When we talk about government spending, the numbers are often so large they lose their meaning. But “fraud” isn’t just a budget line item; it is a direct siphoning of your hard-earned tax dollars into the pockets of criminals.

The Staggering Data

According to the Government Accountability Office (GAO), the federal government loses between $233 billion and $521 billion annually to fraud. To put that in perspective, that is roughly enough to fund the entire Department of Education and the Department of Homeland Security combined.

While the government tracks “improper payments”—which include accidental overpayments—fraud is the intentional theft of these funds. In Fiscal Year 2024, agencies reported $162 billion in improper payments, with 75% of that loss concentrated in just five areas:

| Federal Program | Estimated Improper/Fraudulent Payments (FY2024) |

| Medicare (HHS) | $54 Billion |

| Medicaid (HHS) | $31 Billion |

| Earned Income Tax Credit (Treasury) | $16 Billion |

| SNAP / Food Stamps (USDA) | $11 Billion |

| Unemployment Insurance | ~$4 Billion (Post-Pandemic Baseline) |

Who Is to Blame?

The “blame” is a two-sided coin. On one side are external bad actors: organized crime rings (both domestic and foreign) and “ghost” vendors who exploit archaic government billing systems. In 2025, the DOJ’s National Health Care Fraud Takedown alone uncovered over $14.6 billion in alleged fraud involving 324 defendants.

On the other side is systemic negligence. Many agencies still rely on “pay and chase” models—sending money out first and checking eligibility later. This is essentially leaving the vault door unlocked and hoping no one notices.

The Real-World Outcomes

Fraud isn’t a victimless crime. When billions disappear, the outcomes are felt by every citizen:

this is shocking:

— Arthur MacWaters (@ArthurMacwaters) December 31, 2025

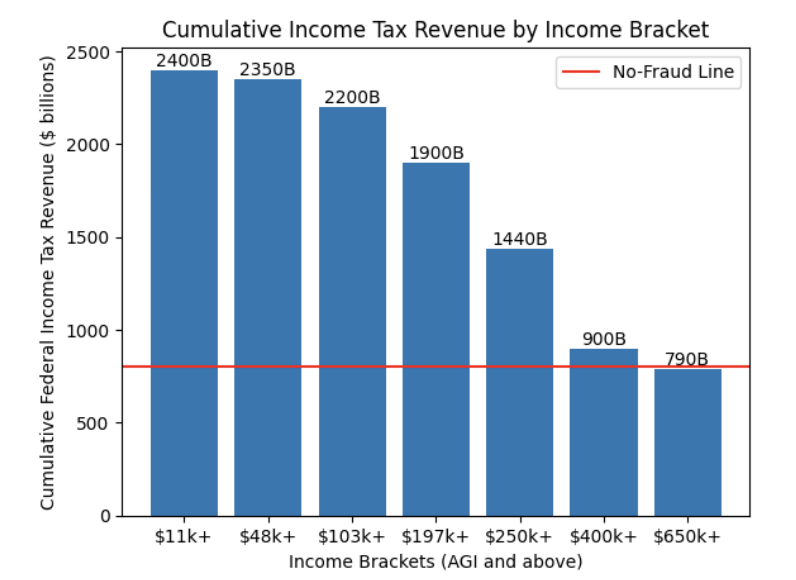

> US collects $2.4T in income tax, but spends $1.5T on fraud

> if we didn't have to pay for fraud, only $900b would need to be collected

> this means anyone with less 500k in income could pay *literally $0* in income tax

we don't need to raise taxes. we… https://t.co/kz1ZU2bRcx pic.twitter.com/An7eotgpOT

- Reduced Services: Every dollar stolen is a dollar not spent on infrastructure, schools, or veterans’ care.

- Increased Scrutiny for the Honest: Fraud leads to “defensive bureaucracy,” making it harder and slower for legitimate claimants to get the help they need.

- The “Fraud Tax”: To cover these losses, the government must either increase the national debt or maintain higher tax rates.

If you cut $1.5 trillion in fraud you could exempt all income tax up to $200,000 🤯 https://t.co/pmhzEVxVcK

— Peter St Onge, Ph.D. (@profstonge) December 31, 2025

Fraud’s Impact on Taxpayers: Key Data and ConsequencesGovernment fraud and improper payments drain billions from federal programs each year, directly affecting taxpayers through higher debt, elevated taxes, or reduced services. The Government Accountability Office (GAO) estimates annual fraud losses at $233–$521 billion (based on 2018–2022 data), while reported improper payments—errors including overpayments and some fraud—totaled $162 billion in FY2024, down from $236 billion in FY2023 due to the end of pandemic programs.

Seventy-five percent of FY2024 improper payments were concentrated in five areas:

| Program | Estimated Improper Payments (FY2024) |

|---|---|

| Medicare (FFS + Parts C/D) | ~$54 billion (FFS: $31.7B; Part C: $19.1B; Part D: $3.6B) |

| Medicaid | $31.1 billion |

| Earned Income Tax Credit | ~$16–20 billion (older estimates; high historical rates) |

| SNAP (Food Stamps) | ~$11–12 billion (10.93% error rate) |

| Other (e.g., Unemployment baseline) | ~$4–5 billion |

Healthcare fraud remains a top issue. In 2025, the DOJ’s largest-ever National Health Care Fraud Takedown charged 324 defendants with schemes totaling $14.6 billion in intended losses.

Blame spans multiple sources: organized crime rings exploiting outdated systems, individuals submitting false claims, providers billing for unnecessary services, and administrative errors like insufficient documentation (79% of Medicaid improper payments). Systemic issues, such as “pay and chase” verification, enable errors.

this is shocking:

— Arthur MacWaters (@ArthurMacwaters) December 31, 2025

> US collects $2.4T in income tax, but spends $1.5T on fraud

> if we didn't have to pay for fraud, only $900b would need to be collected

> this means anyone with less 500k in income could pay *literally $0* in income tax

we don't need to raise taxes. we… https://t.co/kz1ZU2bRcx pic.twitter.com/An7eotgpOT

Outcomes hit taxpayers hardest. Billions lost mean fewer resources for infrastructure or benefits, forcing higher borrowing or taxes. Legitimate recipients face delays from increased scrutiny. Recoveries provide some relief—e.g., DOJ seizures of $245 million in assets—but prevention via better data analytics, audits, and tech upgrades is essential to protect funds.