by Dan Mitchell Tax increases are bad fiscal policy, but that doesn’t necessarily mean that they are politically unpopular. Indeed, many voices in …

Basic survival, emergency preparedness, some politics with a few fun do-it-yourself skills thrown in.

Basic survival, emergency preparedness, some politics with a few fun do-it-yourself skills thrown in.

by Dan Mitchell Tax increases are bad fiscal policy, but that doesn’t necessarily mean that they are politically unpopular. Indeed, many voices in …

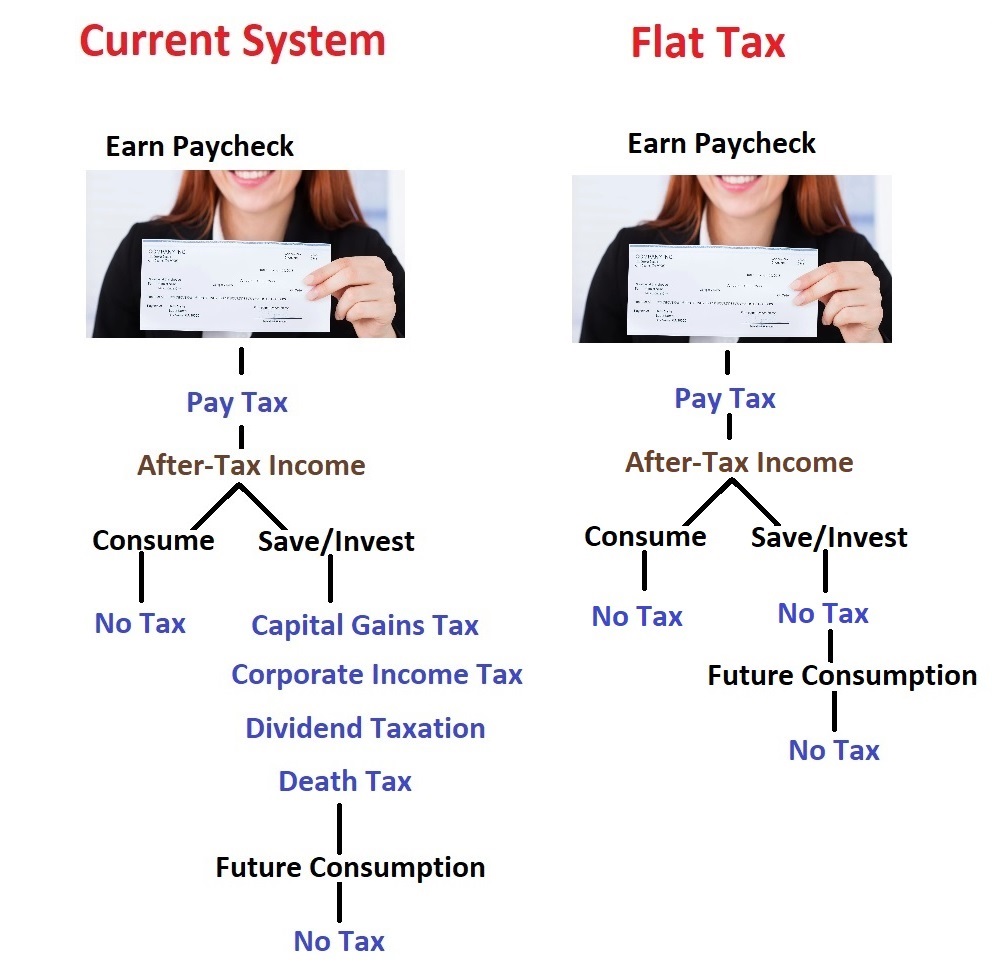

by Dan Mitchell As an economist, I strongly oppose the wealth tax (as well as other forms of double taxation) because it’s foolish to …

This year, state relocation incentives are striking closer to home. Once the near-exclusive domain of economic development offices seeking to …

Just like last year, April 15 isn’t the official deadline this year for filing your annual tax return. But we’re …

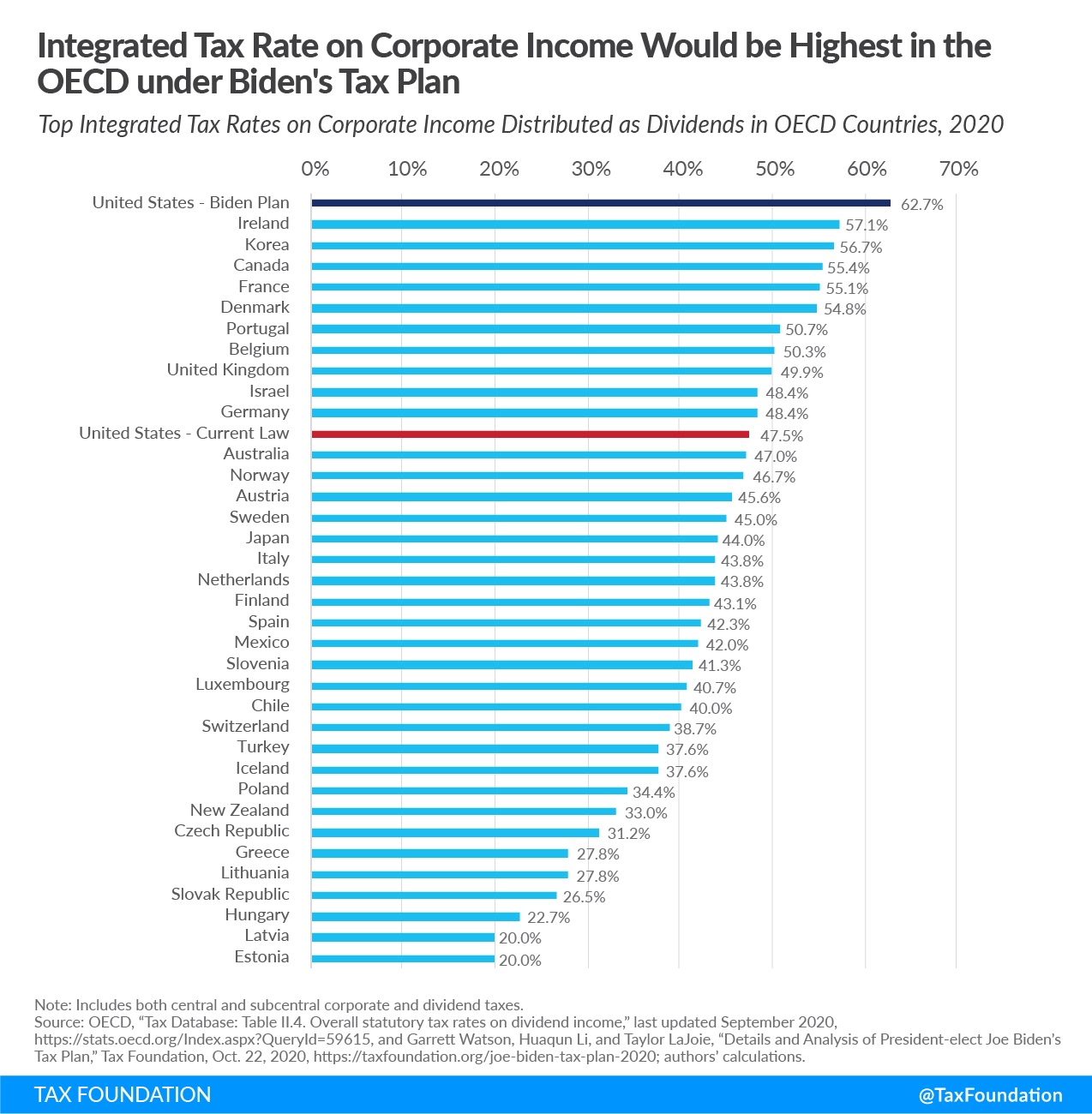

President Biden’s just-released infrastructure proposal takes a “go big or go home” approach. Its various provisions have been tallied at …

by Dan Mitchell Thanks to globalization (as opposed to globalism), jobs and investment are now very mobile. This means the costs of bad policy …

by Dan Mitchell Last summer, I provided testimony to the United Nations’ High-Level Panel on Financial Accountability Transparency & Integrity. I touched on many …

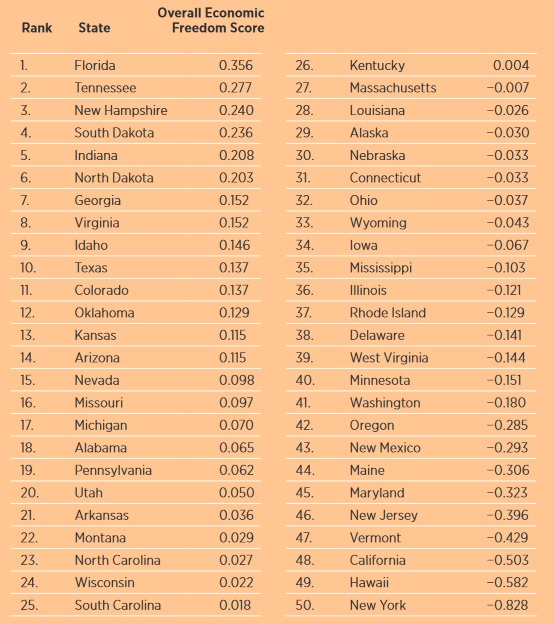

by Dan Mitchell I’ve written favorably about the pro-growth policies of low-tax states such as Texas, Florida, and Tennessee, while criticizing the anti-growth policies …

What’s truly astonishing here is that AOC has been awarded an Economics degree. Alexandria Ocasio Cortez is a perfect representation …

by Dan Mitchell Yesterday’s column featured some of Milton Friedman’s wisdom from 50 years ago on how a high level of societal capital (work ethic, …

By Dan Mitchell Part I of this series featured Dan Hannan explaining how the emergence of capitalism led to mass prosperity, while Part …

by Dan Mitchell Two weeks ago, I shared some video from a presentation to the New Economic School of Georgia (the …

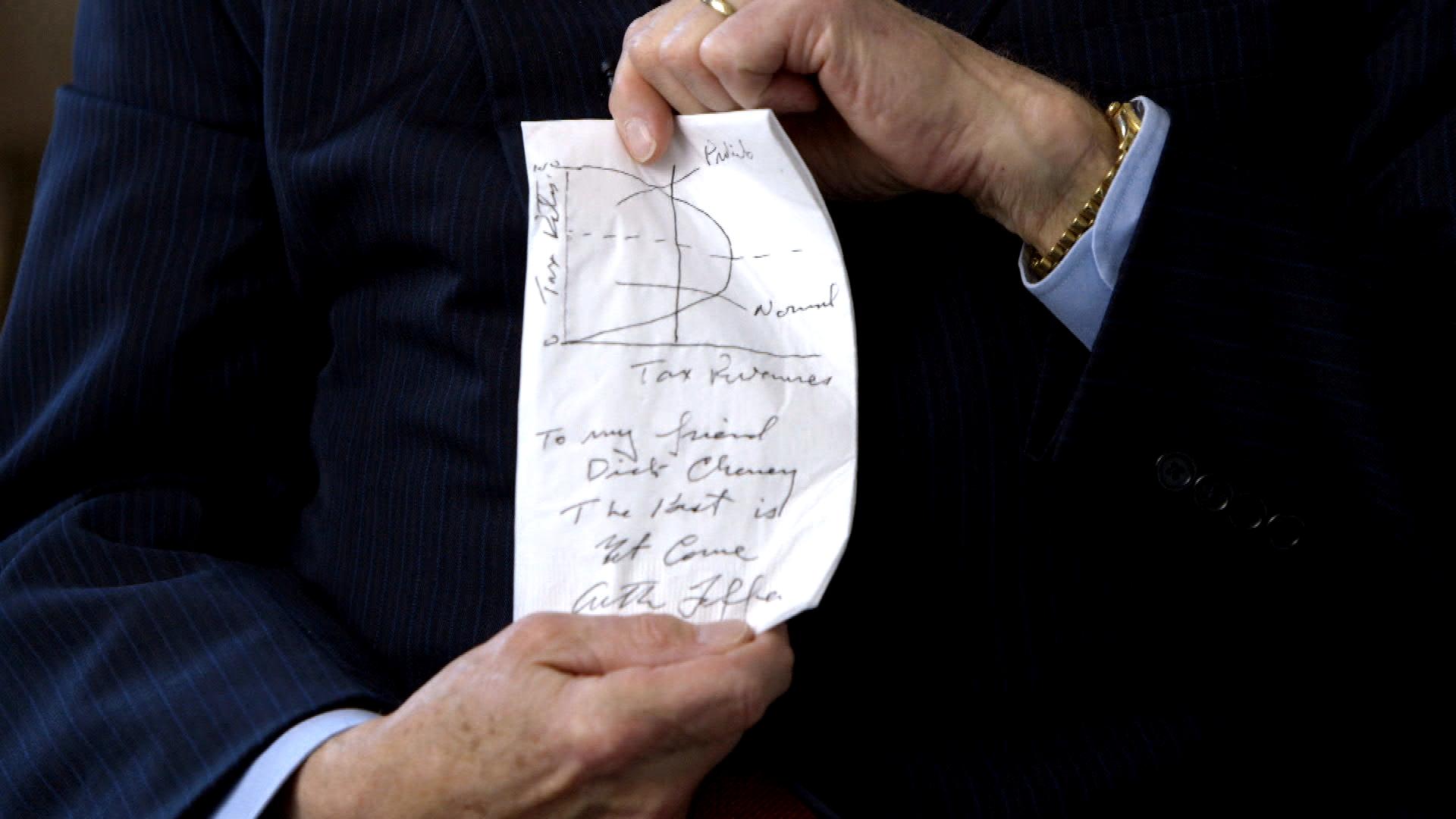

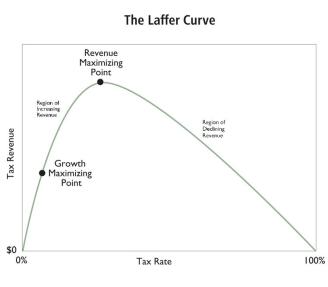

by Dan Mitchell Last week, I gave a presentation on the Laffer Curve to a seminar organized by the New Economic School in …

by Dan Mitchell Yesterday, in Part I of our series about greedy state politicians, we looked at top income tax rates. The worst …

by Dan Mitchell When considering which state has the greediest politicians, the flippant (but understandable) answer is to say “all of them.” …

I’m part of the small minority that thinks the big news from the United Kingdom is that “Brexit” will finally …

I looked last year at how Florida was out-competing New York in the battle to attract successful taxpayers, and then followed up …

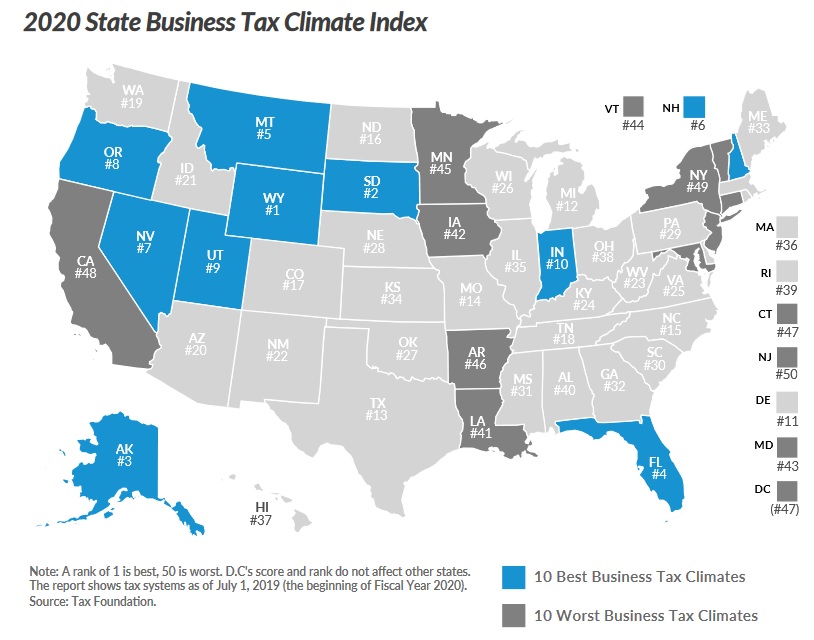

Following their recent assessment of the best and worst countries, the Tax Foundation has published its annual State Business Tax Climate Index, which …

An Oregon jury deadlocked on whether to convict a Christian man who hasn’t paid taxes in 20 years, resulting in …

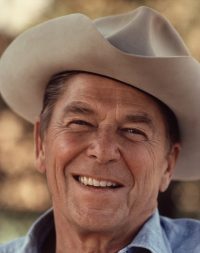

On June 19th, President Trump awarded economist Art Laffer, creator of the Laffer Curve made famous under President Reagan, the …

President Kennedy’s tax rate reductions were a big success. Sadly, very few modern Democrats share JFK’s zeal for pro-growth tax policy. …

I’m a big believer that some images do a great job of capturing an issue. The essential insight of supply-side economics. The …

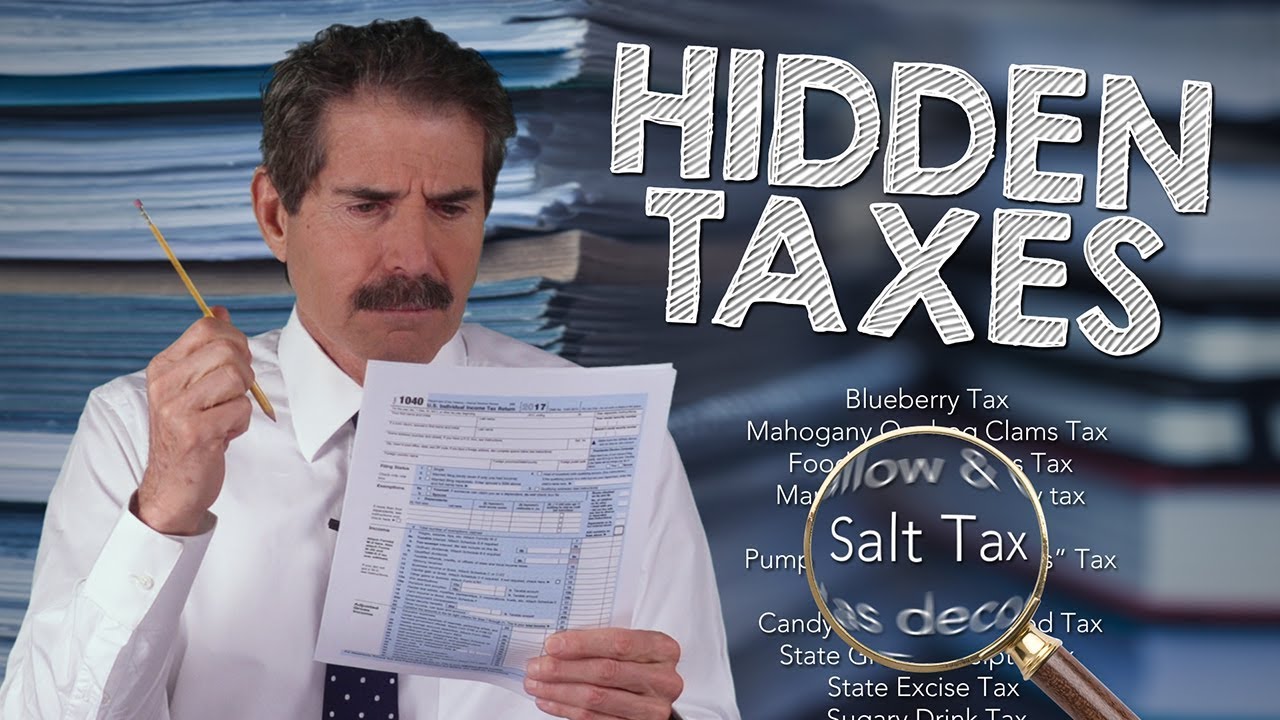

You probably know about property, payroll, and sales taxes, but there are also lots of hidden taxes. Kristin Tate reports …

By Rick Durfee #1 — Driving with your eyes shut –Be Aware of dangers –Open your eyes. –Eyes closed makes …

In a column in the New York Times, Steven Rattner attacks Trump’s tax plan for being unrealistic. Since I also think the proposal …

Steve Forbes — a very nice gentleman. If you ever attend FreedomFest you’ll know that he has no airs and …

I sometimes wonder if I was put on this planet to defend tax competition and tax havens. I argue for fiscal …

Why do many people engage in civil disobedience and decide not to comply with tax laws? Our leftist friends (the …

Learning from New Jersey’s Bad Tax Policy by Dan Mitchell Federalism is a great idea, and not just because America’s Founders wanted a …

It’s a little known fact, and one the IRS wants you to forget, but receipts are not always necessary to …