The Competitive Enterprise Institute (CEI) today launched a new video, “The Carbon Tax Scheme, Explained,” outlining various ways increased costs generated by a carbon tax will be passed on to American families. Last summer, a small number of Republicans in Congress introduced a carbon tax bill and in recent months lobbying campaigns advocating for such a tax have intensified.

The video explains how a carbon tax works and how the costs are inevitably passed on to consumers through higher energy costs. The video also describes how the negative impact these laws and regulations can have on the market, consumers, and our economy.

CEI Senior Fellow Marlo Lewis said:

“A carbon tax is a pernicious idea because it can dramatically increase costs for Americans on a range of necessities without presenting them with a tax bill. In addition to higher costs for energy, businesses that consume energy—like shipping companies, travel services, agriculture and more—will also pass increased costs onto consumers. Some carbon tax proposals attempt to soften the blow for consumers by proposing a ‘rebate,’ but those unfair plans would give people living in cities the same rebate as Americans living in more rural areas, who use more energy. The bottom line is a carbon tax is a bad idea that would harm our economy and punish American consumers.”

Script for “Carbon Tax Scheme Explained” (3:07)

NARRATOR: Just when you thought Washington politicians were running out of ways to tax Americans they have a clever new scheme to tax virtually every aspect of our lives.

It’s not a tax on breathing, but it’s pretty close.

Humans need some basic things to survive—like food, water, and shelter. All of those things require energy—to heat our homes, power our vehicles, manufacture products, and grow, harvest, and ship our food. Energy literally makes our lives possible. But politicians increasingly want to tax and regulate it.

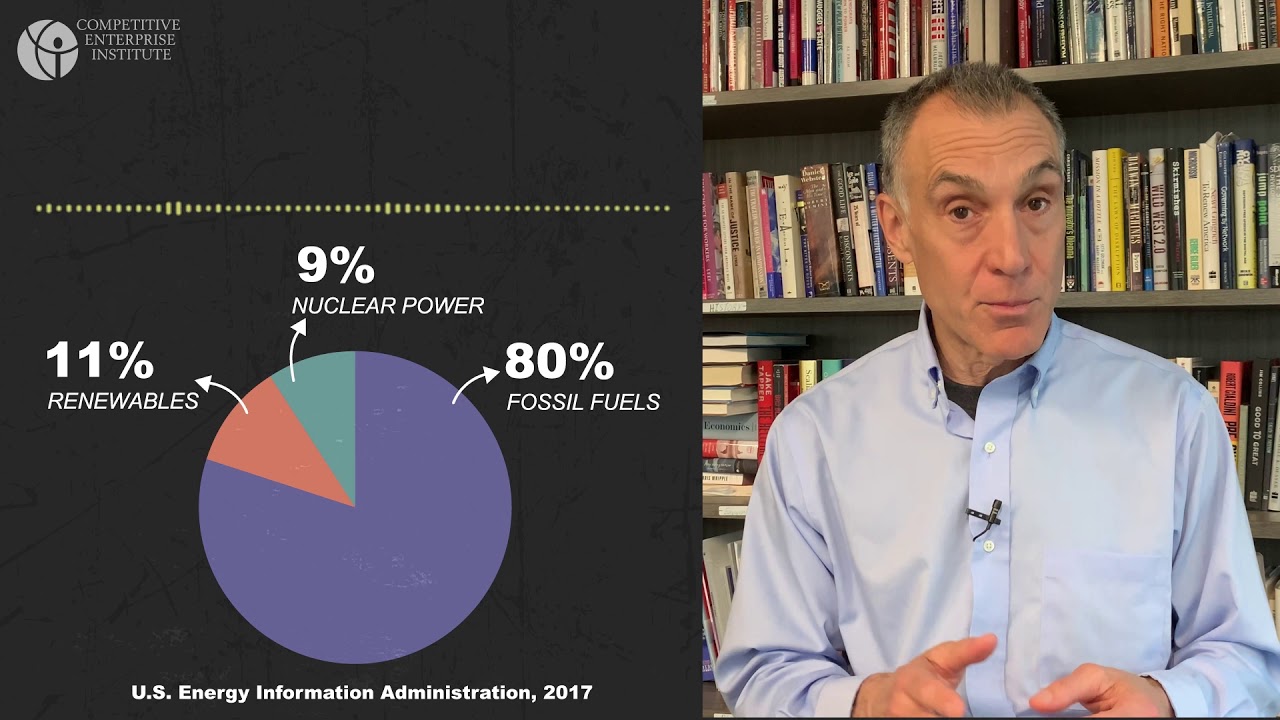

MARLO LEWIS: A carbon tax is a tax on carbon dioxide emissions from energy sources like coal, oil, and natural gas. In fact, 80 percent of all the energy Americans use emits carbon dioxide into the atmosphere. Although energy producers would initially pay most of the tax, who do you think the added cost of the tax gets passed onto? You guessed it, consumers.

NARRATOR: So, how much will the average American pay?

Meet the Willards. They have three kids, one car, an old pickup truck, and a home to call their own. They live within their means, pay their taxes, and even recycle. Estimates show the carbon tax increasing their gas and energy bills by $1,000 a year. And that’s just the start. Rising energy costs will mean pain at the pump for the Willards. Flights to see Grandma could be more expensive. Their grocery bills will likely go up, shipping costs may climb, as well as prices for clothing, TVs, toys, you name it, manufacturers that use energy will pass added costs down to consumers.

And it gets worse. Most carbon tax proposals include an automatic annual increase, meaning that $1,000 per year for the Willards could go significantly higher.

Now, some lawmakers are trying to window-dress their carbon tax schemes by offering rebates to taxpayers. It goes something like this: the government collects carbon tax revenue as an interest-free loan and issues a rebate to Americans like the Willards.

MARLO LEWIS: But what about households in suburbs and rural areas? They still have to heat their homes, they commute longer distances to work and school, and they have to travel farther to see family and friends. They use more energy and will have to pay more for it, yet both households could get the same rebate. Does that seem fair to you?

NARRATOR: The carbon tax is a tax on a basic human need: energy. Politicians think it’s clever because you won’t see the tax taken out of your paycheck, but we’ll all be paying for it, and those who can least afford it, families that rely on affordable energy, will be hit the hardest.

Original can be viewed here. Want to know more about cei.org? Go here.