It’s a little known fact, and one the IRS wants you to forget, but receipts are not always necessary to prove an expense.

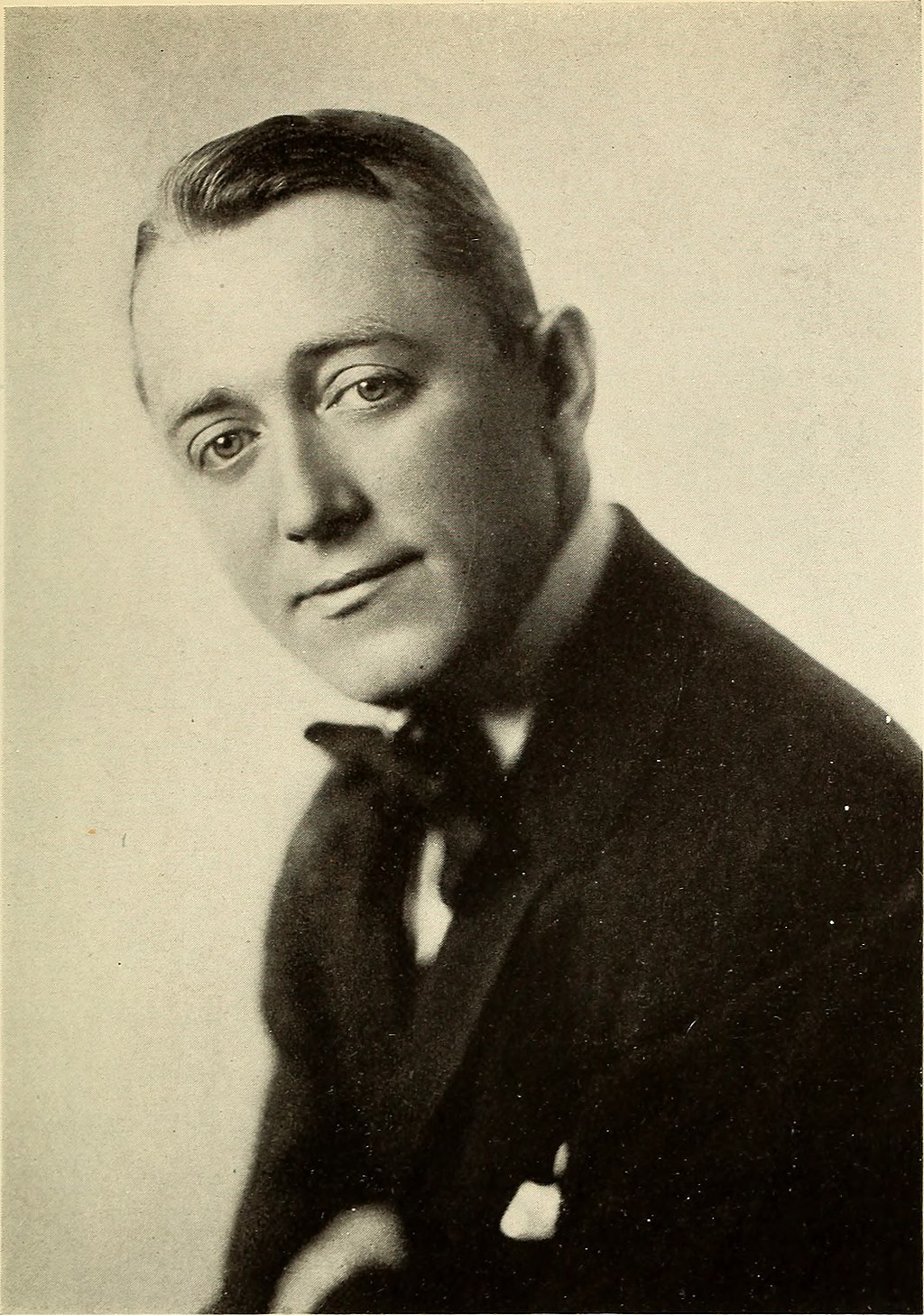

Of course, they want you to have a chit for every nickel and dime. But thanks to a larger than life 1920’s Broadway impresario called George Cohan (“Give my regards to Broadway” & “Yankee Doodle Boy” are two of his memorable contributions to the American musical lexicon,) we don’t have to produce them.

Of course, they want you to have a chit for every nickel and dime. But thanks to a larger than life 1920’s Broadway impresario called George Cohan (“Give my regards to Broadway” & “Yankee Doodle Boy” are two of his memorable contributions to the American musical lexicon,) we don’t have to produce them.

Cohan had the expansive habit of paying for his travel and dining bills in cash. The IRS took a dim view and penalized him. He went to court. And lost. He went again. And won. You can read the court report here.

The Cohan Rule might be just what you need if you can’t find that elusive receipt. You may be able to prove through other supporting evidence, such as oral or writen statements from witnesses, that your charge is tax-deductible.