How does one describe our present banking system?

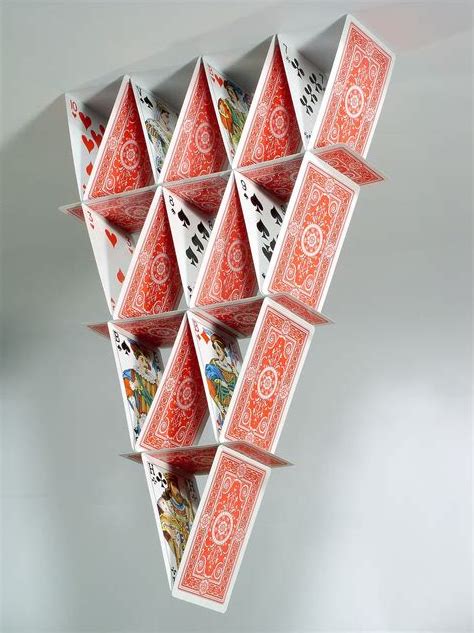

It is like an upside-down pyramid, with the tippy top of it located at the bottom and the widespread base of it placed at the top. If even a slight wind comes along, it will knock down the entire enterprise. The bigger they are, the harder they fall. Heck, you don’t even need a breeze. This enterprise is as unstable as it conceivably can be.

It is like a man wearing 10-inch high-heeled shoes. You look at him crossways, and he’ll fall down (women have far more practice at wearing such shoe-wear). You need not look at him at all and he’ll collapse.

It is like a little kid getting on a bike for the first time, with no training wheels. It is like someone’s first run on stilts. It is like riding a unicycle for a trial run. It is like the first try at tightrope walking.

Are you getting my drift? The banking system is teetering and tottering. Why is this?

It is due to the fact that it engages in fractional reserve demand deposit banking.

What’s that? Mr. Apple comes to a bank and deposits $100. The bank gives him a demand deposit for that amount of money. What does that mean? It means that A has the right to withdraw up to that amount, $100, any time he wants to (assuming the bank is open) or write a valid check for that amount at all times, and the bank is legally obligated to honor it.

What, then, does the bank do with this money? Assuming a 10 reserve reserve ratio, it lends out $90 to Mr. Banana and keeps the remaining $10 in its vault. What does this mean? Exactly the same as before. Mr. Banana now, also, has a checking deposit with the bank; he can call up these funds of his at his own discretion, up to nine ten dollar bills worth of money.

See the problem? The bank now has assets of $100 cash under its control (plus an IOU) and liabilities of $190. There used to be $100 in circulation, there is now $190. If Mr. Banana deposits his money in a second bank with the same reserve ratio, and continues down the line, there will ultimately be $1,000 in the economy, all pyramided on that initial $100 ($90+$81+$72+$63, etc.).

Talk about teeter-tottering. How can all this come tumbling down? Simple. All Mr. Apple and Mr. Banana have to do is demand more than $100 of their money from the bank. The latter cannot make good on its obligations. Its bankruptcy will then become fully evident. (For more on this argument see Fractional Reserve Banking: An Interdisciplinary Perspective by Walter Block.)

Why, then, does banking seem so stable, apart from recent occurrences with the Silicon Valley Bank? There are many reasons, but one is particularly significant.

The Federal Deposit Insurance Corporation (FDIC) makes a highly-regarded offer to the banking public: if ever any bank under its jurisdiction cannot meet its obligations, this monetary authority will bail it out, at least to the extent of $250,000 deposits, and, as we have seen in the Silicon Valley case (home of high tech wokists), without any real upper bound. To the extent people believe in this, the system will not unravel.

However, if there is any problem, remember, we have a teeter-totter system, and if the FDIC indeed has to step in, not as to the degree of at present (at least as of this writing), but to a far greater extent, this can set up a hyper-inflation Germany 1923 style. Then, all bets are truly off.

My initial description of our present banking system is thus incorrect. Matters are far worse. It is not as if one unicycler, tightrope walker, upside down pyramid, or stilts walker, is in danger of taking a tumble, and pulling a few hundreds or thousands of dependents down with him. That is indeed true. But, in addition, it is as if they are all attached together by a rope, and if one of them falls, all are at risk, that is, the entire economy.

How would banking operate if fractional reserves were banned? Simple. Banking would then be like tailoring. What does the tailor do? He does two things. First, micro, he gathers small bits of thread together to create a larger cloth. Or, second, macro, someone comes to him with a gigantic textile, and he breaks it down into smaller garments.

So would it be with a more rational banking system. On the micro level, the banker would gather small deposits from hundreds or thousands of savers, and lend out these monies to investors on a larger scale basis. He would do all of this on a time deposit basis, so that he can be assured that if there is a demand to make good on these deposits, the bank has the wherewithal to meet all obligations.

On the macro level, when a very wealthy depositor leaves in his care a gigantic amount of money, the banker breaks it down to smaller bits and again lends them to investors. From whence does his profit arise? Not from legalized counterfeiting, as at present. Rather, from the differential in interest rates between depositors, who he pays, and borrowers, to whom he lends.

A third licit task performed by banks is to serve as a money warehouse. People leave their savings with the bank for safekeeping, since the banker has the strongest safe in town. But, just as you pay to have your furniture stored, the warehouse does not pay you (imagine if they lent out your furniture to others and didn’t have it available for you when you wanted it back), you pay it. So would it be with banks; you would pay them to keep your nest egg safe.

Boring? Yes. But safe, too.

Walter Block is an American economist and anarcho-capitalist theorist who holds the Harold E. Wirth Eminent Scholar Endowed Chair in Economics at the J. A. Butt School of Business at Loyola University New Orleans. He is a member of the FEE Faculty Network.

This article was originally published on FEE.org. Read the original article.