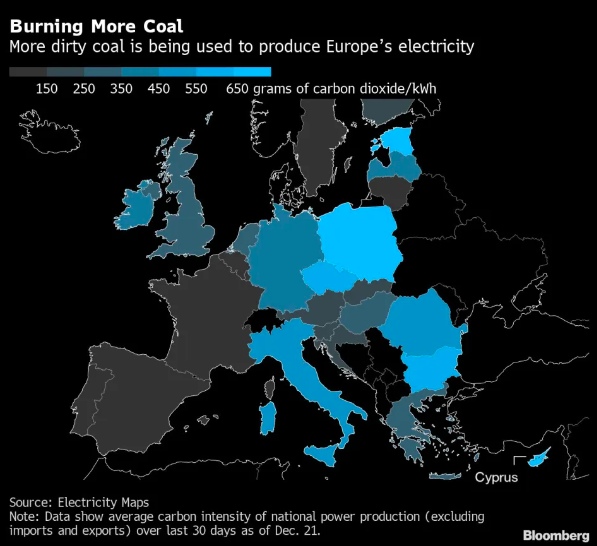

It looks like Santa is delivering coal to all of Europe this year!

EU energy ministers agreed to trigger a cap if the price of month-ahead natural gas futures contracts on the Dutch Title Transfer Facility (TTF) — the bloc’s benchmark gas exchange — exceed €180 ($191) per megawatt hour for more than three consecutive working days.

The month-ahead TTF price must also be €35 ($37) higher than a reference price for liquified natural gas (LNG) for the same period for the cap to be activated. Prices for LNG — a chilled, liquid form of gas that can be transported via sea tankers — are tightly linked to prices for Europe’s natural gas delivered by pipelines.

As this is a political deal, it doesn’t bear scrutiny in the real world. Analysts and traders remain concerned that the mechanism could backfire –— causing prices to rise and worsening potential supply shocks. Germany, the bloc’s biggest economy and one of its largest importers of natural gas, had been the most notable holdout before Monday’s announcement.

“Gas traders would likely liquidate short positions and stop selling futures if they fear the break could be activated imminently, for fear of the resulting losses,” said analysts at Eurasia Group.

Meanwhile, Asia also needs natural gas and is prepared to pay more than the European capped price. Naturally, the suppliers will redirect their gas to Asia. Leaving Europe high and dry – and very, very cold. Thank goodness they were slow to shut down all their old coal power plants

SA coal going to Europe

— Entrepreneur Zone (@SayEntrepreneur) December 15, 2022

Trucks transporting coal to Richard's Bay. pic.twitter.com/aq5aFvqwba

‘Coal is now world’s top energy source’ – Coal, no longer shunned, keeps Europe’s lights on | Climate Depot https://t.co/dQZCOgQq00 pic.twitter.com/zBs6205sdS

— Marc Morano (@ClimateDepot) December 22, 2022

Not in the EU but dealing with supply issues, failure renewables and rising gas prices – The UK

National Grid is set to run a test of one of the UK's coal-fired power generators that’s being kept in reserve to secure supplies. A Drax unit will start up and generate as much as 300 megawatts to check everything is ready if needed.#CostOfNetZero

— Net Zero Watch (@NetZeroWatch) December 15, 2022

👉 https://t.co/dlFqfgWHbg pic.twitter.com/VC07v9KNrx

UK Ministers deliberately shut down the vast majority of the UK’s cheap and reliable coal-fired power stations – and then demolished them. Now we have rocketing prices, widespread fuel poverty, risks of power cuts, and a system of energy rationing on the way.

UK govt has announced it will open the first new coal mine in the country in 30 years in Cumbria

— Craig Kelly (@CKellyUAP) December 18, 2022

GREAT‼️

And Climate Crazies are going nuts

GREAT‼️

Slowly but surely some common sense is returning

MORE coal needed to reduce power prices#ClimateScam https://t.co/eitlW1v80F

European demand is one reason why the world is on track for record coal consumption in 2022 https://t.co/mLj8f7u238

— WSJ Markets (@WSJmarkets) December 22, 2022

Germany is set to boost its reliance on coal despite its ambitious climate goals.

— Net Zero Watch (@NetZeroWatch) December 22, 2022

Europe’s largest economy is burning the fossil fuel for electricity at the fastest pace in at least six years, data compiled by Bloomberg show.#CostOfNetZero

Read more: https://t.co/HpaCnGpLO5 pic.twitter.com/Lz2ySkib9I