The Twitter thread is gold but I’ve added a readable description below.

WHAT ARE CREDIT DEFAULT SWAPS

— GURGAVIN (@gurgavin) March 28, 2023

🧵

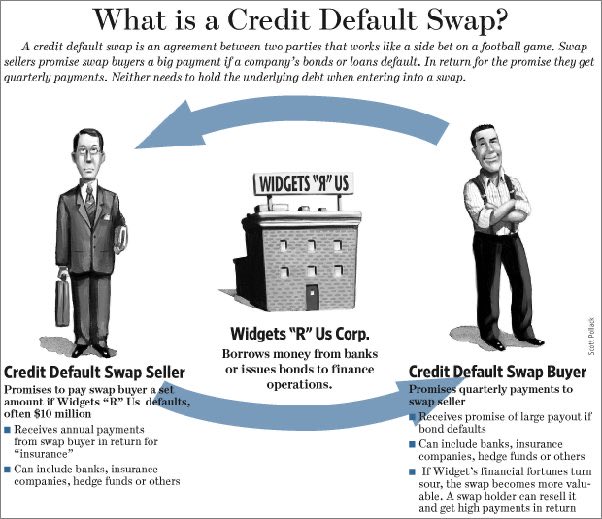

Credit default swaps (CDS) are financial instruments that allow investors to protect themselves from the risk of a borrower defaulting on a loan. In simpler terms, CDS is a type of insurance policy that investors can purchase to protect themselves against the possibility of a borrower defaulting on a debt.

Let’s say you lend $100 to a friend. You want to make sure you get your money back, but you are also aware that your friend may not be able to repay you in the future. To protect yourself against this risk, you could buy a CDS from a third party. This means that if your friend defaults on the loan, the third party will pay you the $100 that you lent.

In the same way, banks and financial institutions use CDS to protect themselves from the risk of default on loans they have given to companies or governments. For example, a bank may have loaned $1 billion to a company and wants to protect itself against the possibility of the company defaulting on the loan. The bank can purchase a CDS from another financial institution, which means that if the company defaults, the bank will receive a payout from the seller of the CDS.

CDS can also be used for speculation or trading purposes. An investor who believes that a company or government will default on its loans can purchase a CDS on that borrower’s debt. If the borrower defaults, the investor receives a payout from the seller of the CDS. This means that an investor can profit from a borrower’s default without actually owning any of the borrower’s debt.

However, the use of CDS has been controversial because they can be used for speculative purposes, which some argue can increase the risk of financial instability. Critics argue that CDS can be used to bet against companies or governments, which can cause panic in the markets and lead to a self-fulfilling prophecy of default. The financial crisis of 2008 highlighted some of the potential risks associated with the use of CDS, as some investors had purchased CDS on risky mortgage-backed securities, which contributed to the collapse of some of the world’s largest financial institutions.

Despite the potential risks, CDS can be a useful tool for managing risk and protecting against default. They allow investors to hedge against the risk of a borrower defaulting on a debt, and can help to reduce the overall risk in the financial system. However, like any financial instrument, CDS should be used responsibly and with a clear understanding of the risks involved.