What is Jock Tax? Jock tax refers to state (and sometimes local) income taxes imposed on non-resident professional athletes for …

Basic survival, emergency preparedness, some politics with a few fun do-it-yourself skills thrown in.

Basic survival, emergency preparedness, some politics with a few fun do-it-yourself skills thrown in.

What is Jock Tax? Jock tax refers to state (and sometimes local) income taxes imposed on non-resident professional athletes for …

Poll: 80 Percent Say Now Is A Bad Time To Raise Taxes. But That’s Exactly What Will Happen If Republicans …

Taxpayer group warns of higher taxes, state costs if Trump tax cuts not extended If Congress fails to extend the …

One of President Donald Trump’s tax policy wishlist items is receiving support from some Democratic lawmakers – but with a …

April 15, 2025 by Dan Mitchell I realize that I should be writing about a serious topic on April 15, such …

President Donald Trump’s approach to economic growth relies on a multifaceted approach that includes reducing wasteful federal spending, placing tariffs …

President Donald Trump is considering a new tax policy where individuals earning less than $150,000 annually might not have to …

Former President Donald J. Trump has spent much of the presidential campaign brainstorming new, and sometimes untested, ways to cut …

…and obliterate the economy Harris' Unrealized Gains Tax Would Obliterate The U.S. Economy https://t.co/aPNwfxJhZY — zerohedge (@zerohedge) August 20, 2024 …

The Real Estate CPA – Nate Sosa, CPA, MST and their team reviewed Kamala Harris’s tax policies. She will raise …

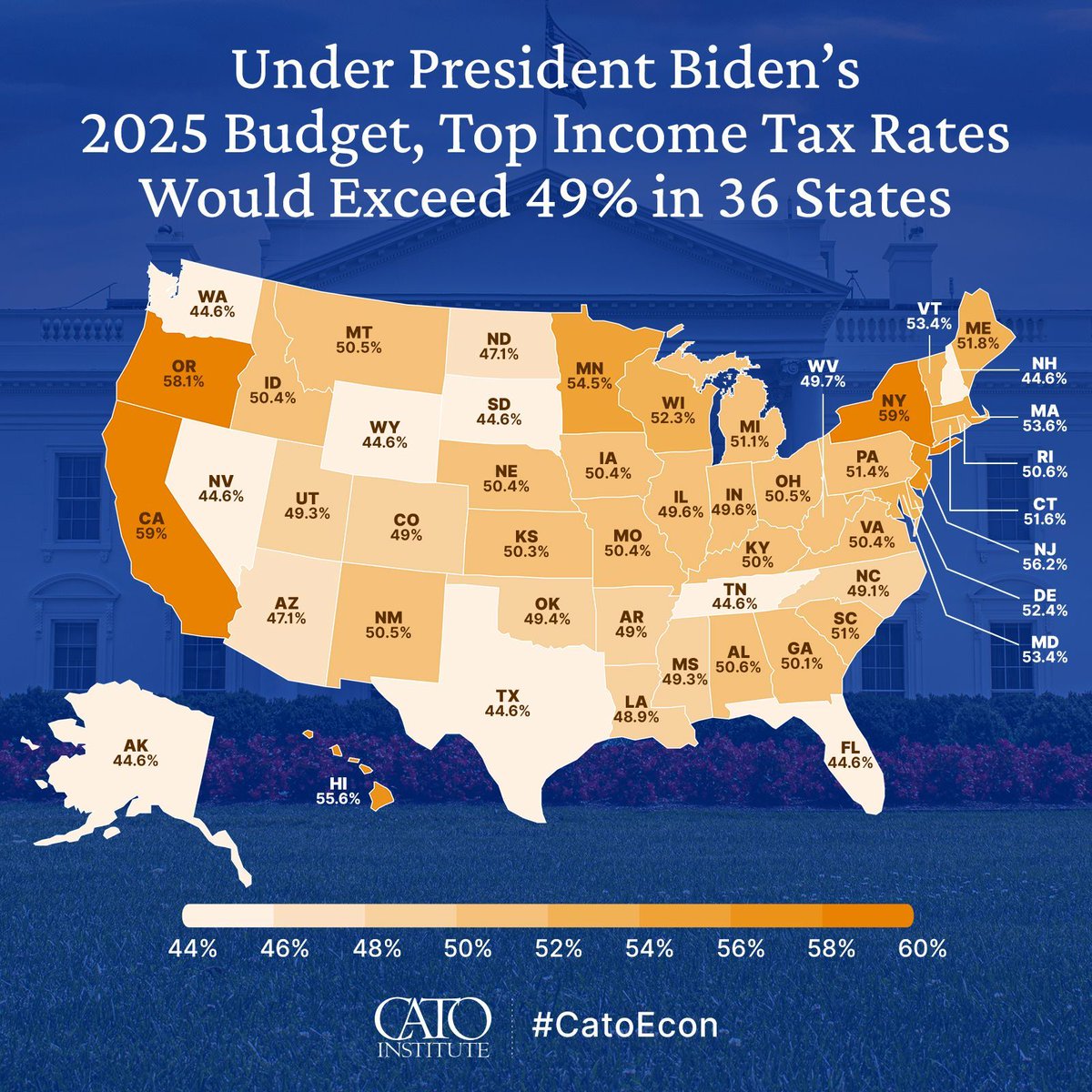

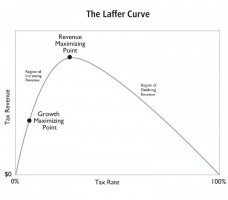

Top Tax Rates Are Already on Wrong Side of Laffer Curve in at Least Ten States Under President Biden’s proposed …

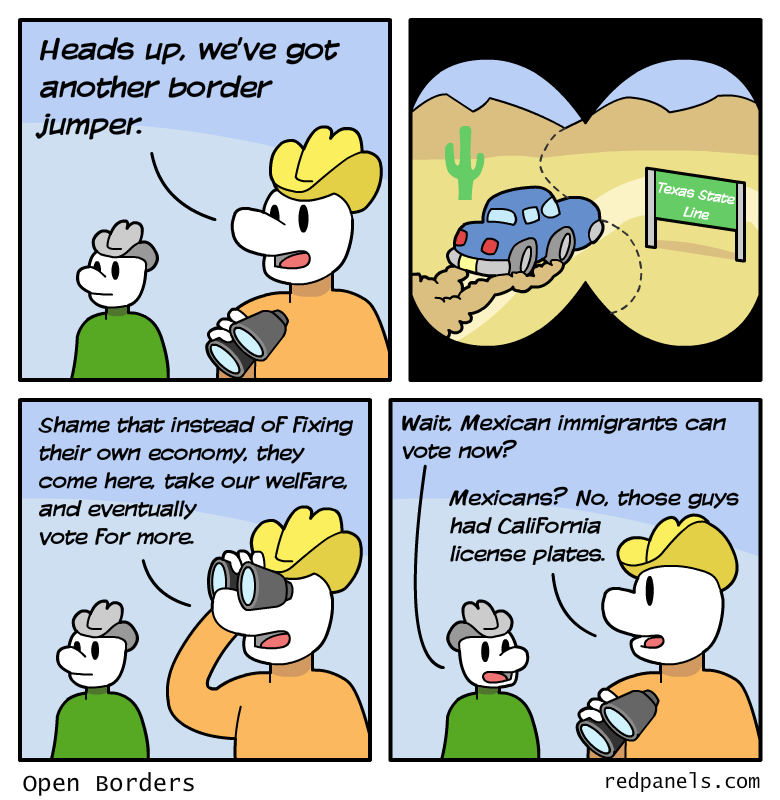

I used to write serious columns every April 15, but that’s too depressing. This decade (2021, 2022, 2023), I switched to sharing tax humor to commemorate the …

As the Internal Revenue Service (IRS) launched pilot programs throughout the U.S. for an unauthorized direct e-file program, Ways and …

When I give speeches about the global fight between tax competition and tax harmonization, especially when speaking in jurisdictions with good tax policy, …

The Laffer Curve’s Latest Victim: California The Laffer Curve is the common-sense notion that people respond to incentives. And even Paul Krugman admits this …

The IRS released new federal income tax brackets last week. Though marginal tax rates did not change, federal law requires the …

The IRS released its strategic operating plan on April 6, describing its intentions for spending the nearly $80 billion of supplemental funding …

What if Tax Day didn’t have to be a hassle? You may not want to hear this, but in many …

The IRS has warned that many taxpayers should expect a smaller refund this tax season because of tax law changes …

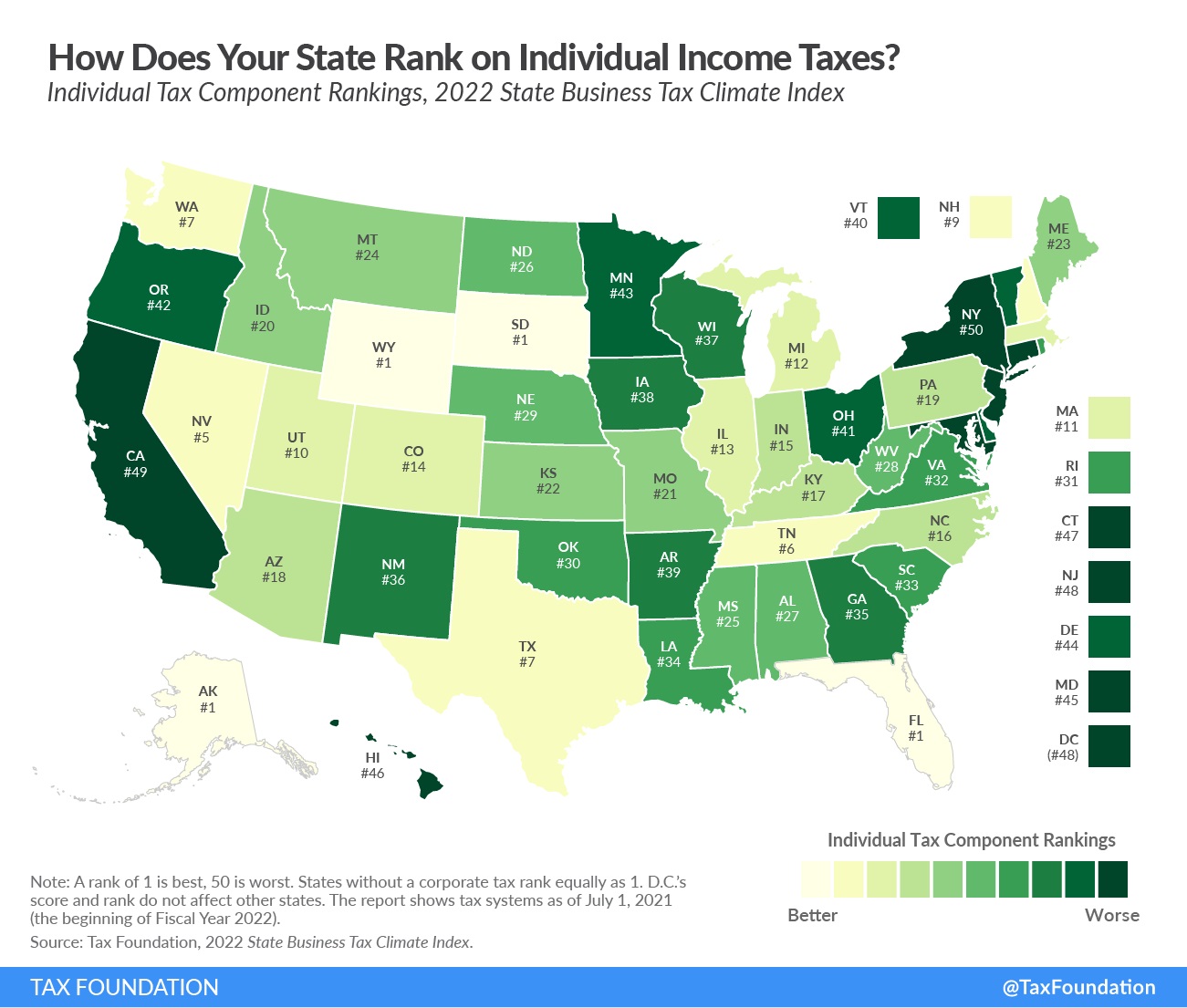

by Dan Mitchell You can actually learn a lot about sensible tax policy by looking at the behavior of professional athletes and sports franchises. Simply …

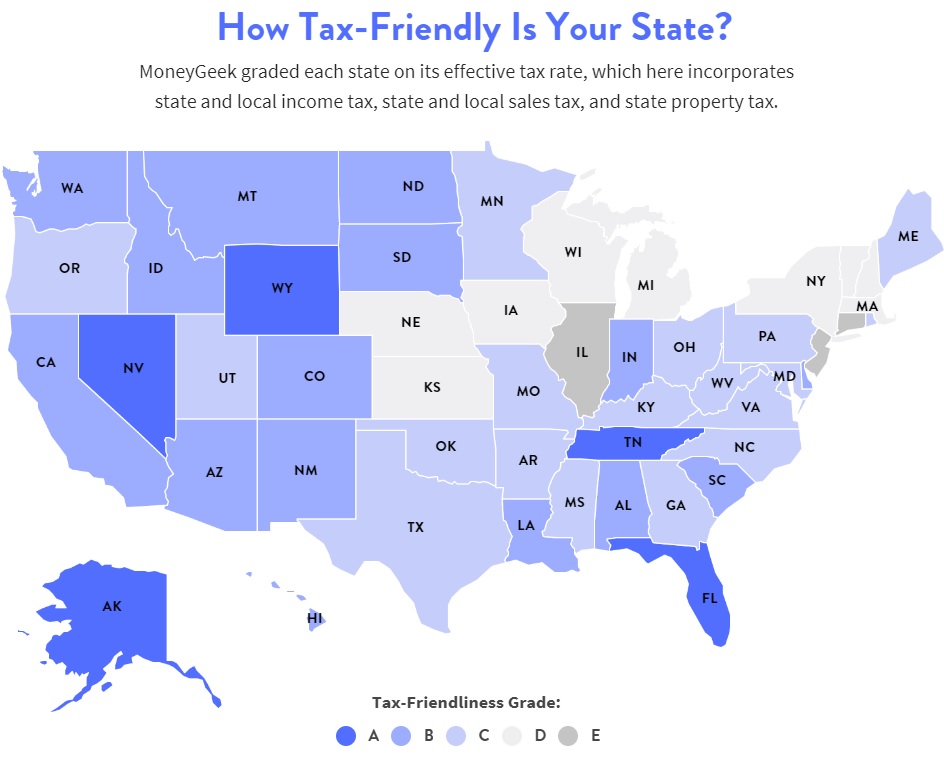

by Dan Mitchell I regularly share reports that measure how states rank for economic policy. Economic Freedom of North America Freedom …

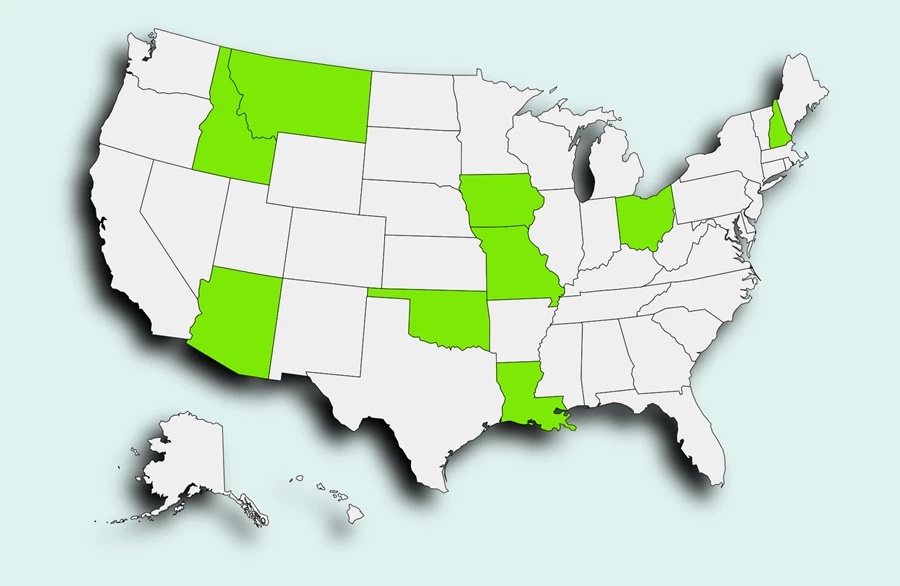

by Dan MitchellI wrote two months ago about Iowa lawmakers voting for a simple and fair flat tax. I explained how …

Just in case you wondered what we achieved in twenty years of training the Afghanistan military. It’s interesting that the …

Americans for Prosperity (AFP) urged lawmakers to reject a border carbon tax, which some are looking to include in Sen. …

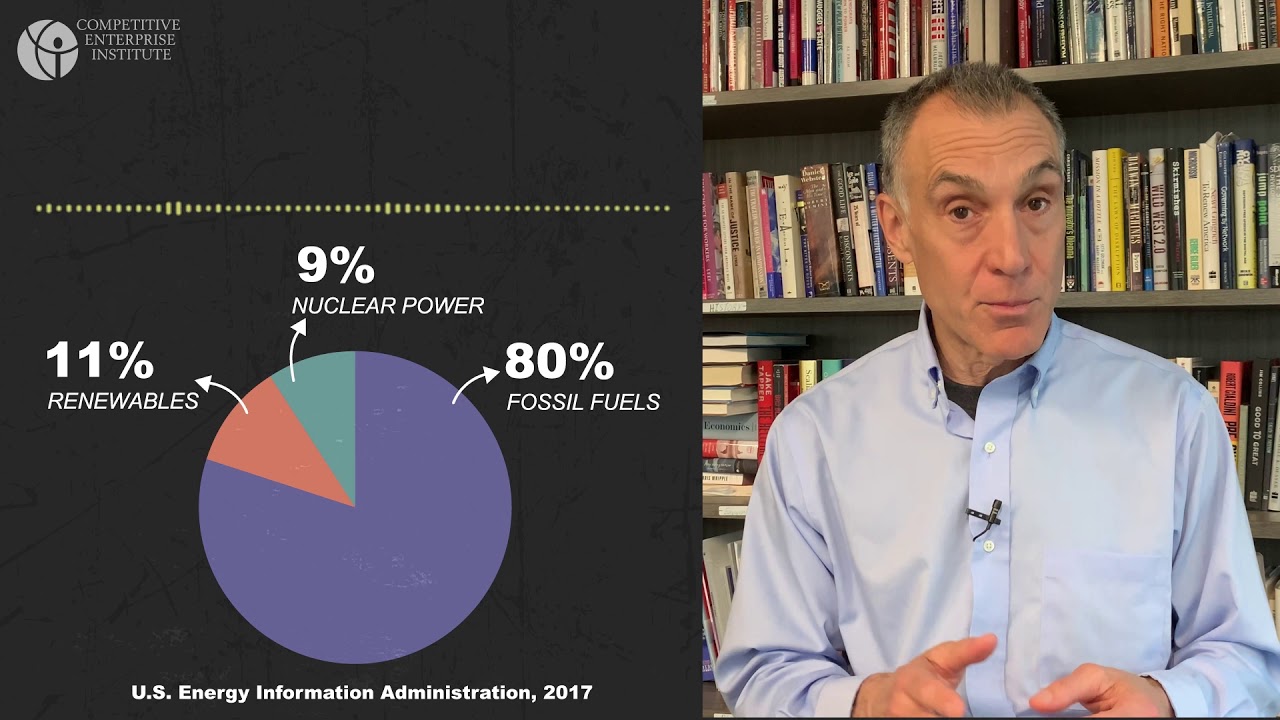

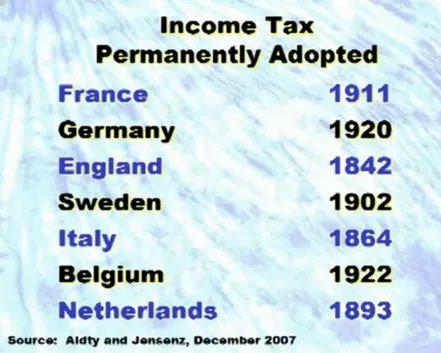

by Dan Mitchell I recently explained the evolution of taxation – and the unfortunate consequences of income taxation – to a seminar in the country …

IRS changes course after Sen. Lee and Rep. Owens of Utah send letter on religious liberty After a June letter to …

Forget “stimulus” spending, these states are showing us a way local governments can actually boost their economies. Finally, some good …

By Dan Mitchell The bad news is that federalism has declined in the United States as politicians in Washington have expanded the size and scope …

The numbers vary wildly from state to state—including a few states that will surprise you. In the mood for a …

Tax his land, Tax his bed, Tax the table,At which he’s fed.Tax his tractor, Tax his mule, Teach him taxesAre …