In this segment from a December interview, I explain that budget deficits are most likely to produce inflation in countries with untrustworthy governments.*

The simple message is that budget deficits are not necessarily inflationary. It depends how budget deficits are financed.

If a government finances its budget deficits by selling bonds to private savers and investors, there is no reason to expect inflation.**

But if a government finances its budget deficits by having its central bank create money, there is every reason to expect inflation.

So why would politicians ever choose the second option? For the simple reason that private savers and investors are reluctant to buy bonds from some governments.

And if those politicians can’t get more money by borrowing, and they also have trouble collecting more tax revenue, then printing money (figuratively speaking) is their only option (they could restrain government spending, but that’s the least-preferred option for most politicians).

Let’s look at two real-world examples.

- Consider the example of Japan. It has been running large deficits for decades, resulting in an enormous accumulation of debt. But Japan has very little inflation by world standards. Why? Because governments bonds are financed by private savers and investors, who are very confident that the Japanese government will not default..

- Consider the example of Argentina. It has been running large deficits for decades. But even though its overall debt level if much lower than Japan’s, Argentina suffers from high inflation. Why? Because the nation’s central bank winds up buying the bonds because private savers and investors are reluctant to lend money to the government.

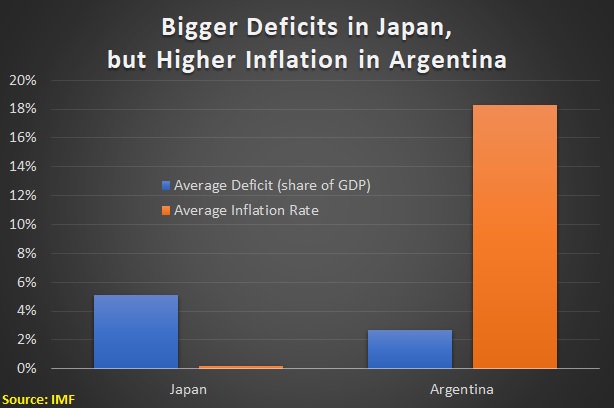

If you want some visual evidence, I went to the International Monetary Fund’s World Economic Outlook database.

Here’s the data for 1998-2022 showing the average budget deficit and average inflation rate in both Japan and Argentina.

The bottom line is that prices are very stable in Japan because the central bank has not been financing Japan’s red ink by creating money.

In Argentina, by contrast, the central bank is routinely used by politicians as a back-door way of financing the government’s budget.

*To make sure that my libertarian credentials don’t get revoked, I should probably point out that all governments are untrustworthy. But some are worse than others, and rule-of-law rankings are probably a good proxy for which ones are partially untrustworthy versus entirely untrustworthy.

**Borrowing from the private sector is economically harmful because budget deficits “crowd out” private investment. Though keep in mind that all the ways of financing government (taxes, borrowing, and money creation) are bad for prosperity.

By Dam Mitchell. Original here. Reproduced with permission.