by Dan Mitchell

I wrote two months ago about Iowa lawmakers voting for a simple and fair flat tax.

I explained how this reform would make the state more competitive, but I want to build upon that argument with some of the Tax Foundation’s data.

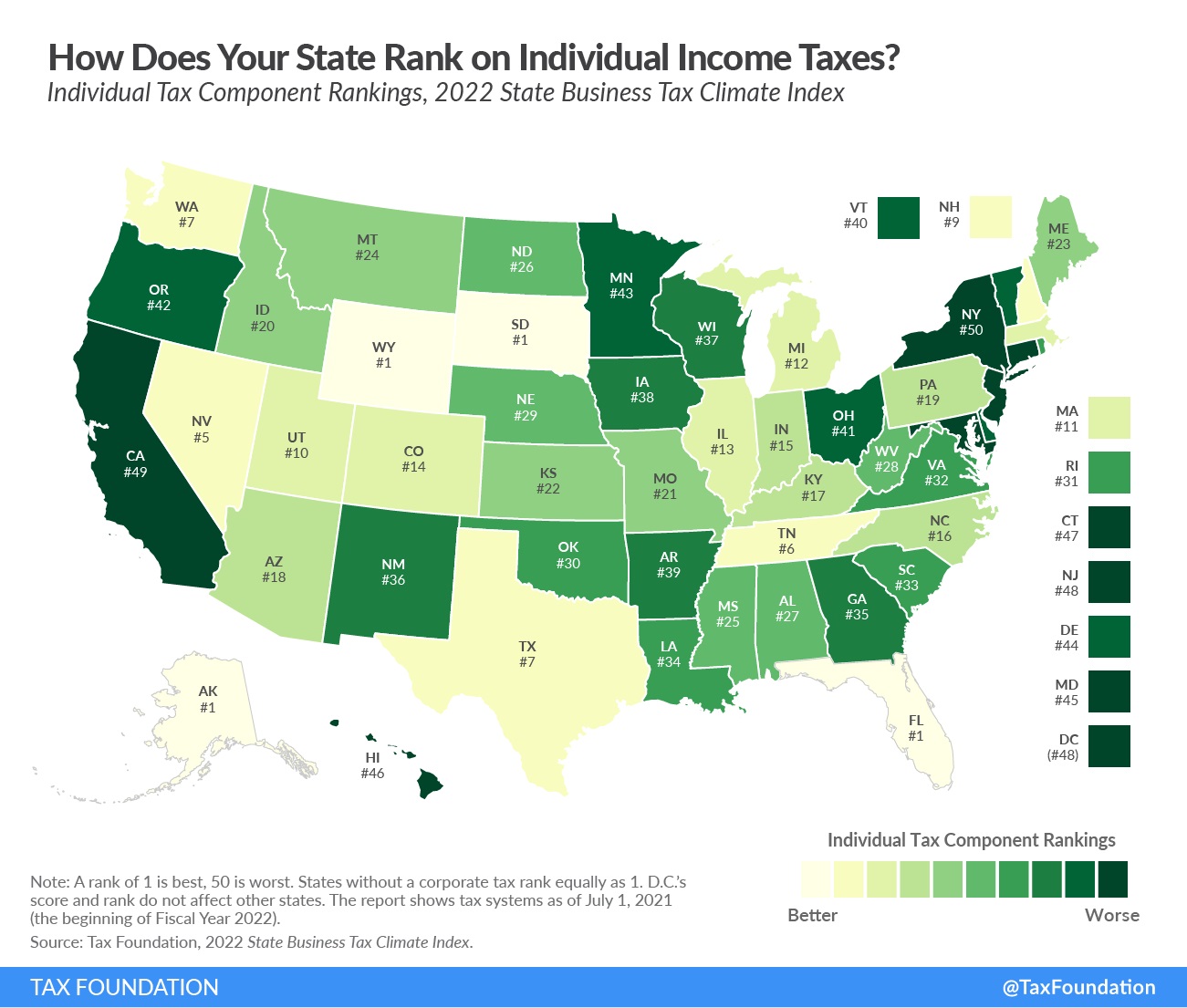

Starting with this map from the State Business Tax Climate Index, which shows Iowa in 38th place for individual income taxes.

That low ranking is where the state’s tax code was as of July 1, 2021, so it obviously doesn’t reflect the reforms enacted earlier this year.

So where will the state rank with the new flat tax?

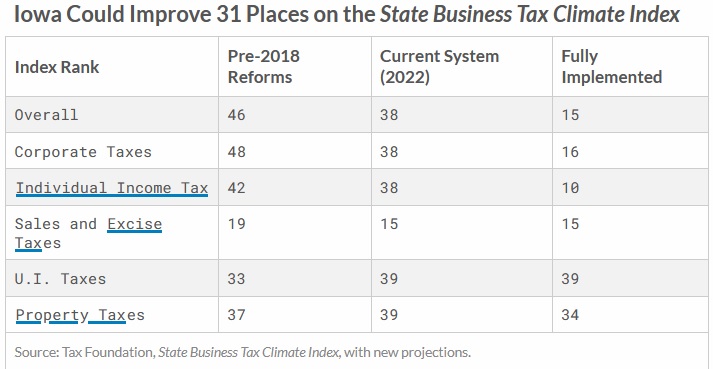

The Tax Foundation crunched the data and shows the state will jump to #15 in the rankings.

The above table shows that the jump is even more impressive when you factor in some modest pro-growth changes that took place a few years ago.

What a huge improvement over just a few years. The only state that may beat Iowa for fastest and biggest increase in tax competitiveness is North Carolina, which jumped 30 spots in just one year.

P.S. Politicians in New York must be upset that there’s no way for them to drop lower than #50. But at least they can take comfort in the fact that they are worse than California.

Daniel J. Mitchell is a public policy economist in Washington. He’s been a Senior Fellow at the Cato Institute, a Senior Fellow at the Heritage Foundation, an economist for Senator Bob Packwood and the Senate Finance Committee, and a Director of Tax and Budget Policy at Citizens for a Sound Economy. His articles can be found in such publications as the Wall Street Journal, New York Times, Investor’s Business Daily, and Washington Times. Mitchell holds bachelor’s and master’s degrees in economics from the University of Georgia and a Ph.D. in economics from George Mason University. Original article can be viewed here.

Self-Reliance Central publishes a variety of perspectives. Nothing written here is to be construed as representing the views of SRC.