By Joseph Edlow a visiting fellow at The Heritage Foundation and former acting director of U.S. Citizenship and Immigration Services in the Department of Homeland Security. Original here.

The Biden administration continues to take America down the unsustainable path of open borders and a welfare state for noncitizens. It has proposed a new “public charge” rule that greatly expands the types of government assistance immigrant applicants may receive without becoming a public charge. The administration is breathing new life into the old adage of never letting a good crisis go to waste.

With unprecedented numbers of illegal border crossers being allowed to remain in the United States, the Department of Homeland Security’s proposed rule will ensure that most never face scrutiny as public charges, regardless of how many public benefits they receive.

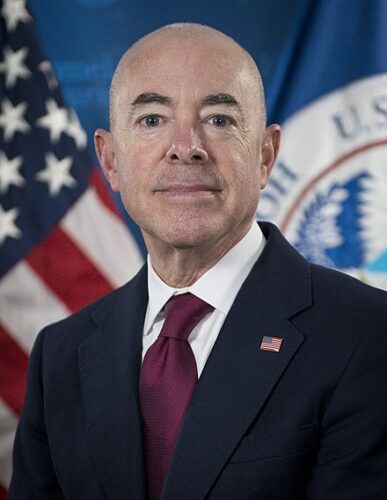

Yet again, Homeland Security Secretary Alejandro Mayorkas says this policy change is consistent with our nation’s values. Apparently, the Biden administration no longer values self-reliance.

Self-sufficiency has long been a basic precept of American immigration law and policy. Since the late 19th century, the United States prohibited entry to those deemed to be public charges. While Congress has taken actions consistent with that principle in almost every major piece of immigration legislation, the unwillingness to concretely define “public charge” has caused unresolved tumult and provided a gray area for those that administer our immigration laws. The Biden administration views this as an opportunity to now render it useless.

Critics of Trump-era immigration policies often focused on the public charge rule, a regulation aimed at finally providing some stability and clarity to the issue. While the rule was ultimately undone through well-funded and coordinated litigation efforts, President Joe Biden’s Department of Homeland Security has recently announced its intention to publish its own version of the public charge rule.

Unlike the previous administration, this new public charge rule appears to largely codify the gap-filling guidance issued in the late ’90s—a measure proven wholly ineffective for over 20 years.

Under the guise of being “fair and humane,” the new rule purports to define public charge as “significant reliance on government support.” While appearing to be broad and sufficiently encompassing in scope, the definition is, at best, misleading.

In the opinion of Biden’s DHS, only cash benefits for income maintenance purposes or long-term institutionalization, when at government expense, meet that standard. Focusing on the former, this definition relegates public charge determinations to only those aliens receiving supplemental Social Security income, cash assistance under Temporary Assistance for Needy Families, or other state, local, or tribal cash programs.

With the focus on cash benefits, DHS seemingly forgets that many in the United States receive and significantly rely on non-cash public benefits. A recipient of federal or state housing assistance is significantly reliant on the government and so are recipients of Medicaid or other state low- or no-cost medical benefits.

Yet, under this proposed rule, neither of those public benefits, nor any other benefit that does not directly provide cash to a recipient, could be considered in determining whether an alien is a public charge. Either DHS is outright ignoring these and other significant benefits or it is drawing an artificial distinction between income deriving cash benefits and other significant non-cash benefits.

Assuming DHS is distinguishing cash and non-cash benefits, DHS is relying on a flawed premise that, for public charge purposes, the analysis should rest on how the benefit is used by the individual. Instead, DHS should generally only look to whether an individual is, in fact, relying on a public benefit at all.

Additionally, the federal government alone spends billions of dollars on federal housing subsidies and Medicaid each year. If the goal is to ensure that aliens are not reliant on the government, the focus should be on how much the government spends on the benefit, not simply whether the benefit is income-deriving.

This proposed rule seems to ignore that reliance on the public benefits comes at a sharp cost to the public. The semantic distinctions never alter the bottom line that everyone who relies on public benefits relies on public tax dollars to fund those benefits.

Self-sufficiency is an American value, but just as critical a value is stewardship of public funds. This rule and its faux distinctions violate the spirit of the law and flies in the face of our American values at great cost to our values and our wallets.

But this rule will certainly keep well within the spirit of Biden’s executive orders aimed at removing barriers to immigration benefits. The narrow definition would, if finalized, remove a large impediment to many aliens seeking permanent residence in the United States who presently utilize non-cash benefits.

With so many non-cash benefit programs operated at the federal and state levels, and with public charge determination requiring consideration of a myriad of factors, the exceptions will rapidly swallow the rule.

While self-sufficiency has long been a principle of our immigration system, this rule codifies little more than lip service to that legacy. The definitions combined with the adjudicatory process will permit most aliens to easily avoid a public charge finding.

As DHS continues to delude itself and the country on the administration’s “humanitarian” open border policies and a meaningful difference between cash and non-cash welfare benefits, the U.S. taxpayers will shoulder the burden.

Joseph Edlow is a visiting fellow at The Heritage Foundation and former acting director of U.S. Citizenship and Immigration Services in the Department of Homeland Security.