“President Biden’s executive actions have cost taxpayers more than $1 trillion so far,” the Heritage Foundation’s Matthew Dickerson told Fox News Digital in an interview. “That’s taking into account the recent student loan executive action, which could cost up to $1 trillion.”

“But earlier this year, the nonpartisan Congressional Budget Office produced an analysis showing that less than ten of Biden’s earlier executive actions cost taxpayers already more than $500 billion,” Dickerson said.

“So it could be up to $1.5 trillion in cost to taxpayers just on executive actions, not legislation going through Congress and being signed into law and being debated,” Dickerson added. “It’s just pure executive actions taken by Biden costing taxpayers up to $1.5 trillion.”

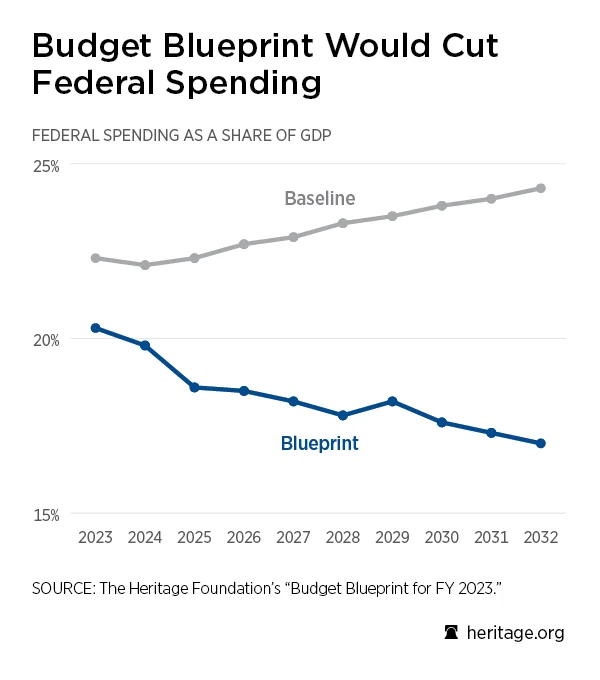

The Heritage Foundation realized that President Joe Biden’s irresponsible budget policies are hurting America’s families and looked at a Budget Blueprint which ticks most conservative boxes and balances the budget by cutting inflationary spending by $15.5 trillion over the next decade

Inflation hit 8.5% in July, a rate not seen since 1981. Prices for things families need, such as gas, groceries, and household staples, have risen since Biden signed his $1.9 trillion American Rescue Plan Act inflationary spending bill into law in March 2021.

There’s an unprecedented worker shortage, with about 755,000 fewer people employed today than at the start of the COVID-19 pandemic, despite a 4.2 million increase in the working-age population.

The American economy shrank in the first half of the year, the traditional start of a recession.

Inflation-adjusted wages for the average American worker have fallen by nearly $3,000 since Biden took office in January 2021.

With these adverse impacts on working-class families, it’s no wonder that inflation and jobs are the top issues on the minds of voters.

While Biden has attempted to blame Russian President Vladmir Putin, greedy corporations, and everyone but himself, the truth is that inflation and the economic downturn have been caused by bad government policies.

The next Congress and the next administration need to chart a different course. That’s why The Heritage Foundation has released the Budget Blueprint, a comprehensive federal budget proposal for fiscal year 2023. (The Daily Signal is the news outlet of The Heritage Foundation.)

The Budget Blueprint includes 230 specific policy reforms to roll back excessive government spending, reform and cut taxes, prioritize taxpayer dollars, improve major entitlement programs, restore federalism, promote opportunity for all, and protect rights and American values.

It lays out a policy agenda that will allow policymakers to go on offense, address America’s most pressing challenges, and save our country.

Government spending, regulations, and inflation are a tax on all Americans, especially working families who struggle to make ends meet. The Budget Blueprint shows how to reverse the growth of inflation and the government spending that’s driving it, with proposals that would balance the budget and cut inflationary spending by $15.5 trillion over the next decade.

The Budget Blueprint would require the Federal Reserve to focus on maintaining stable prices and stop printing trillions of inflationary dollars to bankroll expanding federal deficits.

Unless changes are made, the Medicare Hospital Insurance trust fund and the Social Security trust fund will be depleted by 2028 and 2034, respectively. The Budget Blueprint would modernize and strengthen both programs, achieving better results for current and future beneficiaries.

Under The Heritage Foundation’s proposal, the tax code would be much fairer, more pro-growth, and less burdensome, ending distortions that push consumer prices higher. Compared with current law, the tax policies in the Budget Blueprint would reduce the amount the government takes from American households by $3.2 trillion over the next decade.

A massive tax hike on families would be prevented by making the 2017 Tax Cuts and Jobs Act permanent. Universal savings accounts would be permitted for all Americans, and the inflation tax on capital gains would finally be ended.

Dozens of special-interest tax breaks would be eliminated, paving the way for cutting the corporate tax rate to 15% while allowing for more investment by making full and immediate expensing permanent and extending neutral cost recovery to investments in structures. This would lead to higher wages and more opportunity for workers.

The Budget Blueprint is a pro-family policy agenda. It would advance vital pro-life protections, such as the Hyde Amendment, and protect conscience provisions. Taxpayer funding for institutions that promote anti-American values, such as Planned Parenthood, would finally be rolled back.

Additionally, welfare programs would be refocused to promote the dignity of work and to remove marriage penalties.

The current education system is failing our children. Parents, not bureaucrats, should be making teaching and learning decisions that align with their values. That’s why Heritage’s Budget Blueprint would wind down the federal Department of Education and instead empower parents to make education choices.

The Budget Blueprint also shows how to counter the threat of Communist China. It would provide important investment for our national security, delivering much-needed resources for the Department of Defense to prepare for the era of great power competition with China.

Increases for specific needs in the Army, Navy, and Air Force would result in a net total of $836 billion in funding for national defense in fiscal year 2023, growing to $1.049 trillion by fiscal year 2032.

Equally as important, the Budget Blueprint promotes the American values of free enterprise and limited government, allowing a dynamic American economy to grow so our families and communities flourish and outcompete the authoritarian Chinese Communist Party.

Modeling by The Heritage Foundation’s Center for Data Analysis shows that the policy agenda in the Budget Blueprint would have dramatically positive effects on the economy.

Over the following decade, the median household’s annual after-tax wages would increase an extra $2,200, and 6 million jobs would be created. Investment would grow the American economy and generate an extra $5 trillion in economic activity over the following decade. By dramatically expanding the economy, the Budget Blueprint would create a larger pie and more prosperity for families.

The Heritage Foundation’s Budget Blueprint stands in direct contrast to Biden’s big-government, inflationary policies. The Budget Blueprint is a comprehensive agenda to tackle America’s most pressing challenges.

This piece originally appeared in The Daily Signal

https://www.heritage.org/budget/

https://www.heritage.org/budget/pages/by-the-numbers.html