We all know it’s an aim of the NWO, WEF, etc to get rid of small businesses. Why else was Walmart open in the pandemic and your mom and pop store wasn’t? But this news is shocking – especially as current closures are outstripping the days of the covid.

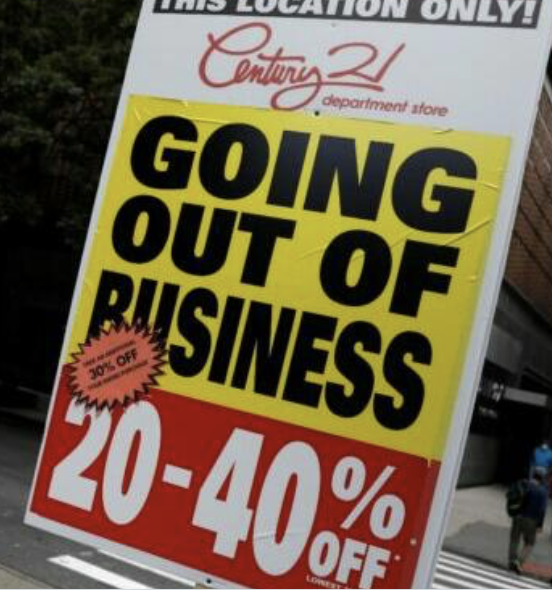

Small businesses across the United States are experiencing a surge in bankruptcies, surpassing levels not seen since 2020.

A note from UBS Evidence Lab shows that private bankruptcy filings in 2023 are already exceeding the most recorded during the early stages of the COVID pandemic by a considerable amount. The four-week moving average for private filings in late February was 73 percent higher than in June 2020.

“[We] believe one of the more underappreciated signs of distress in U.S. corporate credit is already emanating from the small- and mid-size enterprises sector,” Matthew Mish, head of credit strategy at UBS, wrote in a recently published research note. “[The] smallest of firms [are] facing the most severe pressure from rising rates, persistent inflation and slowing growth.”

Industries hit hardest by the wave of bankruptcies include real estate, health care, chemicals, and retail outlets, according to the Swiss bank’s report.

The Federal Reserve’s monetary tightening to combat inflationary pressures has been largely behind the uptick in bankruptcies. UBS indicated that fear of a credit crunch has further worsened the rise in defaults. Small businesses are very reliant on bank loans and these are growing expensive and hard to find.

In fact, credit conditions are tightening across the spectrum. Large businesses and individual borrowers are also feeling pressured.

Small Businesses File For Bankruptcy At Record Pace, Surpassing COVID Crash https://t.co/r7RIJWAOy6

— zerohedge (@zerohedge) April 6, 2023