When I write about Social Security, I normally focus on the program’s huge fiscal imbalance ($44 trillion and climbing) says Dan Mitchell.

But it’s not just a fiscal crisis. Social Security is also an increasingly bad deal for workers. Especially minorities with lower average lifespans. When compared to what they would get from a private retirement system, people are paying in too much and getting out too little.

There’s also another major problem with the program.

Academic experts have quantified how older workers are lured out of the labor force when they get money from the government. And since economic output is a function of the quality and quantity of labor and capital, this means we’re sacrificing wealth and reducing prosperity.

Here are some excerpts from a study by Professors Daniel Fetter and Lee Lockwood.

Many of the most important government programs, including Social Security and Medicare, transfer resources to older people… Standard economic theory predicts that such programs reduce late-life labor supply and that the implicit taxation reduces the ex-post value of the programs to recipients. Understanding the size and nature of such effects on labor supply and welfare is an increasingly important issue, as demographic trends have increased both the potential labor supply of the elderly and its aggregate importance, while simultaneously increasing the need for reforms to government old-age support programs. …We address these questions by investigating Old Age Assistance (OAA), a means-tested program introduced in the 1930s alongside Social Security that later became the Supplemental Security Income (SSI) program.

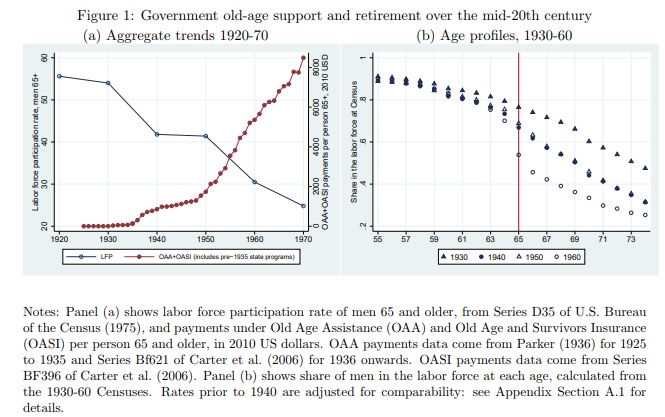

Here are charts illustrating how people are retiring earlier in part because of government payments.

And here are some calculations from the study.

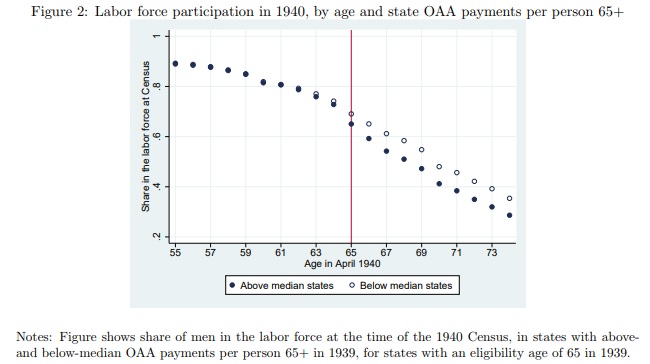

Our estimates indicate that OAA significantly reduced labor force participation among older individuals. The basic patterns that we explore in the data are evident in Figure 2, which plots male labor force participation by age, separately for states with above- and belowmedian OAA payments per person 65 and older. Up to age 65, the age pattern of labor force participation was extremely similar in states with larger and smaller OAA programs. At age 65, however, there was a sharp divergence in labor force participation between states with larger OAA programs relative to those with smaller programs, and this divergence continued at older ages. Our regression results, which isolate variation in OAA program size due to state policy differences, imply that OAA can explain more than half of the large 1930–40 drop in labor force participation of men aged 65–74. …Our results suggest that Social Security had the potential to drive at least half—and likely more—of the mid-century decline in late-life labor supply for men. …Taken as a whole, our results suggest that government old-age support programs can have large effects on labor supply, through both their transfer and taxation components.

This chart captures how old-age payments in various states were associated with varying degrees of labor force participation.

By the way, I’m not sharing this information because it’s bad for people to retire at some point.

I’m merely establishing that there’s academic support for the common-sense observation that people are more likely to leave the labor force when there’s an alternative source of income (though it’s worth noting that there should be a sensible and sustainable systemfor providing that retirement income).

Moreover, people are likely to stop working when government systems give them money before age 65.

Three academics, Andres Erosa, Luisa Fuster, and Gueorgui Kambourov, have a studyquantifying this problem in European nations.

There are substantial differences in labor supply and in the design of tax and transfer programs across countries. The cross-country differences in labor supply increase dramatically late in the life cycle…while differences in employment rates among eight European countries are in the order of 15 percentage points for the 50-54 age group, they increase to 35 percentage points for the 55-59 age group and to more than 50 percentage points for the 60-64 age group. In this paper we quantitatively assess the role of social security, disability insurance, and taxation for understanding differences in labor supply late in the life cycle (age 50+) across European countries and the United States. … The social security, disability insurance, and taxation systems in the United States and European countries in the study are modelled in great detail.

Here’s a sampling of their results.

The main findings are that the model accounts fairly well for how labor supply decreases late in the life cycle for most countries. The model matches remarkably well the large decline in the aggregate labor supply after age 50 in Spain, Italy, and the Netherlands. The results support the view that government policies can go a long way towards accounting for the low labor supply late in the life cycle for these European countries relative to the United States, with social security rules accounting for the bulk of these effects… relative to the United States, the hours worked by men aged 60-64 is…49% in the Netherlands, 66% in Spain, 44% in Italy, and 29% in France. …government policies can go a long way towards accounting for labor supply differences across countries. Social security rules account for the bulk of cross country differences in labor supply late in the life cycle (with its contribution varying from 50% to 100%), but other policies also matter. In accounting for the low labor supply relative to the US at ages 60 to 64, taxes matter importantly in the Netherlands (6%), Italy (6%), and France (5%); disability insurance policies are important for the Netherlands (7%) and Spain (10%).

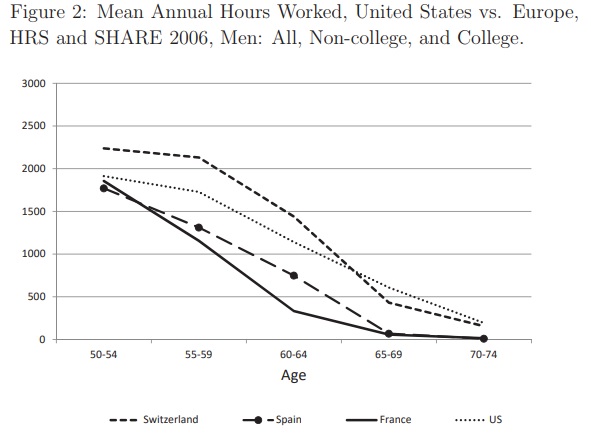

And here’s one of their charts comparing hours worked at various ages in Switzerland, Spain, France, and the United States.

The good news is that we don’t push people out of the labor force as much as the French and the Spanish.

The bad news is that we’re not as good as Switzerland (probably in part because the Swiss have a retirement system based on private saving, so they have the ideal combination of good work incentives and comfortable retirement).

But it shouldn’t matter whether other countries have good systems or bad systems. What does matter is that America’s demographic profile is changing. We’re living longer and having fewer children and our system of entitlements is a mess.

We should be reforming these programs, both for fiscal reasons and economic reasons.

P.S. It’s not just Social Security. Other programs also lure people out of the job market