On June 19th, President Trump awarded economist Art Laffer, creator of the Laffer Curve made famous under President Reagan, the Medal of Freedom. President Trump’s remarks follow this tribute by economist Dan Mitchell

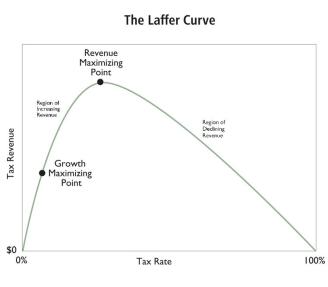

I’m a big fan of the Laffer Curve, which is simply a graphical representation of the common-sense notion that punitively high tax rates can result in less revenue because of reductions in the economy-wide level of work, saving, investment, and entrepreneurship.

This insight of supply-side economics is so obviously true that even Paul Krugman has acknowledged its veracity.

What’s far more important, though, is that Ronald Reagan grasped the importance of Art’s message. And he dramatically reduced tax rates on productive behavior during his presidency.

And those lower tax rates, combined with similar reforms by Margaret Thatcher in the United Kingdom, triggered a global reduction in tax rates that has helped boost growth and reduce poverty all around the world.

In other words, Art Laffer was a consequential man.

So it was great news that President Trump yesterday awarded Art with the Presidential Medal of Freedom.

Let’s look at some commentary on this development, starting with a column in the Washington Examiner by Fred Barnes.

When President Trump announced he was awarding the Presidential Medal of Freedom to economist Arthur Laffer, there were groans of dismay in Washington… Their reaction was hardly a surprise. Laffer is everything they don’t like in an economist. He’s an evangelist for tax cuts. He believes slashing tax rates is the key to economic growth and prosperity. And more often than not, he’s been right about this. Laffer emerged as an influential figure in the 1970s as the champion of reducing income tax rates. He was a key player in the Reagan cuts of 1981 that touched off an economic boom lasting two decades. …Laffer, 78, is not a favorite of conventional, predominantly liberal economists. Tax cuts leave the job of economic growth to the private sector. Liberal economists prefer to give government that job. Tax cuts are not on their agenda. Tax hikes are. …His critics would never admit to Laffer envy. But they show it by paying attention to what he says and to whom he’s affiliated. They rush to criticize him at any opportunity. …Laffer was right…about tax cuts and prosperity.

And here are some excerpts from a Bloomberg column by Professor Karl Smith of the University of North Carolina.

Most important, he highlights how supply-side economics provided a misery-minimizing way of escaping the inflation of the 1970s.

President Donald Trump’s decision to award Arthur Laffer the Presidential Medal of Freedom has met with no shortage of criticism… Laffer was a policy entrepreneur, and his..boldness was crucial in the development of what came to be known as the “Supply Side Revolution,” which even today is grossly underappreciated. In the 1980s, the U.S. economy avoided the malaise that afflicted Japan and much of Western Europe. The primary reason was supply-side economics. …Reducing inflation with minimal damage to the economy was the central goal of supply-side economics. …most economists agreed that inflation could be brought down with a severe enough recession. …Conservative economists argued that the long-term gain was worth that level of pain. Liberal economists argued that inflation was better contained with price and income controls. Robert Mundell, a future Nobel Laureate, argued that there was third way. Restricting the money supply, he said, would cause demand in the economy to contract, but making large tax cuts would cause demand to expand. If done together, these two strategies would cancel each other out, leaving room for supply-side factors to do their work. …Laffer suggested that permanent reductions in taxes and regulations would increase long-term economic growth. A faster-growing economy would increase foreign demand for U.S. financial assets, further raising the value of the dollar and reducing the price of foreign imports. These effects would speed the fall in inflation by increasing the supply of goods for sale. In the early 1980s, the so-called Mundell-Laffer hypothesis was put to the test — and it was, by and large, successful.

I’ve already written about how taming inflation was one of Reagan’s great accomplishments, and this column adds some meat to the bones of my argument.

And it’s worth noting that left-leaning economists thought it couldn’t be done. Professor Bryan Caplan shared this quote from Paul Samuelson.

Today’s inflation is chronic. Its roots are deep in the very nature of the welfare state. [Establishment of price stability through monetary policywould require] abolishing the humane society [and would] reimpose inequality and suffering not tolerated under democracy. A fascist political state would be required to impose such a regime and preserve it. Short of a military junta that imprisons trade union activists and terrorizes intellectuals, this solution to inflation is unrealistic–and, to most of us, undesirable.

It’s laughable to read that today, but during the Keynesian era of the 1970s, this kind of nonsense was very common (in addition to the Samuelson’s equally foolish observationson the supposed strength of the Soviet economy).

The bottom line is that Art Laffer and supply-side economics deserve credit for insights on monetary policy in addition to tax policy.

But since Art is most famous for the Laffer Curve, let’s close with a few additional observations on that part of supply-side economics.

Many folks on the left today criticize Art for being too aggressive about the location of the revenue-maximizing point of the Laffer Curve. In other words, they disagree with him on whether certain tax cuts will raise revenue or lose revenue.

While I think there’s very strong evidence that lower tax rates can increase revenue, I also think it doesn’t happen very often.

But I also think that debate doesn’t matter. Simply stated, I don’t want politicians to have more revenue, which means that I don’t want to be at the revenue-maximizing point of the Laffer Curve.

Moreover, there’s a lot of economic damage that occurs as tax rates approach that point, which is why I often cite academic research confirming that one additional dollar of tax revenue is associated with several dollars (or more!) of lost economic output.

Call me crazy, but I’m not willing to destroy $5 or $10 of private-sector income in order to increase Washington’s income by $1.

The bottom line is that the key insight of the Laffer Curve is that there’s a cost to raising tax rates, regardless of whether a nation is on the left side of the curve or the right side of the curve.

P.S. While I’m a huge fan of Art Laffer, that doesn’t mean universal agreement. I think he’s wrong in his analysis of destination-based state sales taxes. And I think he has a blind spot about the danger of a value-added tax.

Remarks by President Trump at Presentation of the Medal of Freedom to Dr. Arthur Laffer

THE PRESIDENT: Well, this is a big day. Very important for a very important subject. Today it’s my privilege to award our nation’s highest civilian honor to the father of supply-side economics: Dr. Arthur Laffer. (Applause.)

I know Art has been to the Oval Office, unlike most people, many times. But this is a very special time for you. This is a tremendous award. You have the Congressional Medal of Honor on the military side, which, of course, is something incredibly special. And the presidential medal is — I just want to congratulate you. There’s nothing like it, right?

DR. LAFFER: Nothing.

THE PRESIDENT: Thank you very much, Art.

Joining us for this momentous ceremony are Art’s six children. Thank you very much. Congratulations. (Applause.) And we’re also grateful to be joined by Vice President Mike Pence. We just got back from Florida. (Applause.) Had a big night. That was a big night in Orlando, Mike. Right?

Secretary Steve Mnuchin, Alex Acosta, Elaine Chao, and Ben Carson, thank you very much for being here. And our top economic advisor and a great friend — of all of us, actually. I hear that voice and I just say “money, money, money.” Larry Kudlow. (Laughter.) Right? Larry. Thank you, Larry.

MR. KUDLOW: Thank you, sir.

THE PRESIDENT: Few people in history have revolutionized economic thought and policy like Dr. Art Laffer.

He developed a brilliant theory, shaped unprecedented economic reforms, and helped turn a severe recession into a remarkable boom. He proved that the most powerful way to grow the economy and raise government revenue was not to increase tax rates but to adopt strong incentives that unleash the power of human freedom and innovate, create jobs, and deliver greater opportunity to all Americans. And he’s proved it over and over again.

A Yale graduate, Art went on to earn his PhD in Economics from Stanford University. He became the youngest-ever tenured professor at the University of Chicago. Oh, that’s good. That wasn’t too long, was it? (Laughter.) He’s very deceiving. He’s a little older than he looks. He looks like he’s in his forties. (Laughter.) He’s a little older than that. Just a little bit, right?

DR. LAFFER: A lot.

THE PRESIDENT: Don’t talk about it. (Laughs.)

In 1970, Art served as the very first chief economist at the Office of Management and Budget, where he designed an economic model that is still used today to forecast tax revenue and accurately predict economic growth.

Art then returned to the University of Chicago. At the start of the Ford administration, our nation’s economic situation was becoming dire indeed. We remember.

In 1974 alone, 2 million Americans joined the unemployment lines, and inflation hit 11 percent. Right now, we have inflation at almost nothing. (Applause.) I like that better. Don’t you? It’s good to read this because we read this and we realize how well we’re doing right now.

The consensus in Washington, on both sides of the aisle, was that the government could tax, inflate, and regulate its way to prosperity. But Art had a different idea. Right? You did have a different idea. I’d have you tell it. It would be much more interesting, huh?

In 1974, Art came to dinner with the White House Chief Staff — Chief of Staff Don Rumsfeld; Deputy Chief of Staff Dick Cheney — who’s been, by the way, a tremendous supporter, and we appreciate Dick very much; and Wall Street Journal reporter Jude Wanniski.

The dinner has since become very, very legendary in many minds. Art drew on his napkin a series of lines and a curve that changed history. With the now famous “Laffer Curve” — still, a very, very highly respected economic curve — Art showed that if tax rates are too high, people stop spending and they stop investing.

The result is less growth and lower tax revenues. On the other hand, at the certain point on the curve, lower tax rates spur investment, economic growth, and raise government revenue.

I think Steve Forbes agrees with that. (Laughter.) Where’s Steve? I’ve heard you for a long time talking about that. Very much agree.

Prominent academics called this theory “insanity,” “totally wacky,” and “completely off the wall.”

With optimism, confidence, and exceptional intellect, Art would go on to prove them all wrong. He proved them wrong on a number of occasions.

In 1978, California Governor Jerry Brown asked Art to help him implement Proposition 13, which the people had overwhelmingly enacted to dramatically reduce the state property tax. I think they could use it again out there, by the way. They should do that immediately. The results were so successful that job creation soon grew at twice the nationwide rate. Within two years, 43 states adopted similar reforms.

During that same period, Art also advised Ronald Reagan, and helped shape his low-tax, pro-growth agenda. After President Reagan’s election, Art served on the President’s Economic Policy Advisory Board. He played a vital role in both the 1981 and 1986 tax rate cuts, which ultimately lowered the top marginal tax rate from 70 percent to 28 percent. That’s not bad. That’s a pretty big reduction, I would say.

The Reagan economy soared, creating sustained economic growth, shrinking poverty, expanding incomes, and dramatically increasing federal revenue. Sounds very familiar. Sounds very, very familiar, actually. Our economy has never, ever been stronger than it is today. (Applause.) It’s true.

Dr. Laffer’s policies not only expanded opportunity for our citizens; they spurred economic reforms around the world and helped lift untold millions out of poverty. Art has advised many world leaders, including former UK Prime Minister Margaret Thatcher — a great one.

Staying true to the pro-growth vision that Dr. Laffer helped develop, in 2017, we passed historic tax cuts and reforms into law. Now, unemployment has reached its lowest level in over 51 years, with fast-growing wages, low inflation, and real GDP. And this is GDP growth that’s higher than anybody ever thought possible. First quarter was 3.2. And everybody said the first quarter is not going to be so good because the first quarter is never very good for us. But it was not only good; it was double and even triple what people expected. And we’re going to see some other very pleasant surprises, especially when the trade deals are all worked out. And they’re coming along very well, Art, as you know.

Our tax cuts and reforms also created Opportunity Zones in distressed communities, another idea that Dr. Laffer helped develop early in his career.

In 1999, TIME magazine named Dr. Laffer one of the greatest minds of the 20th century. Former Wall Street Journal reporter Jude Wanniski wrote, “In studying public finance, there is nothing more important than an appreciation of the Laffer Curve.” I’ve heard and studied the Laffer Curve for many years in the Wharton School of Finance. It’s a very important thing that you’ve done, Art. Very important.

Dr. Laffer helped inspire, guide, and implement extraordinary economic reforms that recognize the power of human freedom and ingenuity to grow our economy and lift families out of poverty and into a really bright future.

Today, our nation is stronger, our people more prosperous, and the world a much better place because of the brilliance and boldness of Dr. Arthur Laffer.

And it’s now my profound honor to ask the military aide to come forward as I present Dr. Laffer with the Presidential Medal of Freedom. It’s my great honor. Thank you. (Applause.)

MILITARY AIDE: Arthur B. Laffer, the Father of Supply-Side Economics, is one of the most influential economists in American history. He is renowned for his economic theory, “The Laffer Curve,” which establishes the strong incentive effects of lower tax rates that spur investment, production, jobs, wages, economic growth, and tax compliance.

Among other accomplishments during his distinguished career, Dr. Laffer was the first chief economist of the Office of Management and Budget and a top economic advisor to President Ronald Reagan.

The United States proudly recognizes Arthur B. Laffer for his public service and his contributions to economic policy, which have helped spur prosperity for our nation.

(The Medal of Freedom is presented.) (Applause.)

DR. LAFFER: Oh, my gosh. (Laughter.) When your staff said, “Keep it short,” I didn’t know that’s what they meant. (Laughter.) No, I’m just joking.

THE PRESIDENT: This is your day.

DR. LAFFER: Thank you very much.

Let me, if I can: Sincerity and brevity — or so they say — go hand in hand. And in that vein, Mr. President, I want to thank you from the top, the middle, and the bottom of my heart. Thank you.

Good economic policy is a team effort. And goodness knows my fellow teammates are the best ever: Larry Kudlow, my friend forever and ever and ever. Steve Moore. Where are you, Steve? Steve Moore. Steve Forbes. Steve Forbes canceled his trip abroad to be here today. Is David Malpass here? Kevin Hassett. Team players, Steven Mnuchin, wherever — there you are. You’re way back there. Steven. You don’t get a better team than that, ever. I mean, this is the team of all teams.

And I just want to reflect for a second on some of my past colleagues and working with other administrations. For example, in the past, my colleagues included Nobel Laureate and dear friend Bob Mundell; the legendary editorial page editor, Bob Bartley, of the Wall Street Journal; Jude Wanniski, the crazy, wild revolutionary for supply-side economics; Milton Friedman, of course; my godfather and dearest supporter, Justin Dart; George Schultz, my mentor who has hired me four times and not gotten tired of it yet, I guess; Jack Kemp, who we called, “The Weapon” — he’s delivered it; and my classmate at Yale, and my dear friend, a guy named Dick Cheney. It’s just really wonderful to have — each of whom deserves a lot of praise.

By the way, just for the record, Bob Bartley, Milton Friedman, Justin Dart, George Schultz, Jack Kemp, and Dick Cheney all received the President Medal of Freedom. Isn’t that amazing? I’m in great, great company, let me tell you. I’m awed by that.

But to get over the — to get the ball over the — to get the ball over the goal line, committed leadership is the sine qua non for this. And we had President Kennedy, President Reagan, Prime Minister Margaret Thatcher, and of course, you, Mr. President, Donald Trump, to really make it all happen. Without the leaders — (applause) — and all I can say is, wow.

I mean, you know, President Kennedy established the current Presidential Medal of Freedom, and both President Reagan and Margaret Thatcher were recipients.

My business partner is here. My business partner’s friends and fellow dreamcatchers — a number of whom are here today, by the way — have allowed all of this to happen for me, and I am eternally grateful. They are the salt of the Earth. And, in fact, they actually lived the lives that we economists just talk about. They actually do it. And it is for them that we do what we do. They have kept, do keep, and will keep America prosperous.

And my final shout-out, if I may, is to my family — my wonderful family. All six of my children are here today, as well as Mike Madzin and Mike Stabile. I’m missing my 13 grandchildren and my 4 great-grandchildren, for which I am sure the White House staff is eternally grateful. (Laughter.)

My family makes me very, very proud and gives me a reason every morning to get up and get to work. Thank you. (Applause.)

END

5:31 P.M. EDT