by Dan Mitchell

I’ve spent several decades trying to convince people that we should have free markets and small government in order to increase national prosperity.

Indeed, I’ve even pointed out how very small increases in annual growth can lead to big improvements in living standards over just a couple of decades.

But some folks on the left are not very receptive to this argument. They genuinely (but incorrectly) seem to think the economy is a fixed pie (which also explains, at least in part, why they are so focused on redistribution).

So let’s share some hard data in hopes of getting them to understand that more prosperity is possible.

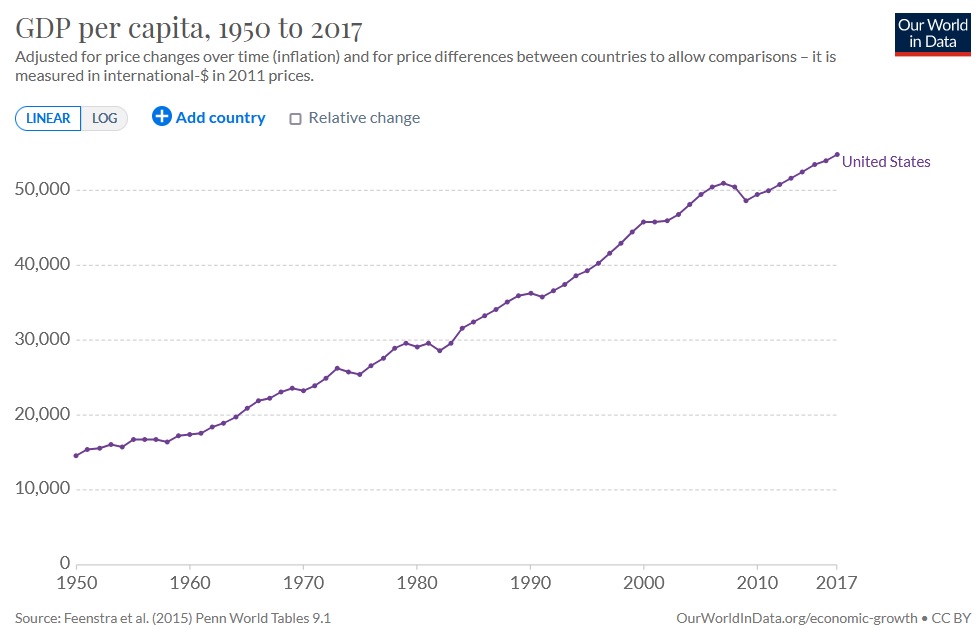

We’ll start will this chart of inflation-adjusted per-capita economic output in the United States, which comes from Oxford University’s Our World in Data.

The obvious takeaway from this data is that Americans are much richer today than they were after World War II. Adjusted for inflation, we’re now about four times richer than our grandparents.

Some of our friends on the left may be thinking these numbers are distorted, that average output has only increased because the rich have gotten so much richer.

Well, it is true that the rich have gotten richer. But it’s also true that the rest of us have become richer as well.

Which is why I shared data earlier this year showing median living standards rather than mean (average) living standards.

Folks on the left may also suspect that the post-1950 data is an anomaly. In other words, maybe I’m guilty of cherry-picking data.

That’s a common practice in the world of policy, so I don’t blame people for being suspicious.

So take a look at this chart, which I also first shared earlier this year. It shows that the increase in living standards has been even more dramatic if you look at changes since 1820.

By the way, none of these observations are new. Back in 1997, Micahel Cox and Richard Alm wrote a must-read article for the Dallas Federal Reserve Bank’s Annual Report.

Here are some of their findings.

What really matters…isn’t what something costs in money; it’s what it costs in time. Making money takes time, so when we shop, we’re really spending time. The real cost of living isn’t measured in dollars and cents but in the hours and minutes we must work to live. …A pair of stockings cost just 25¢ a century ago. This sounds wonderful until we learn that a worker of the era earned only 14.8¢ an hour. So paying for the stockings took 1 hour 41 minutes of work. Today a better pair requires only about 18 minutes of work. …In calculating our cost of living, a good place to start is with the basics—food, shelter and clothing. In terms of time on the job, the cost of a half-gallon of milk fell from 39 minutes in 1919 to 16 minutes in 1950, 10 minutes in 1975 and 7 minutes in 1997. A pound of ground beef steadily declined from 30 minutes in 1919 to 23 minutes in 1950, 11 minutes in 1975 and 6 minutes in 1997. Paying for a dozen oranges required 1 hour 8 minutes of work in 1919. Now it takes less than 10 minutes, half what it did in 1950.

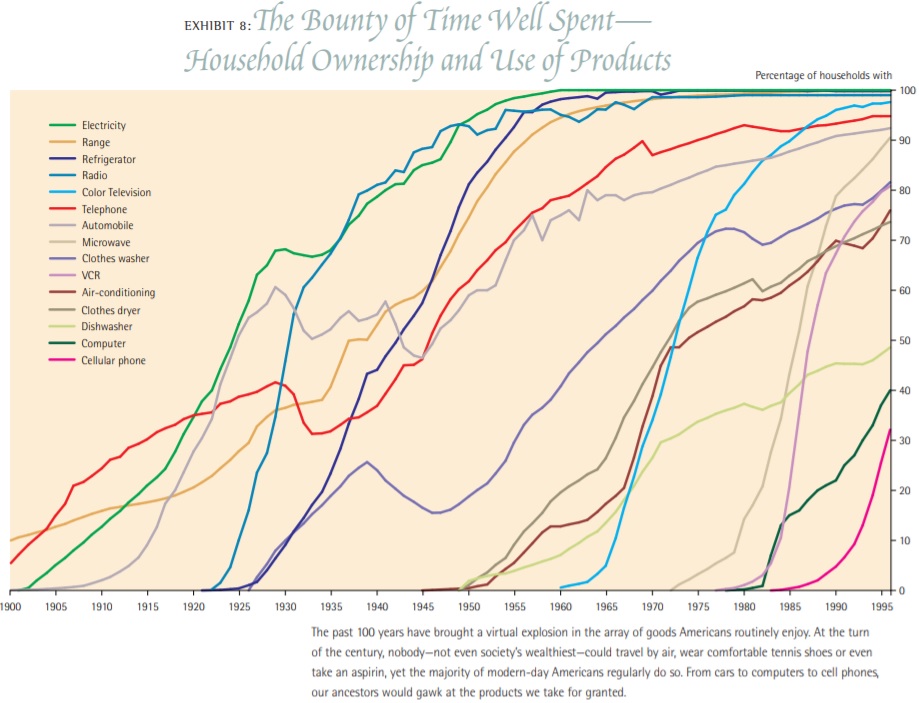

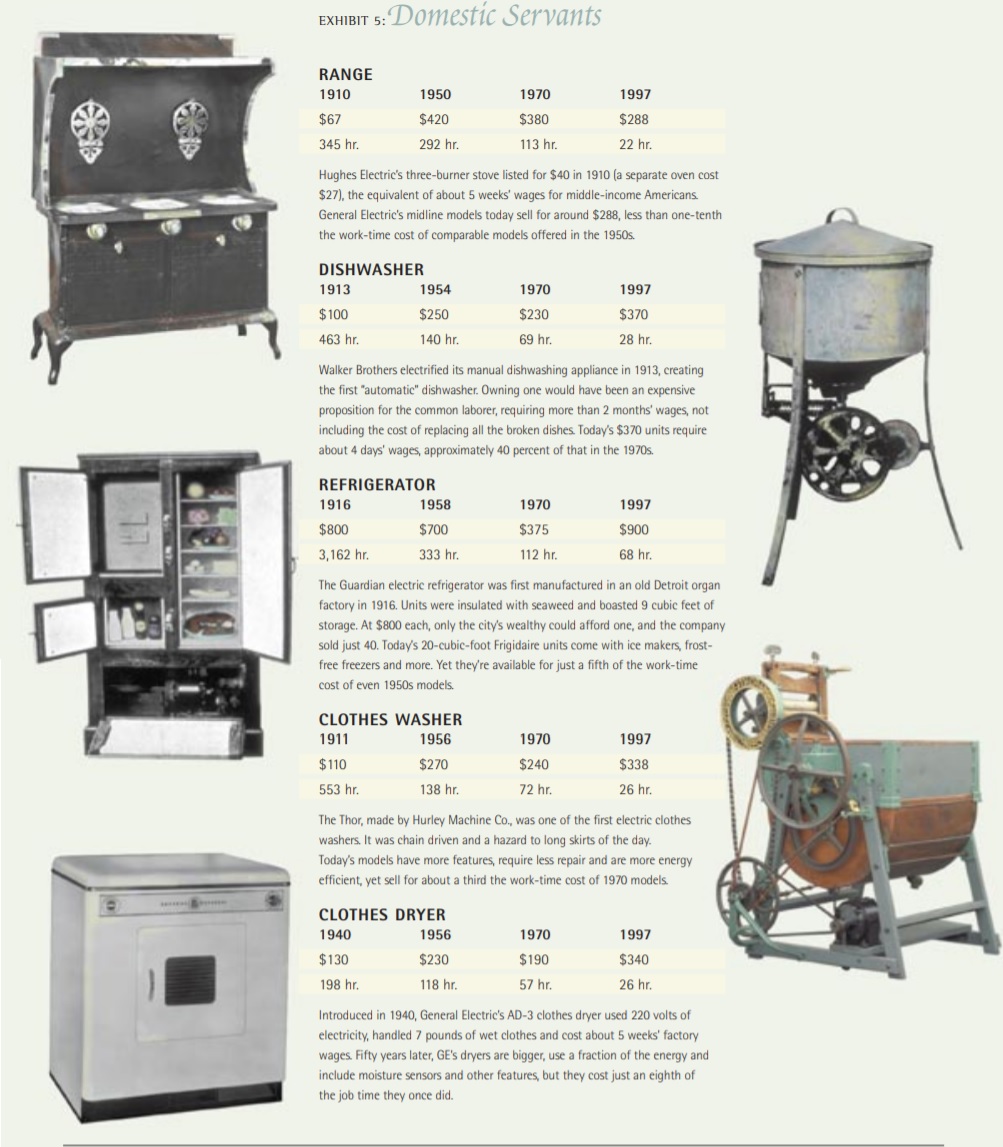

These two visuals from the article are very informative.

First, look at how consumer products went from rare luxuries early in the 20th century to everyday products by the end of the century.

Equally important, these products have become cheaper and cheaper over time.

As illustrated by this second visual from the article.

All the data in the Cox-Alm article is more than 20 years old, so the numbers would be even more impressive today.

Indeed, you can see some more up-to-date data from Mark Perry, Steve Horwitz, and James Pethokoukis.

Professor Don Boudreaux put these numbers in context a few years ago in a column for the Foundation for Economic Education. Here’s some of what he wrote.

What is the minimum amount of money that you would demand in exchange for your going back to live even as John D. Rockefeller lived in 1916? …Think about it. …If you were a 1916 American billionaire you could, of course, afford prime real-estate. You could afford a home on 5th Avenue or one overlooking the Pacific Ocean… But when you traveled from your Manhattan digs to your west-coast palace, it would take a few days, and if you made that trip during the summer months, you’d likely not have air-conditioning in your private railroad car.…You could neither listen to radio (the first commercial radio broadcast occurred in 1920) nor watch television. …Obviously, you could not download music. …Your telephone was attached to a wall. You could not use it to Skype. …Even the best medical care back then was horrid by today’s standards: it was much more painful and much less effective. …Antibiotics weren’t available. …Dental care wasn’t any better. …You were completely cut off from the cultural richness that globalization has spawned over the past century. …I wouldn’t be remotely tempted to quit the 2016 me so that I could be a one-billion-dollar-richer me in 1916. This fact means that, by 1916 standards, I am today more than a billionaire. It means, at least given my preferences, I am today materially richer than was John D. Rockefeller.

The bottom line is that we have become richer and we can continue to become richer.

But how fast things improve is partly a function of government policy. If we can impose some restraints on the size and scope of government, that will give the private sector some breathing room to grow and prosper.

In other words, we don’t need perfect policy, but it is important to at least have good policy.