By Tim Chapman

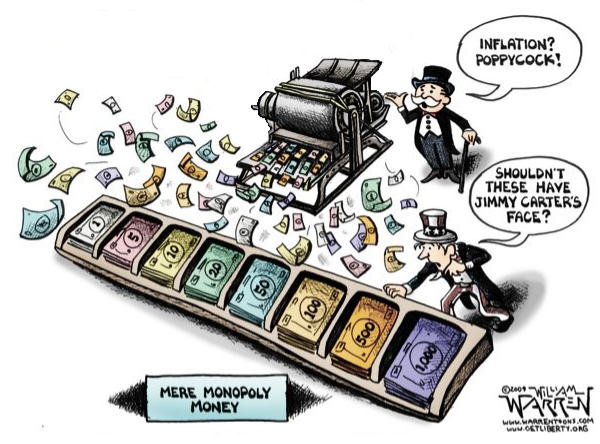

As we mark the two-year anniversary of the Inflation Reduction Act (IRA), it’s hard to pinpoint what exactly has been reduced. Inflation continues to strain American families by an extra $1,000 per month, and the burden of government regulation on businesses has certainly not eased, as they struggle under new tax rates, mandates, and rising supply costs.

The $750 billion health care, tax, and climate bill, hailed by President Biden as “one of the most significant laws in our history,” has proven to be a fiscal disaster. The American people are learning the hard way that the IRA was never truly about reducing inflation; it was a massive spending package filled with radical left-wing wish list items that placed the United States in the worst economic position in the history of our country.

Perhaps the most glaring example of IRA’s destructive priorities is its reckless spending on climate initiatives like the “Green New Deal.” Goldman Sachs now estimates that taxpayers will shell out a staggering $1.2 trillion—over three times the initial prediction—to fund the IRA’s war on the U.S. energy sector. The legislation spent billions on energy tax credits for renewables like wind, solar, and hydropower, along with consumer rebates for electric vehicles, rooftop solar panels, and more energy-efficient home appliances. But what Democrats conveniently overlook is that while these subsidies aimed to promote green energy and electric vehicles, they’ve also drastically raised electricity and gas prices, leaving Americans to foot the bill.

Electricity prices have skyrocketed by 30% since 2021, rising 13 times faster than in the previous seven years. Meanwhile, gas prices have more than doubled since Biden took office. Rising energy costs have also been a major driver of food inflation, forcing Americans to spend over 11% of their disposable income on food—the highest percentage in three decades. These costs are compounding the financial strain already felt by Americans, who are grappling with a historic 20% inflation rate produced by IRA’s reckless spending spree.

What’s worse, Democrats seem utterly indifferent to the financial strain Americans are facing due to their radical climate agenda. In fact, it’s safe to say that skyrocketing energy costs aren’t just accidental side effects of their policies—they’re the intended results. In 2022, Biden praised the pain Americans feel at the pump as “part of an incredible transition,” while Transportation Secretary Pete Buttigieg suggested that Americans should switch to electric vehicles so that they “never have to worry about gas prices again.”

IRA has been just as much of a nightmare for small businesses. Already grappling with lower consumer demand and higher supply costs, small business owners now face new regulations and tax rates, making survival nearly impossible. The Internal Revenue Service, armed with $80 billion in IRA funding, has launched a “witch hunt” against small businesses as part of its spending plan. Despite assurances that audits on small businesses wouldn’t increase, their focus is now on companies earning over $400,000—a threshold that hardly qualifies as “large.”

As if that weren’t enough, IRA’s 15% minimum tax on big corporations and the 1% tax on stock buybacks have trickled down, hitting small suppliers and partners, while stricter limits on loss deductions have made it even harder for small businesses to recover from setbacks. It’s no wonder that nearly half of small businesses now say they won’t survive another four years of Biden administration policies.

The fallout from IRA has also wreaked havoc on America’s seniors and the pharmaceutical industry. Medicare Part D premiums have risen by over 20% due to IRA, raising costs for more than eight million beneficiaries in 2024 alone. To make matters worse, the number of available Part D plans has plummeted to its lowest levels ever recorded, leaving seniors with fewer options. The legislation’s government-mandated drug price setting, which imposes a 95% tax on companies that don’t comply, also destroys all incentive for innovation. Simply put, rather than improving care for seniors or encouraging new life-saving drug development, IRA spends $3 billion on a new government healthcare bureaucracy.

Biden could have tackled inflation far more effectively with sensible policies that wouldn’t stifle small businesses or undermine U.S. innovation. Former Vice President Mike Pence’s multi-part plan was carefully designed to achieve these goals. It aimed to curb government spending significantly and encourage job growth, potentially saving taxpayers up to $1.05 trillion over ten years. Rather than squandering billions on ineffective government programs, Washington could have taken smarter steps: freezing non-defense discretionary spending for a year, eliminating the ineffective Environmental Protection Agency, cutting down on improper payments, avoiding the wasteful $80 billion IRS expansion targeting Americans, and removing unnecessary tax credits.

These commonsense policies would have curbed inflation without crushing small businesses, America’s seniors, or our middle class. By cutting regulatory burdens, these measures could have fostered a thriving business environment and sustained economic growth. Instead, we’re left with the mess of IRA’s broken promises.

While Biden and Democrats toast the two-year anniversary of this disastrous legislation from their ivory towers in DC, millions of Americans are left questioning what’s worth celebrating. Our nation deserves better than the failed promises and fiscal irresponsibility of the IRA. It’s high time we reject reckless spending and embrace practical, effective fiscal policies that will get our country back on track.

Tim Chapman is president of Advancing American Freedom.