the Earned Income Tax Credit for workers in lower-income jobs, which would cut taxes by up to $1,250, and has previously said she would continue President Joe Biden’s promise not to raise taxes on American households earning $400,000 or less annually, and does support raising taxes for high earners and corporations, according to The New York Times.

No Tax On Tips: Harris has separately endorsed a plan to get rid of taxes on tips for hospitality and service workers, echoing a proposal by former President Donald Trump—which has been criticized by some experts—though a campaign official told CNN tips would still be subject to payroll taxes, and would include an income limit and guardrails to prevent people like hedge fund managers from taking advantage of the policy.

Prescription Drug Prices: Harris proposed a $35 cap on insulin and capping out-of-pocket expenses on prescription drugs at $2,000 per year on Friday, also saying she would speed up Medicare negotiations on the price of prescription drugs—after the Biden administration announced a deal lowering costs on 10 medications—and crack down on anti-competitive practices in the pharmaceutical industry that cause higher prices.

Healthcare: The Harris campaign also announced her intention to work with states to cancel Americans’ medical debt, and she proposed expanding subsidies for Affordable Care Act plans that would save health insurance customers an average of $700 on their health insurance premiums.

Paid Leave: Harris has not released a specific paid leave proposal, but she has previously co-sponsored 12-week paid leave legislation, Politico notes, with Sen. Patty Murray, D-Wash., telling the outlet, “I absolutely believe that when they are in office, we will get a paid leave bill done finally.”

Minimum Wage: Harris called for raising the minimum wage in a Las Vegas speech earlier in August, but her campaign has not specified how high she believes it should be raised.

Fed Independence: Harris has vowed to maintain the Federal Reserve’s independence after Trump said he believed “the president should have at least [a] say” on the Federal Reserve’s decisions, with Harris telling reporters, “The Fed is an independent entity and as president I would never interfere in the decisions that the Fed makes.”