| By Dan Mitchell |

Last week, I shared some data showing how the economy enjoyed a strong recovery from recession in the early 1920s when President Warren Harding cut government spending.

(And these were genuine cuts, not the nonsense we get from today’s politicians, who claim they’ve cut spending simply because the budget increases by 5 percent rather than 7 percent.)

What happened nearly 100 years ago is very relevant today since we still have advocates of Keynesian economics who claim that more spending (especially debt-financed spending) is a recipe for more growth.

To show why this view is misguided, let’s now look at what happened in the 1940s after World War II came to an end.

In a column for today’s Wall Street Journal, Professor Richard Vedder explains that the Keynesians predicted economic disaster because of big reductions in government spending.

…many Americans assumed the end of the war would mean a resumption of the Depression, which was cut off by the World War II military buildup. In the middle of the fighting, America’s leading Keynesian economist, Alvin Hansen of Harvard, said: “When the war is over, the government cannot just disband the Army, close down munitions factories, stop building ships, and remove economic controls.” …When the sudden end of combat became apparent in late August 1945, economist Everett Hagen predicted that the unemployment rate in the first quarter of 1946 would be 14.8%.

So what actually happened?

Vedder points out that the Keynesian predictions of massive unemployment were wildly inaccurate.

Millions of military personnel did become jobless within months and defense spending plummeted, putting more out of work. In June 1946 federal employment was almost precisely 10 million less than a year earlier. Yet the sharp rise in overall unemployment didn’t occur. The total unemployment rate for 1946 was 3.9%… Perhaps most interesting for today, all this occurred as the U.S. moved from an extremely expansionary fiscal policy—with budget deficits equal to almost 25% of gross domestic product in 1944 (the equivalent of more than $5 trillion today)—to an extremely contractionary one. The U.S. by 1947 was running a budget surplus exceeding 5% of output—the equivalent of more than $1 trillion today. …This was the complete reverse of the expectation of the newly dominant Keynesian economists.

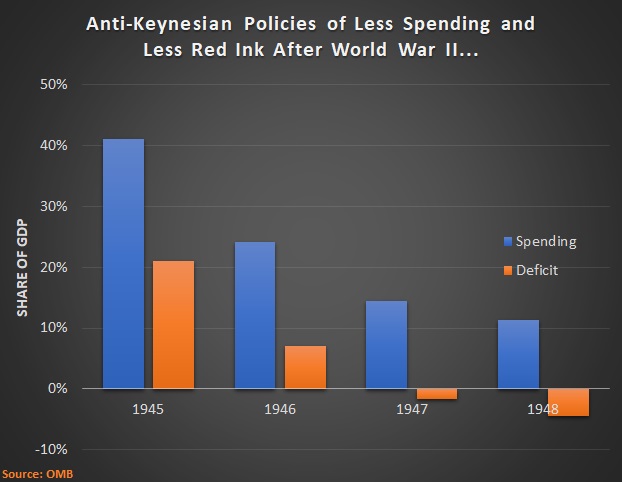

In the following chart, you can see the numbers from the Office of Management and Budget’s Historical Tables (Table 1.2), which show that fiscal policy between 1945 and 1948 was very contractionary, at least as defined by the Keynesians.

There definitely were huge spending cuts (the real kind, not the fake kind) during those years, and big deficits also became big surpluses.

Professor Vedder’s column explained that this anti-Keynesian policy didn’t produce mass unemployment.

But what about economic growth?

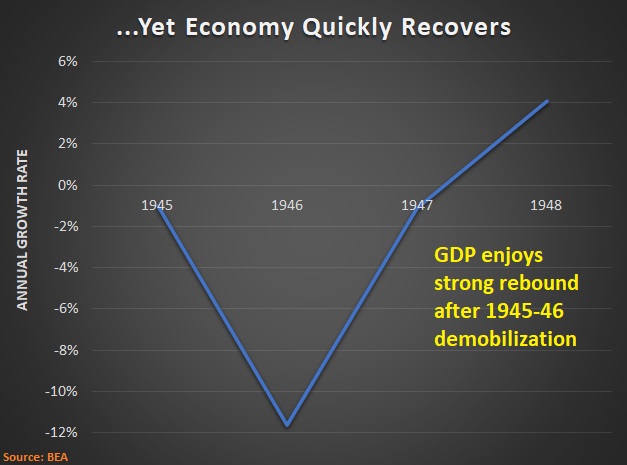

Well, you’ll see in the chart below the data from the Bureau of Economic Analysis for the 1945-48 period. There was a recession in 1946, which could be interpreted as evidence for Keynesianism.

But then look what happened in the next couple of years. There were more budget cuts, deficits became surpluses, and the economy enjoyed a strong rebound.

According to Keynesian theory, these two charts can’t exist. There can’t be an economic recovery when spending and deficits are falling.

Yet that’s exactly what happened after World War II (just as it happened under Harding, as Thomas Sowell observed).

Maybe, just maybe, Keynesianism is simply wrong. Maybe it’s nothing more than the economic version of a perpetual motion machine?

P.S. It’s also worth noting that huge increases in spending and debt under Hoover and Roosevelt didn’t produce good results in the 1930s.

Daniel J. Mitchell is a public policy economist in Washington. He’s been a Senior Fellow at the Cato Institute, a Senior Fellow at the Heritage Foundation, an economist for Senator Bob Packwood and the Senate Finance Committee, and a Director of Tax and Budget Policy at Citizens for a Sound Economy. His articles can be found in such publications as the Wall Street Journal, New York Times, Investor’s Business Daily, and Washington Times. Mitchell holds bachelor’s and master’s degrees in economics from the University of Georgia and a Ph.D. in economics from George Mason University. Original article can be viewed here.

Self-Reliance Central publishes a variety of perspectives. Nothing written here is to be construed as representing the views of SRC.