Tiffany Cianci, a small business advocate and former franchisee, has been vocal about the impact of private equity (PE) on small businesses and the broader economy, particularly through a detailed thread shared on X under her handle @TheVinoMom.

Her thread (below) paints private equity as a predatory force that’s using debt to gut profitable businesses, risking a massive – potentially catastrophic – economic fallout and recession/depression.

Below is a summary of her key points from that thread. Her fears are being shared and echoed across social media although the legacy media is not sharing them as yet.

🚨 THE NEXT 2008 IS HAPPENING NOW 🚨

— Tiffany Cianci (@TheVinoMom) March 17, 2025

Party City. Joann’s. Forever 21. Big Lots. ALL COLLAPSING.

But this isn’t just “retail struggling.” This is financial arson.

Private equity rigged the system. They built a time bomb. And now? It’s detonating.

A MEGATHREAD: 🧵⬇️ pic.twitter.com/rpKcxwxDxd

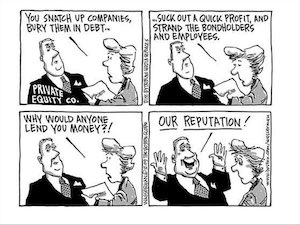

Core Argument: Private Equity as “Financial Arson”

Cianci claims that a financial crisis akin to 2008 is unfolding now, driven by private equity (PE) firms. She cites the collapse of major retail chains like Party City, Joann’s, Forever 21, and Big Lots as evidence—not as natural retail struggles, but as deliberate “financial arson” orchestrated by PE. She argues that these firms are rigging the system with a “time bomb” set to detonate, threatening pensions, jobs, and entire industries.

The Mechanism: “Back Floating Rate Debt”

- 2008 Parallel: Cianci draws a comparison to the 2008 crisis, where adjustable-rate mortgages and collateralized debt obligations (CDOs) sank the economy. She says PE is using a similar tactic with “back floating rate debt”—essentially adjustable-rate loans rebranded under a new name.

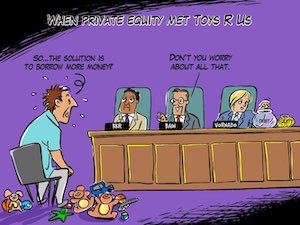

- How It Works: PE firms acquire profitable businesses (e.g., Joann’s, where 97% of stores were profitable), load them with massive debt (e.g., $1 billion for Joann’s), and force the businesses—not the PE firms—to repay it. When interest rates rise, the debt becomes unmanageable, triggering bankruptcy, even if the business itself is operationally sound.

- Outcome: The businesses collapse, leaving PE firms to profit from the wreckage while employees, communities, and investors (like pension funds) bear the losses.

Real-World Examples

- Joann’s: Despite strong sales and loyal customers, it collapsed under PE-imposed debt, not operational failure.

- Party City, Hooters, etc.: Similar stories of cash-positive businesses bankrupted by debt strategies, not market conditions.

Broader Economic Threat

- Pension Risk: Cianci warns that PE is selling this “junk debt” into pension funds, echoing concerns from X users like @mikeroche. If these investments fail, retirees could lose savings, amplifying the crisis.

- Scale: She estimates a $3.8 trillion exposure (per a March 17, 2025, post on theworldwatch.com), dwarfing 2008’s impact, though this figure lacks detailed sourcing in the thread.

Personal Experience

Cianci ties this to her own story. Her Little Gym franchise was acquired by Unleashed Brands, a PE-backed firm, in 2021. She alleges they imposed higher fees and forced new contracts, terminating her franchise when she resisted—costing her $300,000 and her business. She frames this as part of a nationwide pattern of PE “strip-mining” small businesses.