So this was a surprise. Biden’s pandering again.

Starting May 1st, home buyers with a credit score >680 will pay a higher mortgage rate to subsidize the costs for home buyers with a lower credit score

— Michael Burry Stock Tracker ♟ (@burrytracker) April 21, 2023

The new rule appears to punish home buyers with a strong financial position pic.twitter.com/YbxTDMpK7c

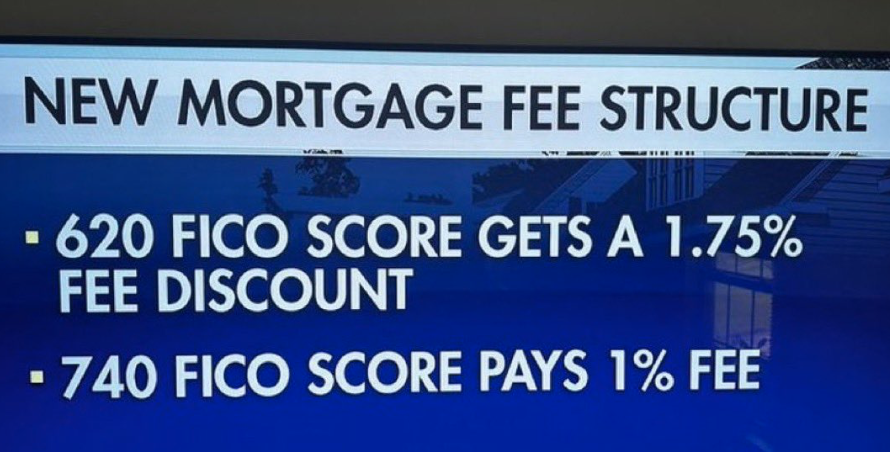

A little-noticed revamp of federal rules on mortgage fees will offer discounted rates for home buyers with riskier credit backgrounds — and force higher-credit homebuyers to foot the bill. From May 1st, if you have a credit score higher than 740 you will pay an extra 1% on your mortgage. Those with 620 or less will receive a 1.75% decrease.

Fannie Mae and Freddie Mac will enact changes to fees known as loan-level price adjustments (LLPAs) on May 1 that will affect mortgages originating at private banks nationwide, from Wells Fargo to JPMorgan Chase, effectively tweaking interest rates paid by the vast majority of homebuyers.

The result, according to industry pros: pricier monthly mortgage payments for most homebuyers — an ugly surprise for those who worked for years to build their credit, only to face higher costs than they expected as part of a housing affordability push by the US Federal Housing Finance Agency.

The tweaks could further complicate the strenuous mortgage application process and add more pressure on a core segment of buyers in a housing market already in the midst of a major downturn, the experts added. The average 30-year mortgage rate is hovering at 6.27% as of last week — up from about 5% one year ago and more than twice as high as it was two years ago, according to Freddie Mac data.

Under the new rules, high-credit buyers with scores ranging from 680 to above 780 will see a spike in their mortgage costs – with applicants who place 15% to 20% down payment experiencing the biggest increase in fees.