The Laffer Curve’s Latest Victim: California

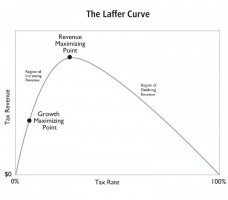

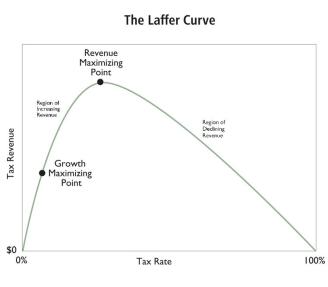

The Laffer Curve is the common-sense notion that people respond to incentives.

And even Paul Krugman admits this has implications for tax revenue.

For instance, if tax rates increase, people may decide to earn and/or report less taxable income. When that happens, revenue won’t increase by as much as politicians hope.

And the reverse is true (in some cases, dramatically true) if tax rates decrease.

For today’s column, let’s look at a real-world example of the Laffer Curve.

Joshua Rauh of Stanford and Ryan Shyu of Amazon have new research that looks at what happened after California voters approved a big class-warfare tax increase in 2012.

Here are some excerpts from their study.

In this paper we study the question of the elasticity of the tax base with respect to taxation…on the universe of California taxpayers around the implementation of major 2012 ballot initiative, Proposition 30. …The Proposition 30 ballot initiative increased marginal income tax rates…by 3 percentage points for singles with over $500,000 in taxable income (married couples with over $1 million)…, the highest state-level marginal tax rate in the nation. …We…document a substantial onetime outflow of high-earning taxpayers from California in response to Proposition 30. …For those earning over $5 million, the rate of departures spiked from 1.5% after the 2011 tax year to 2.125% after the 2012 tax year, with a similar effect among taxpayers earning $2-5 million in 2012. …California top-earners on average report $522,000 less in taxable income in 2012, $357,000 less in 2013, and $599,000 less in 2014; this is relative to a baseline mean income of $4.15 million amongst our defined group of California top-earners in 2011. Compared to counterfactuals in similarly high-tax states, California top-earners on average report $352,000 less in taxable income in 2012, $373,000 less in 2013, and $481,000 less in 2014.

So some upper-income taxpayers moved and others (unsurprisingly) earned/reported less taxable income.

Did that have an impact on tax revenue?

The answer is yes.

…we assess the implications of our estimates for tax revenue in the context of California Proposition 30. A back of the envelope calculation based on our econometric estimates finds that the intensive and extensive margin responses to taxation combined to undo 45.2% of the revenue gains from taxation that otherwise would have accrued to California in the absence of behavioral responses within the first year and 60.9% within the first two years.

Wow, more than 60 percent of projected revenue evaporated within two years.

By the way, these estimates are based on data only through the middle of last decade. And something significant happened after that: The state and local tax deduction was curtailed as part of the Trump tax package.

The authors speculate that this will have very important implications.

…the “Tax Cuts and Jobs Act” (TCJA). Under this law, the top rate is 37% for single and head-of-household filers earning over $500,000, and for married filers earning over $600,000. Despite this nominal cut to top rates, the legislation on net increased rates on top earners because it capped state and local deductions at $10,000 total. … we use our top line intensive margin elasticity estimate to provide a ballpark quantification of the federal tax revenue implications of TCJA for the particular set of California high earners in our treatment group. …Consider a married California taxpayer earning $4.15 million of wage income. In 2017, this taxpayer pays a federal tax bill of $1,431,305. In 2018, incorporating the 8.6% income decrease, this taxpayer pays a federal tax bill of $1,333,946. This amounts to a 6.8% decrease in tax revenue, putting the TCJA on the wrong side of the Laffer Curve for high-earning individuals in California. … the TCJA increased incentives (in terms of the level of the average tax rate gap) to leave California for zero-tax states by 2.15 times the amount of Proposition 30 for those earning over $5 million, and by a factor of 2.43 for those earning from $2-5 million. Based on these scaling factors, we would predict an out-migration effect of 1.46% of those earning $2-5 million, and 1.51% of those earning $5 million.

None of this should be a surprise.

Indeed, I wrote back in 2012 that bad things would happen when Proposition 30 was approved.

I feel safe in stating that this measure is going to accelerate California’s economic decline. Some successful taxpayers are going to tunnel under the proverbial Berlin Wall and escape to states with better (or less worse) fiscal policy. …It goes without saying, of course, that California’s politicians…will act surprised when revenues fall short of projections because of the Laffer Curve.

To be fair, I don’t know if California politicians are genuinely surprised. I suspect many of them privately understand the adverse consequences of class-warfare tax policy. But they nonetheless support bad policy because they are motivated by a selfish desire to maximize votes.