By Rich Checkan

You’ve heard about the ‘War on Cash.’ There is wide ranging speculation on the reasons behind it. But whatever the cause, the effect must be that we protect ourselves. Perhaps, we can even profit from the situation.

The war on cash cannot be stopped.

We can all agree, cash is how the bad guys, like drug dealers, tax evaders, and especially terrorists, operate. The U.S. government has a legitimate purpose: to root out criminals as they launder money. Under the Bank Secrecy Act the Financial Crimes Enforcement Network (FinCEN) has great power to do so. However, this power affects us law-abiding citizens as well.

The Currency Transaction Reports required to be filed by banks, casinos, or customs authorities for transactions over $10,000 to catch the criminals, also impact our own freedom to use hard earned legitimate cash without creating a bureaucratic paper trail.

In addition, negative interest rates may make cash foolish to hold.

Too much cash in your account is not good for Wall Street. To ‘stimulate’ the economy, why not charge folks for holding cash? Sounds crazy? Well, in Switzerland, their National Bank has already implemented a negative interest rate policy, causing a run on some banks. But, we have learned little from their experience.

ZIRP and NIRP: Twin Strategies in the War on Cash.

ZIRP (Zero Interest Rate Policy) has been implemented, and NIRP (Negative Interest Rate Policy) has been suggested as possible solutions to stagnant economic growth. Fed Chair, Janet Yellen, says: “These strategies are on the table.”

ZIRP and NIRP, it is argued, would make it easier for consumers to finance cars, boats and homes. The policies would create more demand for goods and services, increase business earnings and stimulate the need to hire more employees and lower unemployment.

ZIRP and NIRP have powerful proponents. Citibank’s Chief Economist Willem Buiter suggests we abolish the use of cash altogether or tax it punitively. Under a regime of ‘cash repression,’ good conservative savers are penalized unless they invest in riskier fare and become the guarantors of capital growth.

Those opposed to ZIRP and NIRP believe these policies would allow poorly run financial institutions to maintain cash reserves at a low cost, enabling them to avoid failure while they continue tight credit procedures that would fail to stimulate any economy.

Penalties on cash assets

According to a Swiss RE study, U.S. savers lost $470 billion between 2008-2013 due to low rates, amounting to a virtual penalty of .8% on cash assets.

The best weapon in the war on cash

If we are to be cashless, so be it. Let us own the world’s oldest store of portable wealth instead of cash – gold and silver. Even those who never considered ownership of these core precious metals before are now driven by all logic to own and stockpile these assets of true wealth.

Gold and silver are negotiable everywhere in the world. They are the world’s oldest currencies. You can use them to buy a home or a loaf of bread.

Silver is especially handy for use in day-to-day living. Small denomination U.S. coins – dimes, quarters and half-dollars – minted before 1965 (so called ‘Junk Silver’) contain 90% silver, are easy to store and are extremely portable.

Silver is:

- An important growth substitute for idle cash

- A true store of wealth that responds to inflation

- Immediately negotiable and usable in a crisis

- Free of any ties to banks, mutual funds, SEC regulated or insurance regulated institutions

What does JPMorgan Chase know?

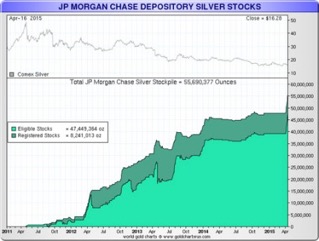

Along with Citibank, JPMorgan Chase is also an institutional cash abolitionist. Astonishingly, while soldiering in the war against cash, the firm has stockpiled 55 million ounces of physical silver since 2012.

Along with Citibank, JPMorgan Chase is also an institutional cash abolitionist. Astonishingly, while soldiering in the war against cash, the firm has stockpiled 55 million ounces of physical silver since 2012.

With cash earning nothing, and silver being so favorably priced, it simply makes good investing sense to own silver.

Our exclusive offer to Self-Reliance Central readers offers you small amounts of 90% silver that can be easily stored in your own home. Click here for more details.

Our exclusive offer to Self-Reliance Central readers offers you small amounts of 90% silver that can be easily stored in your own home. Click here for more details.

Also, watch for our upcoming series as to how silver and gold have been a proven force of salvation in countless hardship situations throughout history. Our first story is The Tale of the Taels. Discover how Vietnam refugees in the 1970s rebuilt their lives when their cash was useless.